News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

Google Finance Integrates AI and Prediction Market Data for Smarter Insights

Cointribune·2025/11/08 05:21

Kazakhstan launches a billion-dollar crypto fund with seized assets

Cointribune·2025/11/08 05:21

Ripple Avoids Wall Street After SEC Victory

Cointribune·2025/11/08 05:21

The Story of Brother Machi's "Going to Zero": Just Be Happy

AICoin·2025/11/08 03:57

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

Cointelegraph·2025/11/08 01:57

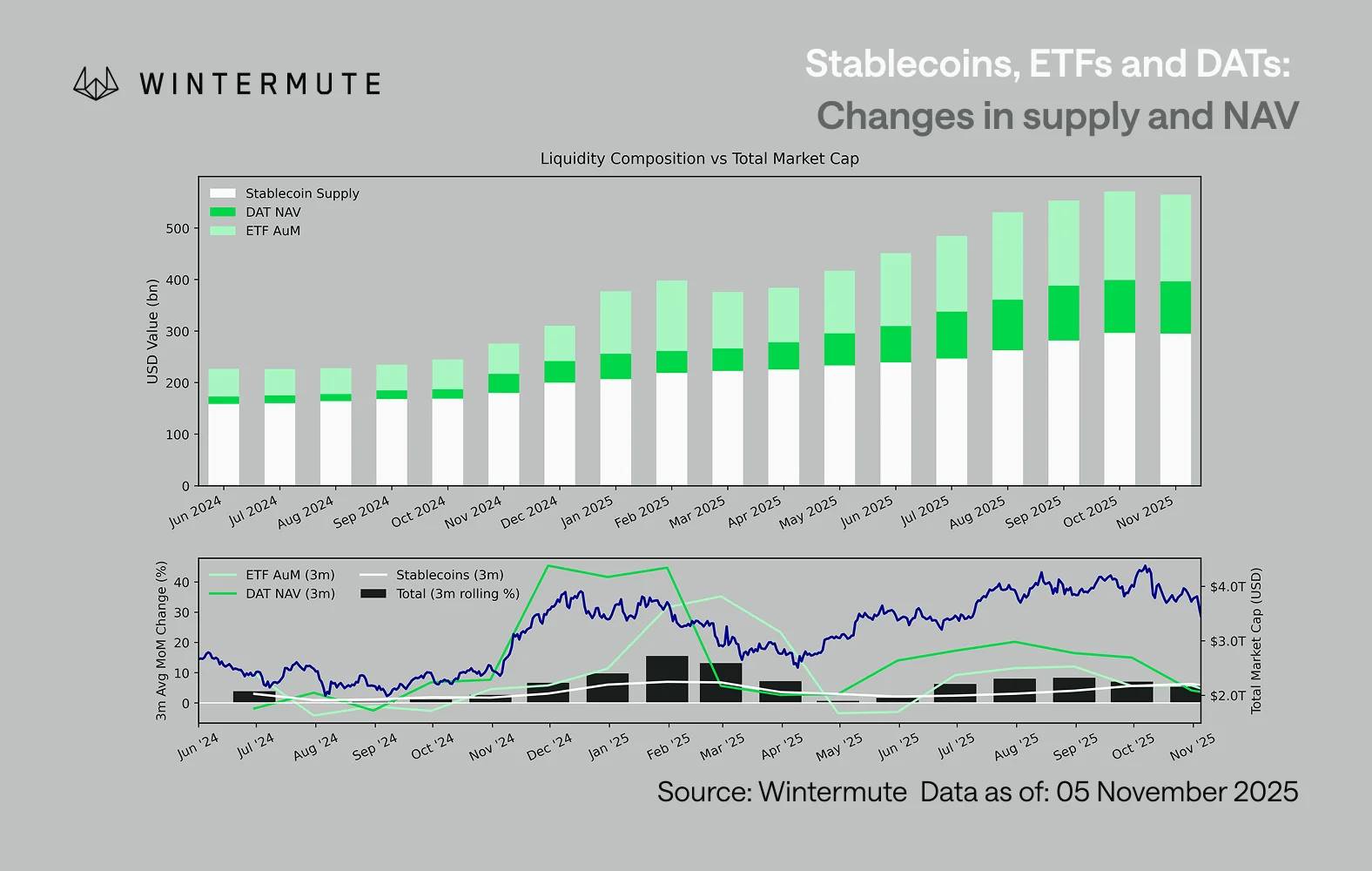

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

深潮·2025/11/07 22:52

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

ForesightNews·2025/11/07 22:23

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.

ForesightNews·2025/11/07 22:22

Crypto: Balancer publishes a preliminary report on the hack that targeted it

Cointribune·2025/11/07 22:15

UNDP Launches Major Blockchain Training and Advisory Push for Governments

Cointribune·2025/11/07 22:15

Flash

- 05:32Plume releases Q4 roadmap and will launch the Nest points systemForesight News reported that Plume released its Q4 roadmap in its Q3 2025 summary, stating that Nest, as its staking and RWA yield protocol, has completed a comprehensive rebranding and will launch brand new institutional and retail vaults, as well as the Nest points system.

- 05:32Bitcoin OG "1011short" closed all BTC long positions, losing $1.3 millionJinse Finance reported, according to Lookonchain monitoring, Bitcoin OG "1011short" has just closed all BTC long positions, incurring a loss of $1.3 million. He has now switched his entire position to $ETH longs, holding 40,000 ETH (worth approximately $138 million), with a liquidation price of $2,532.81.

- 05:32DefiLlama launches LlamaAI, offering in-depth analysis and original chartsForesight News reported that DefiLlama has announced the launch of LlamaAI, allowing users to generate in-depth analysis, original charts, and real insights with a single prompt. This feature is now available to DefiLlama Pro subscribers.