News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

How the Trump family is reshaping prediction markets and the boundaries of information.

The MegaMafia 2.0 Accelerator Program focuses on incubating innovative crypto consumer products aimed at mainstream users.

Investing in the new stablecoin sector requires finding a balance among technological innovation, regulatory compliance, and market demand.

Whale Accumulation, Animoca Brands' Entry, and Bullish Technical Indicators Fuel AERO's 7% Surge

Revolutionizing Cross-Border Payments: How Ripple's Partnership Aims to Bypass Traditional Banking in Infrastructure-Limited Regions

The Federal Reserve announced a 25 basis point rate cut and halted quantitative tightening (QT), but the market experienced short-term panic due to Powell's hawkish comments regarding uncertainty over a rate cut in December. Bitcoin and Ethereum prices declined. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

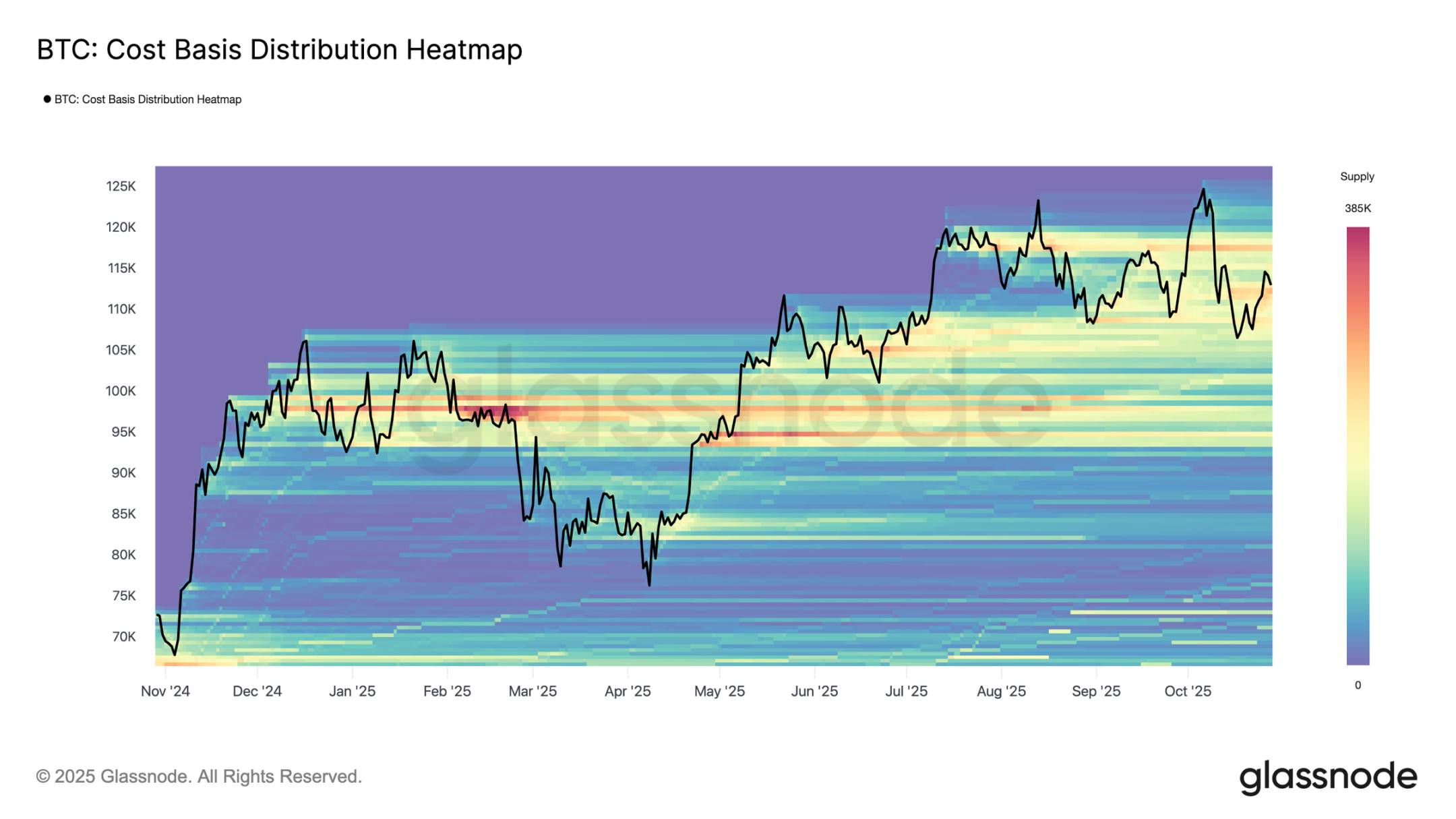

Bitcoin is showing clear signs of weakness, and market confidence is being put to the test.

- 03:54The Jupiter community is currently voting on whether to burn the previously repurchased 130 million JUP.BlockBeats News, October 31, Jupiter officially posted on social media stating that after the team reduced the size of the decentralized autonomous organization (DAO) and reset the community, the "Litterbox burn vote" marks the next major step in this new beginning—refocusing on making JUP the core of the ecosystem and rebuilding long-term confidence and consensus. Currently, 50% of Jupiter's on-chain revenue goes into the "Litterbox Trust," which uses these funds to buy back JUP from the open market. To date, approximately 130 million JUP have been repurchased, accounting for about 4% of the circulating supply. These tokens were originally intended for use by the DAO after three years. However, recently, token holders have made it clear that these JUP are causing uncertainty for the community and token holders. The team has heard everyone's concerns. Today, the DAO will begin voting on whether these existing tokens should be burned (with 4 days and 13 hours remaining until the deadline). In the coming weeks, there will be another separate vote to decide how to handle the ongoing revenue flowing into the "Litterbox."

- 03:53SuiNS launches retrospective governance airdrop campaign to reward early active usersBlockBeats News, October 31, according to official sources, Sui blockchain domain name service Sui Name Service (SuiNS) has announced the launch of a retrospective governance reward airdrop, aimed at rewarding early active users. Any user who has voted (with more than 0.1 NS tokens) on SuiNS DAO proposals between November 2024 and June 2025 will be eligible for rewards. The earlier and longer the voting period, the higher the accumulated governance weight and the greater the airdrop reward. Currently, users can check by connecting their wallets. This airdrop does not require claiming or any additional steps. This airdrop aims to ensure that rewards benefit members who actively participate in building the SuiNS community. By linking identity, ownership, and governance, SuiNS is committed to further building a "participation equals influence" system.

- 03:53Brevis partners with KaitoAI to introduce privacy-preserving on-chain verification for the InfoFi ecosystemBlockBeats News, on October 31, the intelligent verifiable computation platform Brevis announced a new partnership with KaitoAI to introduce privacy-preserving on-chain verification features to the InfoFi ecosystem. Starting today, any activity on the Kaito platform can utilize Brevis's zero-knowledge proof technology to verify users' on-chain identities without exposing their wallet addresses. The first implemented application is the Brevis Yapper leaderboard. This move addresses a fundamental limitation of InfoFi: previously, activities could only track social data, and whenever on-chain behavior needed to be verified, users were required to publicly connect their wallets, resulting in privacy leaks. Now, users can anonymously prove they are "long-term holders" or "active DeFi users" without exposing their entire asset portfolio.