News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Whales sell $4.2 billion worth of bitcoin, mysterious Chinese figure Garrett Jin caught in public controversy2Chainlink holds 63% oracle market share as LINK price tests resistance3Top 3 Altcoins for November Gains: Experts Highlight ETH, ADA, and LINK

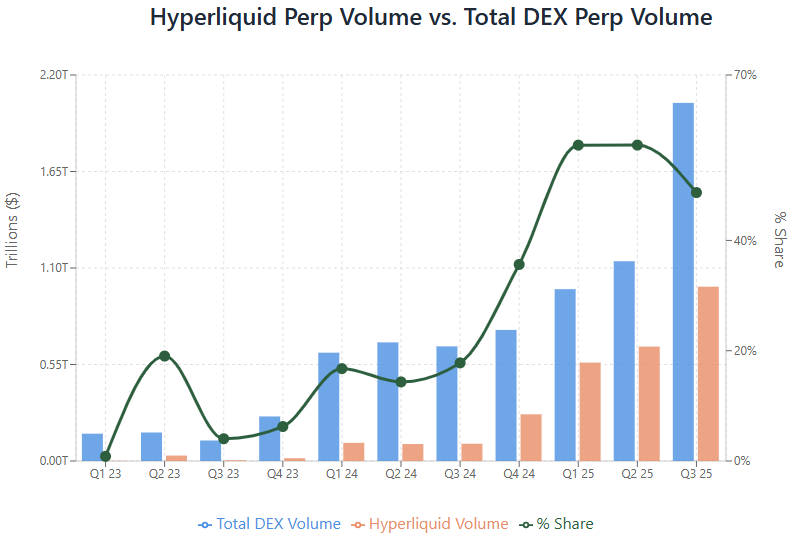

Arete Capital: Hyperliquid 2026 Investment Thesis, Building a Comprehensive On-chain Financial Landscape

The grand vision of unified development across the entire financial sector on Hyperliquid has never been so clear.

深潮·2025/10/15 07:34

S&P Index Adjusted as Expected: Key Observations on Timing and Scope of the Adjustment!

Bitpush·2025/10/15 07:33

$15 billion worth of bitcoin seized! US and UK join forces to crack down on Southeast Asia pig-butchering scam empire

The US and UK have jointly taken action against one of the largest investment fraud networks in history, seizing a record amount of funds.

ForesightNews 速递·2025/10/15 07:32

Research Report|In-Depth Analysis and Market Cap of Yield Basis(YB)

Bitget·2025/10/15 07:23

Is the soon-to-TGE DEX Lithos actually a public goods fund?

On the surface, it is a DEX, but in reality, 40% of the initial supply will be used to fund public goods.

ForesightNews 速递·2025/10/15 07:13

Returning from mining to gaming, The9 Limited plans to build a "Web3 version of Steam"

You can say it doesn't understand mining, but never say it doesn't understand gaming.

ForesightNews 速递·2025/10/15 07:13

Gold Rush Handbook: What Are the Secrets to Wealth in the Six New Projects on MetaDAO?

Where does the next opportunity lie?

ForesightNews 速递·2025/10/15 07:13

Bitcoin Dominance Rejected at 60.3% as Chart Signals Sharp Drop Toward 56%

Cryptonewsland·2025/10/15 06:09

The Next Big Rally — 5 Altcoins Set to Erupt 50+% as Momentum Returns

Cryptonewsland·2025/10/15 06:09

Flash

- 07:33The United States indicts Chen Zhi, the leader of Asia's largest transnational criminal organization, for involvement in multi-billion dollar cryptocurrency fraud.ChainCatcher news, according to official documents, the United States District Court for the Eastern District of New York formally indicted Chen Zhi (also known as "Vincent"), founder and chairman of the Cambodian conglomerate Prince Holding Group, on October 8, 2025. The indictment accuses Chen Zhi of developing Prince Group, which ostensibly operates in real estate and financial services, into one of Asia's largest transnational criminal organizations since 2015. By establishing at least 10 forced labor scam compounds in Cambodia, the group carried out cryptocurrency investment scams such as "pig-butchering," resulting in billions of dollars in losses for victims worldwide. Prosecutors allege that Chen Zhi and his associates bribed foreign officials, used violence to protect their criminal activities, and laundered criminal proceeds through professional money laundering networks as well as Prince Group's online gambling and cryptocurrency mining businesses. As of 2020, Chen Zhi personally held approximately 127,271 bitcoins, and the U.S. government will seek to confiscate these assets. Chen Zhi is charged with conspiracy to commit wire fraud and conspiracy to commit money laundering. The case is currently being presided over by Judge Rachel P. Kovner.

- 07:33The U.S. Department of Justice confirms it has seized 127,271 BTC related to a pig-butchering scam case.ChainCatcher News, according to a joint announcement by the U.S. Attorney's Office for the Eastern District of New York and the National Security Division, the U.S. government has filed a civil forfeiture lawsuit for approximately 127,271 bitcoins (currently valued at about $15 billion), and confirmed that these funds are now in U.S. custody. The announcement stated that these crypto assets were obtained by the defendants through fraud and money laundering activities, and were originally stored in non-custodial wallets controlled by them. The U.S. authorities have now obtained the private keys and taken over the storage addresses of the funds. The Department of Justice stated that this is the largest crypto asset seizure operation in U.S. history.

- 07:334E: The Crypto Market May Introduce a "Circuit Breaker Mechanism" as Powell Sends Strong Rate Cut SignalsOctober 15 news, according to 4E observation, the recent sharp decline in the crypto market has exposed structural issues in exchange liquidation and risk control. Some platforms profited during extreme market conditions, while others lost hundreds of millions of dollars. Industry reports point out that automated liquidation systems designed to provide liquidity have instead amplified market chaos during violent fluctuations, prompting institutions to re-examine risk management. 10x Research noted that the industry is exploring whether to adopt traditional finance's "Circuit Breakers" to limit extreme volatility. If implemented, this mechanism could permanently change the volatility structure and profit logic of the crypto market. The report recalls that a similar systemic reflection last occurred after Elon Musk announced in 2021 that Tesla would stop accepting bitcoin payments. On the macro side, Federal Reserve Chairman Powell warned in a speech early this morning that the U.S. labor market is cooling, hinting at support for another 25 basis point rate cut. He pointed out, "The downside risk to employment has increased," and even if official data is delayed due to a government shutdown, the Fed's internal research is sufficient to support a rate cut decision. As a result, the yield on 30-year U.S. Treasury bonds fell to 4.60%, hitting a new low since April.In addition, Republican Congressman Troy Downing has proposed the "Retirement Investment Choice Act," which aims to include cryptocurrencies and private equity in the investment scope of 401(k) retirement plans. This means that the executive order from the Trump era is expected to be formally legislated, paving the way for crypto assets to further integrate into mainstream investment channels.4E reminds investors: If the "Circuit Breakers" mechanism is officially introduced, it will mark a key step for the crypto market towards institutionalization and risk control. However, short-term liquidity and volatility structures may undergo drastic changes, so close attention should be paid to the chain reactions of market system reforms.

![[Bitpush Daily News Highlights] The US plans to confiscate 127,000 BTC, potentially increasing its bitcoin holdings to 324,000 BTC; Powell hints at possible rate cuts due to weak hiring and rising unemployment; Japan to introduce new regulations banning crypto insider trading; US Republicans propose a bill to codify Trump’s executive order allowing 401(k) investments in cryptocurrency and private equity.](https://img.bgstatic.com/multiLang/image/social/b0411719ec6c4657208c834dbbc069d31760470562725.png)