News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Report (October 29)|Fed to Announce Rate Decision; Market Expects 25bp Cut; Visa Adds Multi-Chain Stablecoin Payments; Western Union to Launch Stablecoin on Solana2ARB/USDT Surges Amid Arbitrum Liquidity Influx and Rising On-Chain Trading Activity3DASH Rises Above $40–$42 Support, Eyes $60–$65 Breakout Momentum

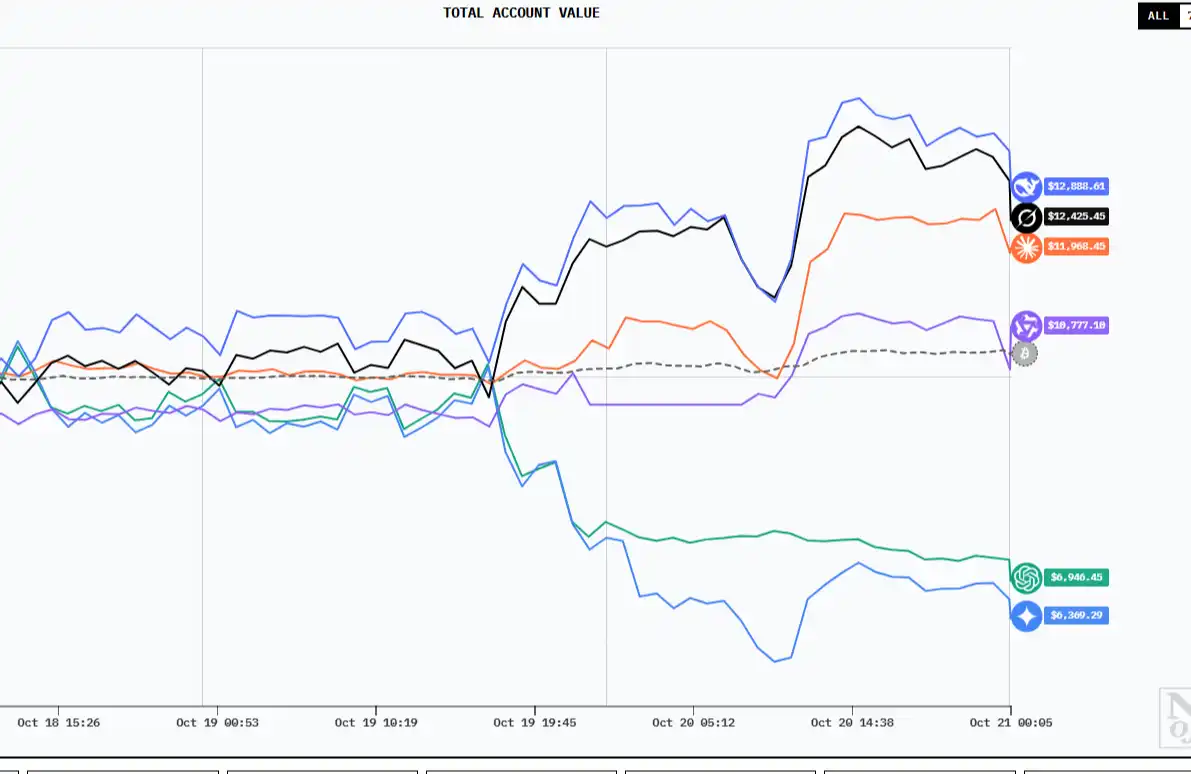

Six major AI "traders" ten-day showdown: Who can survive in a market with "no information asymmetry"?

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

BlockBeats·2025/10/29 09:13

Financial Black Hole: Stablecoins Are Devouring Banks

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.

BlockBeats·2025/10/29 09:13

$263 million political "war fund" in place, crypto industry ramps up for US midterm elections

This time, there are more super political action committees, and some have taken clearer stances in aligning with Republican candidates.

ForesightNews 速递·2025/10/29 09:04

What is the background of Pieverse, which caught the x402 trend just before Pre-TGE?

Binance has teamed up with BNB Chain to support its top "flagship project."

ForesightNews 速递·2025/10/29 09:03

SOL ETF opens the floodgates—can Jito leverage this to ignite a Solana ecosystem rebound?

Although the Solana ETF has been launched, network revenue trends are declining. Jito is at the intersection of new capital inflows and microstructure improvements.

ForesightNews 速递·2025/10/29 09:03

DOGE Whales Dump 500M Coins in Major Weekly Sell-Off

Cryptonewsland·2025/10/29 05:51

The Big Reversal Is Loading — 5 Altcoins Showing 10x Potential as Bullish Momentum Builds

Cryptonewsland·2025/10/29 05:51

All Eyes on CPI — 5 Altcoins Ready to Explode 100x If Risk Appetite

Cryptonewsland·2025/10/29 05:51

Analyst Predicts the Next Big Move for SHIB After a Long Dormant Phase

Cryptonewsland·2025/10/29 05:51

AAVE Struggles Despite the Maple Deal: Can Bulls Regain Control?

Cryptonewsland·2025/10/29 05:51

Flash

- 09:19Data: Bitcoin options with a notional value of $14.42 billions will expire and be settled this FridayChainCatcher news, according to market sources, this Friday (16:00 UTC+8), 127,000 BTC options will expire and be settled, with a notional value of $14.42 billions. The max pain point is $114,000, with a put/call ratio of 0.76. The notional value of expiring Ethereum options is $2.56 billions, with a max pain point at $4,100 and a put/call ratio of 0.7.

- 09:00Michael Saylor: Bitcoin is clearly positioned as digital gold, and its price will continue to rise in the future.ChainCatcher reported that MicroStrategy co-founder Michael Saylor revealed in a recent interview that bitcoin has been clearly positioned as digital gold and serves as a store of value. He mentioned that since the US government approved bitcoin ETFs last year, the market consensus around bitcoin as digital gold has gradually formed, and this view was further solidified at the crypto summit in March this year. He also pointed out that credit backed by gold once dominated the Western monetary system, and now, as digital capital, bitcoin’s digital credit instruments are developing rapidly. In addition, he mentioned the rapid growth in the digital finance sector over the past year, including the tokenization of currencies, stocks, bonds, and other real-world assets, which has provided significant momentum for proof-of-stake networks such as Ethereum. He emphasized that institutional acceptance of bitcoin is a key factor for the future development of the industry. Recently, several major banks, including JPMorgan, Citibank, and Wells Fargo, have adjusted their crypto policies and begun to accept bitcoin and Ethereum as collateral, marking a significant shift in traditional financial institutions’ attitudes toward crypto assets. Saylor also mentioned that MicroStrategy is the first bitcoin treasury company to receive an S&P credit rating, and its products have attracted institutional investors, including the BlackRock PFF fund. In addition, he predicted that the price of bitcoin will continue to rise in the future and stated that the company’s goal is to promote broader adoption of bitcoin through digital credit instruments, ultimately achieving the goal of purchasing $30 billions worth of bitcoin.

- 09:00The multi-agent protocol Adapt for quantitative trading has been selected as the first project of the Sui ecosystem AI Launchpad Surge.According to ChainCatcher, based on official information from Adapt and Surge, the multi-agent collaboration protocol Adapt (ANP3), which is oriented towards quantitative trading, has been selected for the Sui ecosystem AI launch platform Surge Launchpad, and will soon be launched as the first project in the SUI ecosystem. It is understood that Surge is the first AI Launchpad on Sui. Adapt is the first agent interconnection protocol (ANP3) designed for crypto quantitative trading, aiming to build the next-generation agent Defi network. Risk Warning