News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

From the frustration of not getting paid for fixing bikes as a teenager, to disrupting the financial system three times with E-Loan, Prosper, and Ripple, see how Chris Larsen is reshaping the payment world for ordinary people.

All efforts ultimately point toward one core goal: maximizing user experience value.

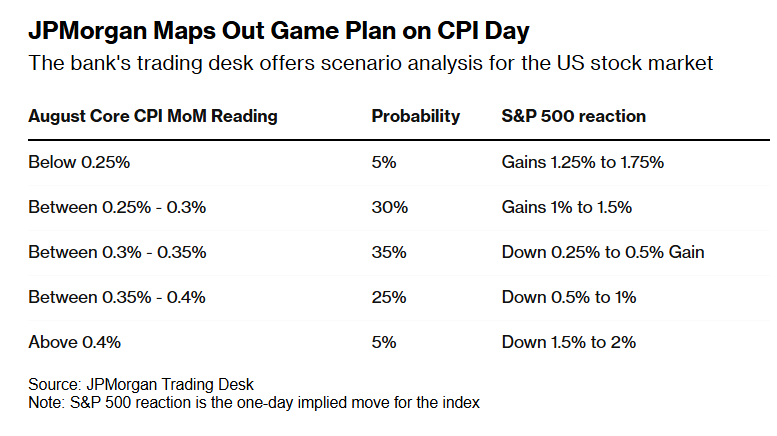

The PPI data may indicate that the CPI will also cool down, adding complexity to the debate over the extent of the Federal Reserve's rate cut in September...

The August CPI is about to be released, but Wall Street remains calm. This Thursday, the implied volatility in the stock market is lower than the average actual volatility on CPI release days over the past year and also lower than the expected volatility for the next non-farm payroll day.

- 22:50US Senator: Crypto Market Structure Bill Expected to Pass This YearJinse Finance reported that U.S. Senators Cynthia Lummis and Kirsten Gillibrand stated that both parties are continuously advancing crypto market structure legislation, hoping to complete it by the end of the year. Previously, the Senate Banking Committee had set a target for the end of September, but progress has been delayed to October or even the end of the year. Gillibrand emphasized that Congress is currently facing fiscal cliff negotiations and that legislation should not have an “artificial deadline,” adding that no “red lines” have been drawn in the negotiations; Lummis, on the other hand, stated that “it must be completed by the end of the year,” describing the process as “like being pregnant for four years.” Democrats have proposed that the bill should include consumer protection, division of regulatory authority, and ethical provisions, prohibiting the president, vice president, and their families from profiting from crypto projects to prevent conflicts of interest. Gillibrand stressed that the ethical perspective is crucial for industry trust, while Lummis believes that restrictions on officials’ investments should be legislated together with other securities, rather than targeting crypto specifically.

- 22:08The probability of a 25 basis point rate cut by the Federal Reserve in September is 92%.Jinse Finance reported, according to CME "FedWatch": the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 92%, and the probability of a 50 basis points cut is 8%. The probability of a cumulative 25 basis points rate cut by the Federal Reserve in October is 21.2%, a cumulative 50 basis points cut is 72.6%, and a cumulative 75 basis points cut is 6.2%.

- 21:53SEC Chairman: The Combination of Blockchain and AI Will Usher in a New Era of Prosperity, SEC Determined to Seize the OpportunityBlockBeats News, on September 11, Paul S. Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), reiterated in a post the key points from his speech at the inaugural OECD Global Financial Markets Roundtable. "The SEC's priorities in the crypto space are clear: we must ensure the security status of crypto assets. Most crypto tokens are not securities, and we will clearly define these boundaries. Blockchain is reshaping the way transactions and settlements are conducted, and artificial intelligence is opening the door to proxy finance—a system where autonomous AI agents execute trades, allocate capital, and manage risk at speeds unmatched by humans, with securities law compliance embedded in their code. The potential benefits are enormous: faster markets, lower costs, and broader access to strategies once exclusive to major Wall Street firms. By combining AI with blockchain, we can empower individuals, enhance competition, and unlock new prosperity. The SEC is determined to seize the opportunities before us."