News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin's Structural Bottom: A Strategic Entry Point for Long-Term Investors2Ethereum (ETH) Price Prediction for August 31, 2025: Is Now the Time to Buy the Dip?3XRP's AMM Liquidity and RLUSD: A Strategic DeFi Play for Risk-Adjusted Returns

Bitcoin Hovers Around $107K as Weakest Month for Crypto Begins

CryptoNewsNet·2025/09/01 09:45

Bitcoin ETFs see first-ever outflow of $751 million as Ethereum funds gain $3.9 billion

Coinjournal·2025/09/01 09:40

Filecoin (FIL) To Rally Higher? Key Emerging Bullish Fractal Setup Saying Yes!

CoinsProbe·2025/09/01 09:30

5 Cryptos That Soared Despite the Ongoing Crypto Crash

Cryptoticker·2025/09/01 09:20

Will Bitcoin Price Crash to $75,000?

Cryptoticker·2025/09/01 09:20

Build a Launchpad platform in just 3 days and $400 with step-by-step guidance

It turns out that creating meaningful products doesn't require millions of dollars in funding, months of labor, or even a team.

BlockBeats·2025/09/01 08:56

Must-Read Before WLFI Launch: 20 Q&As Fully Explain the Governance Model

WLFI token holders can submit and vote on official proposals via the Snapshot platform, but World Liberty Financial reserves the right to screen and reject any proposals.

BlockBeats·2025/09/01 08:54

Flash

- 09:37Rate cut expectations and trade situation boost gold prices; London gold mining stocks strengthenJinse Finance reported that London-listed gold sector stocks rose as gold prices strengthened. Victoria Scholar, Head of Investment at Interactive Investor, stated in a report that gold prices continue to climb, approaching historical highs, driven by expectations of a US interest rate cut this month and uncertainty over tariffs. "This week's focus is on the Federal Reserve's Beige Book, the US non-farm payroll report, the Job Openings and Labor Turnover Survey, and the ADP report." Hochschild Mining shares rose 5%, Alien Metals gained 3.85%, and Fresnillo increased by 1.6%.

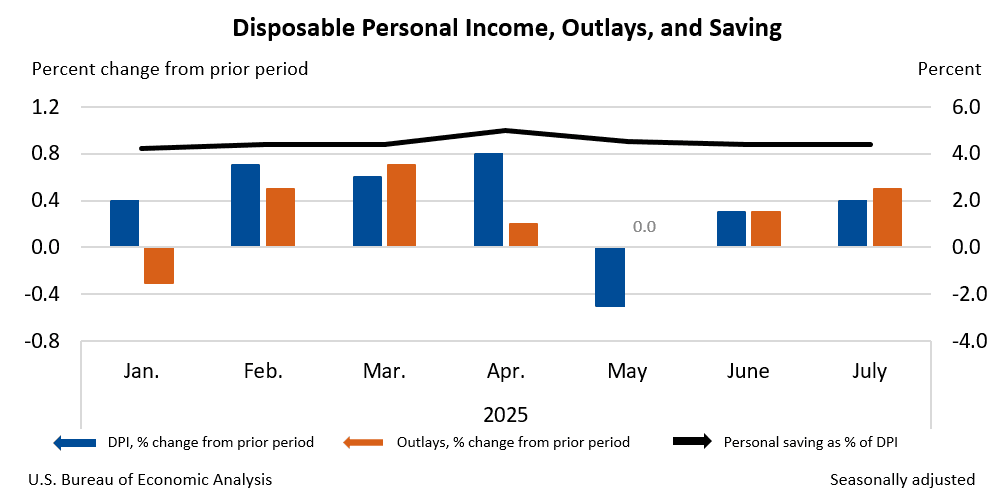

- 09:13CoinShares: Digital asset investment products saw $2.48 billion in inflows last weekJinse Finance reported that the latest report from a certain exchange shows that digital asset investment products recorded an inflow of $2.48 billion last week. In August alone, the total inflow reached $4.37 billion, bringing the year-to-date inflow to $35.5 billion. This week saw strong capital inflows, but after the release of the core Personal Consumption Expenditures (PCE) data on Friday, inflows turned negative. The data failed to support expectations for a Federal Reserve rate cut in September, disappointing digital asset investors. This situation, coupled with the recent downward trend in prices, led to a 10% decline in total assets under management from the recent peak, down to $219 billion. Ethereum continued to outperform Bitcoin, attracting $1.4 billion in inflows, while Bitcoin saw $748 million. In August, Ethereum accumulated $3.95 billion in inflows, while Bitcoin experienced an outflow of $301 million. Meanwhile, Solana and XRP continued to benefit from optimism surrounding the prospects of a US ETF launch, with inflows of $177 million and $134 million, respectively.

- 09:02595,000 new tokens were created on Pumpfun in AugustJinse Finance reported, according to @defioasis data, in August, Pumpfun created a total of 595,000 new tokens, regaining the main market share of the Solana Launchpad; nearly 1.35 million addresses traded these new tokens created by Pumpfun during the month. However, the overall loss reached $66 million, and there were no addresses with realized profits exceeding $1 million; 65.4% of addresses lost between $0 and $1,000, with an average loss of $73.41.