News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?2Is XRP about to break through $3?3Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels

HYPE tops $50, overtakes Chainlink in the market cap list

Coinjournal·2025/09/08 10:42

OpenAI Takes on LinkedIn with AI-Powered Job Platform

Cointribune·2025/09/08 10:42

Kaspa (KAS) To Rise Ahead? Key Harmonic Pattern Hints at Potential Upside Move

CoinsProbe·2025/09/08 10:35

FARTCOIN To Soar Higher? Key Emerging Fractal Setup Saying Yes!

CoinsProbe·2025/09/08 10:35

Is Pudgy Penguins (PENGU) Poised for a Bullish Breakout? Key Fractal Pattern Saying Yes!

CoinsProbe·2025/09/08 10:35

Fed Rate Cuts Incoming: Can Bitcoin Smash Through 120K?

Cryptoticker·2025/09/08 10:21

Crypto News Today: These Altcoin ETFs Could Challenge Bitcoin and Ethereum

Cryptoticker·2025/09/08 10:21

El Salvador celebrates Bitcoin anniversary amid mixed results 4 years on

Cointime·2025/09/08 10:14

Trump’s oil donors are getting what they paid for – and they know it

Share link:In this post: Trump’s top oil donors are now directly influencing U.S. energy policy from inside his administration. Oil companies are receiving major tax breaks, permit approvals, and regulatory rollbacks. Despite policy wins, oil prices remain low and industry layoffs are increasing.

Cryptopolitan·2025/09/08 08:46

El Salvador marks Bitcoin Day with 21 BTC purchase

Share link:In this post: El Salvador adds another 21 BTC on the nation’s Bitcoin Day, worth roughly $2.3 billion at current prices. The country now holds around 6,313.18 BTC, worth around $702 million. The nation also redistributed its holdings last month across multiple addresses, with a cap of 500 BTC per address.

Cryptopolitan·2025/09/08 08:46

Flash

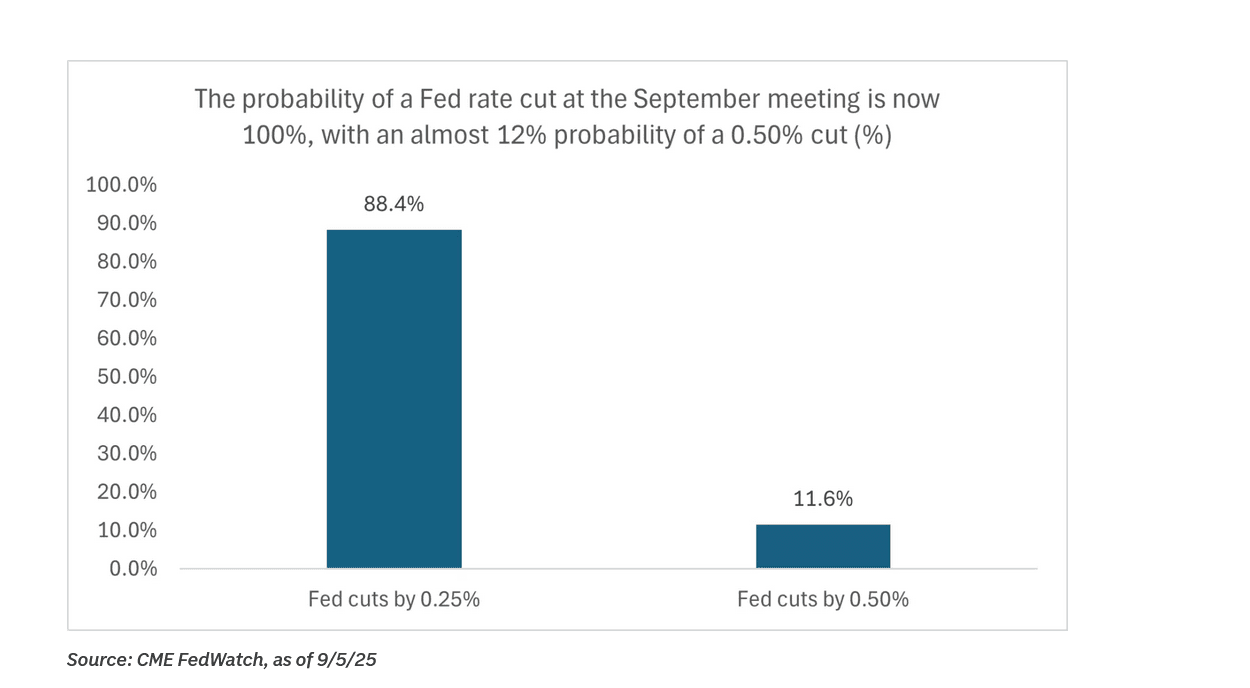

- 10:25US employment data may be significantly revised downward, strengthening expectations of interest rate cutsAccording to ChainCatcher, citing Golden Ten Data, economists from Wells Fargo, Lianxin Company, and Pantheon Macroeconomics expect that the annual benchmark revision data for nonfarm payrolls released by the U.S. Bureau of Labor Statistics on Tuesday will show that the number of employed people in March is nearly 800,000 less than currently estimated, averaging about 67,000 fewer per month. Nomura Securities, Bank of America, and Royal Bank of Canada, however, indicate that the number of downwardly revised jobs may be close to 1 million. A significant downward revision in the data would indicate a weakening of last year's labor market momentum and reinforce market expectations for a Federal Reserve rate cut.

- 10:25Spot gold surpasses $3,620 per ounce, reaching a new all-time highJinse Finance reported that the intraday gain of spot gold has expanded to 1%, now quoted at $3,617.84 per ounce, continuing to reach a new all-time high.

- 09:31Goldman Sachs: US Stock Rally Expected to Expand to Small-Cap SectorAccording to ChainCatcher, citing Golden Ten Data, strategists at Goldman Sachs stated that as the economic outlook remains strong, laggards including small-cap stocks are beginning to catch up, and the record-breaking rally in the U.S. stock market is likely to broaden. The Goldman Sachs team believes that the Federal Reserve's expected rate cuts and a rebound in corporate earnings increase the likelihood of the rally spreading to areas such as small-cap stocks. Kostin pointed out that the breadth of the market rally is limited, indicating that there is still room for a "catch-up" rally in underperforming market sectors.