News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Is the US government shutdown the main culprit behind the global financial market downturn?

If the crypto market of 2019 taught us anything, it's that boredom is often the prelude to a breakout.

Such pullbacks are not uncommon in a bull market; their purpose is to test your conviction.

If the Federal Reserve's balance sheet expands, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.

We are building a new cultural layer, a cultural ecosystem belonging to Web3, where technology, music, and people are brought together once again.

Is the institutional narrative behind Canton becoming impossible to hide?

Among the three core issues faced at the inception of Bitcoin, the privacy sector has become the only remaining area with the potential for asymmetric returns.

Bitmine's market capitalization to net asset value ratio has plummeted from 5.6 in July to 1.2, with its stock price down 70% from its peak.

- 11:34BONK launches new product Junk.funBlockBeats News, November 5, according to official sources, a new product Junk.fun, jointly supported by Solana ecosystem Meme coin BONK and privacy blockchain Manta Network, has been officially launched. Junk.fun leverages Solana's rent mechanism to help users destroy worthless Memecoins or NFTs with one click, release the occupied SOL rent, and convert it into CREDITS points. Users can use CREDITS points to participate in official ecosystem activities. Currently, a total reward pool of $75,000 has been launched, and the event will last for three weeks.

- 11:34Opinion: The Federal Reserve's independence faces a "one-two punch" from Trump, but the president's statements have limited influenceBlockBeats News, November 5th—Under nearly a year of sustained attacks from Trump, the Federal Reserve is under heavy pressure. The Fed is simultaneously facing Trump’s insults, threats to fire Fed Chair Powell, ongoing efforts to dismiss Fed Governor Cook, and explicit demands to cut interest rates to reduce government debt costs. In addition, Treasury Secretary Bessent has accused the Fed of overstepping its authority since the financial crisis. However, no matter how anxious economists are about the threats facing the Fed, financial markets remained calm throughout 2025. Scholar Francesco Bianchi updated his research findings, showing that Trump’s inappropriate comments about the Fed on social media during his first term led to a statistically significant decline in market expectations for the federal funds rate. The situation in 2025 is consistent with this, indicating that the market considers Trump’s threats “effective” and expects the Fed to respond with rate cuts. But in the long run, the president’s influence through public statements is limited, and there is no sign that “bond vigilantes” will restrict presidential actions by raising inflation expectations (the term “bond vigilantes” refers to investors who force policy adjustments by selling bonds and pushing up yields). Former Fed Governor Randy Kroszner pointed out that financial markets are hardly concerned that Trump’s actions will lead to higher medium-term inflation. Former Treasury Secretary Larry Summers also commented that complaints about the “Fed overstepping its authority” do not even make the top 100 problems facing the United States.

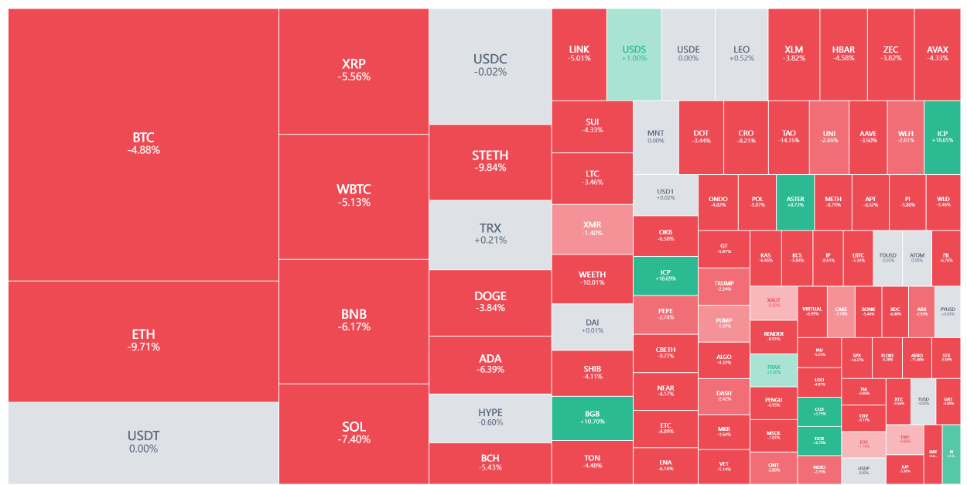

- 11:34QCP: Bitcoin Tests $100,000 Key Support Level as ETF Outflows Intensify Selling PressureBlockBeats News, November 5th, QCP Capital posted on social media that due to the strengthening of the US dollar and renewed uncertainty over the Federal Reserve's policy outlook, the price of bitcoin has fallen, testing the key support level of $100,000. Previously, the continuous inflow of funds into US spot bitcoin ETFs, which had been a bullish factor, has reversed, with approximately $1.3 billions in redemptions recorded over four consecutive trading days, further increasing market pressure. When the price hit its low, passive liquidations exceeded $1 billions, while market makers' short gamma positions amplified volatility. Now, the $100,000 mark has become the watershed for market trends—whether stabilized ETF fund flows can reverse sentiment will be the key going forward.