News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

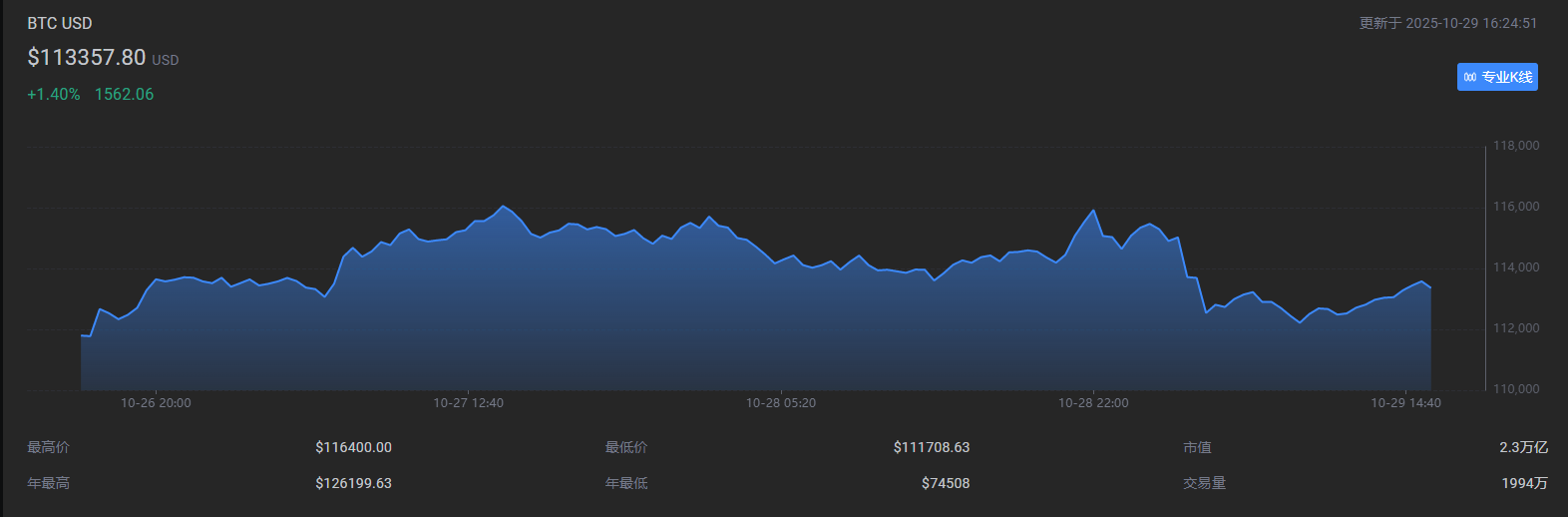

Risk appetite has not yet increased, and liquidity in the crypto market remains extremely tight.

The improvement in the US-China tariff war and BTC has once again fallen to the bull-bear dividing line, with cyclical patterns indicating clear signs of a "peak."

Bittensor is migrating Bitcoin-style mining to AI through "incentivized computation," building an open multi-subnet marketplace powered by TAO, where inference, training, and computing power providers are rewarded based on performance. Jacob visited China for the first time, discussing his experience leaving Google, ecosystem expansion in Asia, TAO halving, protocol revenue, and his five-year vision.

DAT's corporate structure possesses unique advantages that ETFs cannot match, which is precisely why it commands a premium over its book value.

x402 ignites the AI payment revolution as AEON takes the lead in bringing it to global commerce.

![[October 11 Short Whale] Sells Another 200 BTC—What Kind of Market Trend Will Collide with the Federal Reserve Decision?](https://img.bgstatic.com/multiLang/image/social/79491c3fe8d0d3b17d283ebd2a9faa8e1761739967786.png)

The cryptocurrency market showed signs of recovery in October 2025, with investor sentiment shifting from cautious to cautiously optimistic. Net capital inflow turned positive, institutional participation increased, and the regulatory environment improved. Bitcoin spot ETF saw significant capital inflows, while the approval of altcoin ETFs injected new liquidity into the market. On the macro level, expectations of a Federal Reserve rate cut intensified, and the global policy environment became more favorable. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved and updated.

- 12:45Fed Decision Preview: Market Focus on Powell's Press ConferenceJinse Finance reported that the market generally expects the Federal Reserve to cut interest rates by 25 basis points, adjusting the policy rate to 3.75-4.00%. At the same time, it is expected that the central bank will announce the end of quantitative tightening (QT). This meeting will not release the quarterly economic outlook report, so the main focus will be on Powell's press conference. It is expected that Federal Reserve Chairman Powell will once again characterize the rate cut as a risk management measure and, in the absence of key economic data, will not disclose too much information in order to maintain stable market expectations. The current market expectation is that a rate cut by the Federal Reserve in October is a certainty, and the probability of a rate cut in December is also close to 100%. By 2026, a cumulative rate cut of 117 basis points is expected, higher than the 75 basis points projected by the Federal Reserve. (Golden Ten Data)

- 12:22Ironlight approved to operate an alternative trading system for tokenized securities in the USAccording to ChainCatcher, Ironlight Markets, a subsidiary of Ironlight Group, has received FINRA approval to operate a US-regulated Alternative Trading System (ATS) for trading traditional securities and tokenized securities. It is reported that Ironlight's ATS combines a centralized order book with atomic on-chain settlement, enabling real-time trading and clearing. The system allows banks, brokers, and registered investment advisors to connect via FIX or API interfaces, thereby bringing blockchain efficiency to regulated markets.

- 12:16Stablecoin company Hercle completes $10 million equity financing, led by F-PrimeJinse Finance reported that stablecoin company Hercle has announced the completion of a $10 million equity financing round, led by global venture capital firm F-Prime. Valuation information has not yet been disclosed. The company utilizes stablecoin technology to improve the efficiency of global remittance transactions, and the new funds will be used to support its global expansion.