News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Hyperliquid airdrop project ratings: Which ones are worth participating in?2Bitcoin Cash (BCH) May Sustain $600 Level After 32% Volume Spike and Growing Institutional Interest3Worldcoin (WLD) To Rise Higher? Key Breakout Signals Potential Upside Move

Bitcoin taps $111.3K as forecast says 10% dip ‘worst case scenario’

Cointelegraph·2025/09/07 12:15

Toyota Launches Blockchain Solution to Transform Vehicles Into Digital Assets

Coinspaidmedia·2025/09/07 09:40

SEC Eyes Cross-Border Crypto Pump-and-Dump Enforcement, Could Include Bitcoin Cases

Coinotag·2025/09/07 08:15

Michael Saylor’s Net Worth May Be Linked to MicroStrategy Stock Gains and Large Bitcoin Holdings

Coinotag·2025/09/07 08:15

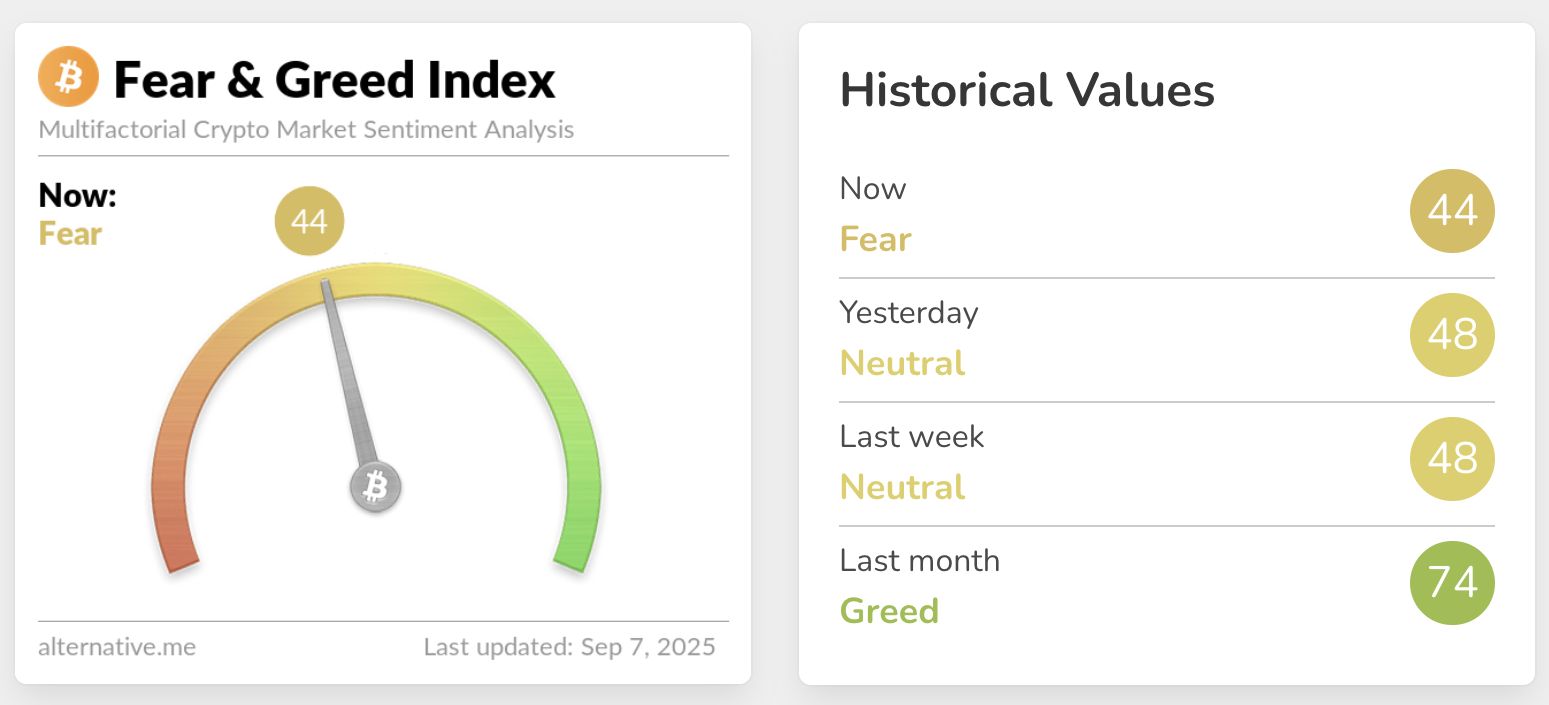

Traders Weigh Which Major Asset May Lead Next Move as Bitcoin Remains Indecisive and Sentiment Cools

Coinotag·2025/09/07 08:15

Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels

Cryptonewsland·2025/09/07 07:50

Almost Certain Rate Cut Sparks Altcoin Rally: Top 5 Coins to Accumulate Now

Cryptonewsland·2025/09/07 07:50

SHIB Forecast Weakens as Whales Sell and Derivatives Activity Declines

Cryptonewsland·2025/09/07 07:50

Market Spotlight 2025: DOGE’s $1.7B Derivatives Surge, Polygon’s CDK Launch, BlockDAG’s Whale-Fueled Momentum

Explore DOGE’s price outlook, Polygon’s POL performance, and why whale interest is backing BlockDAG as one of the strongest crypto coins to buy in 2025.$4.4M Whale Buy Reinforces BlockDAG’s MomentumDogecoin Price Outlook: Project Sakura and Technical SetupsPolygon Price Performance: CDK Enterprise in FocusFinal Words

Coinomedia·2025/09/07 07:40

$3B in Shorts Face Liquidation if BTC Hits $117K

If Bitcoin touches $117K, $3 billion in short positions will be liquidated.What Happens When Shorts Get Liquidated?Bullish Pressure Mounts

Coinomedia·2025/09/07 07:40

Flash

- 11:51Tether CEO: No Bitcoin has been sold, only part of the reserves have been allocated to XXIJinse Finance reported that Tether CEO Paolo Ardoino stated on the X platform: "Tether has not sold any bitcoin, but has allocated part of its bitcoin reserves to XXI. As the world becomes increasingly uncertain, Tether will continue to invest part of its profits in safe assets such as bitcoin, gold, and land. Tether is a stable company."

- 11:21ether.fi Foundation: 73 ETH of protocol revenue was used this week to purchase 264,000 ETHFIChainCatcher news, the ether.fi Foundation released an ETHFI token buyback update on the X platform, disclosing that it has used 73 ETH (approximately $314,000) of protocol revenue to purchase 264,000 ETHFI. In addition, about 155,000 ETHFI have been burned, and approximately 108,000 ETHFI have been distributed to sETHFI holders.

- 10:52Analysis: Venezuela's inflation rate reaches 229%, USDT becomes the preferred local settlement methodJinse Finance reported that as Venezuela's annual inflation rate soared to 229%, stablecoins such as USDT have become the "de facto" currency for millions of Venezuelans within the financial system. It is reported that locals refer to Bitcoin as "exchange dollars," while the country's currency, the bolivar, has virtually disappeared from daily commercial activities. Hyperinflation, strict capital controls, and a fragmented exchange rate system have led people to increasingly prefer stablecoins over cash or local bank transfers. From small grocery stores to medium-sized businesses, USDT has replaced fiat cash as the preferred settlement method locally.