News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If the Supreme Court ultimately rules that Trump does not have the authority to bypass Congress to initiate trade conflicts, then Wednesday's market movement may be just the prelude to a market frenzy.

The new valuation makes Ripple one of the highest-valued private crypto companies in the world.

The market may have entered a mild bear market.

Sideways movement is not the end, but the starting point for increasing positions.

Elon Musk's trillion-dollar compensation plan will be put to a vote on Thursday. The board of directors has made it clear: either retain him with this sky-high package, or face the risk of a potential stock price drop if he leaves.

The market may have entered a mild bear market.

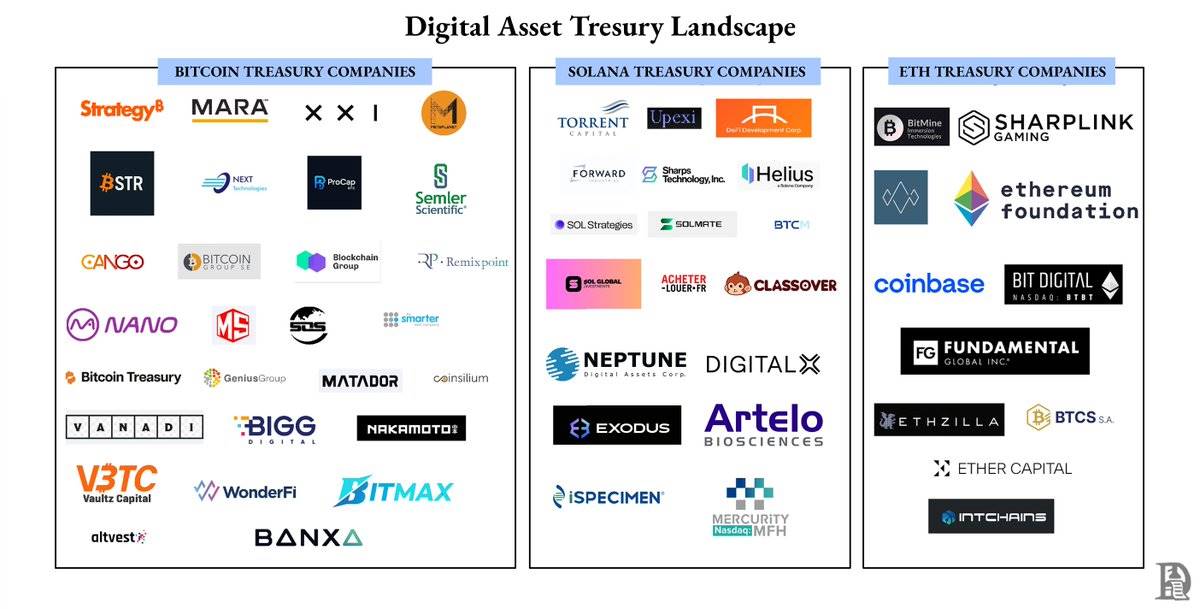

How did DATCo grow from a fringe corporate experiment into a powerful force spanning Bitcoin, Ethereum, and various altcoins, with a scale of 130 billions USD?

When "tokenization" loses its meaning: Why are we paying a premium to buy gold on-chain?

They imitated the asset and liability structure of Strategy, but did not replicate its capital structure.

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.

- 12:46Survey: The proportion of traditional hedge funds holding cryptocurrencies has risen to 55%Jinse Finance reported that a joint survey by the Alternative Investment Management Association (AIMA) and PwC shows that the proportion of traditional hedge funds holding cryptocurrencies has risen from 47% in 2024 to 55% this year. The survey covered 122 institutional investors and hedge fund management companies worldwide, with nearly $1 trillion in assets under management. 47% of the institutional investors surveyed indicated that the current regulatory environment encourages them to increase their cryptocurrency allocations, mainly benefiting from Trump appointing crypto-friendly regulatory agency heads and signing the GENIUS Act. Among crypto-focused funds, Bitcoin remains the most popular asset, followed by Ethereum and Solana. Traditional hedge funds allocate an average of 7% of their assets under management to cryptocurrencies, up from 6% last year. 71% of respondents plan to increase their cryptocurrency exposure in the next twelve months.

- 12:35Galaxy Research: Over 70% of the Top 100 Cryptocurrencies by Market Cap Have Dropped More Than 50% from Their All-Time HighsAccording to ChainCatcher, Galaxy Research stated in an article that "among the top 100 cryptocurrencies by market capitalization, 72 have dropped by 50% or more from their all-time highs."

- 12:01BlackRock deposits 4,652.87 BTC and 57,455 ETH into a certain exchangeAccording to Jinse Finance, OnchainLens monitoring shows that BlackRock has deposited 4,652.87 BTC, valued at $478.51 million, and 57,455 ETH, valued at $194.86 million, into a certain exchange.