News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Prediction markets are becoming the focus of community discussions; however, beneath the immense spotlight, several major questions and concerns are gradually emerging.

For exchanges and market makers, keeping retail investors trading continuously, engaging in repeated speculation, and retaining them long-term is far more profitable than "flushing out retail investors once a year."

Everyone should have their own mission, no matter how big or small, as long as it makes you happy.

A brutal "Squid Game".

USDe withstood the test during a record-breaking liquidation day in October, and remains safe unless multiple "black swan events" occur simultaneously.

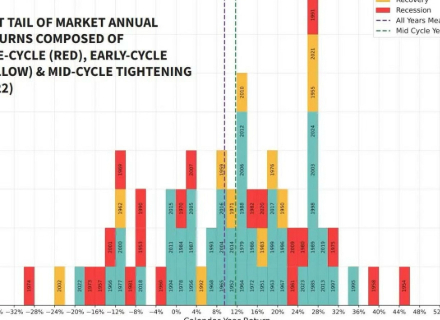

The global economy faces risks from feedback loops among policy, leverage, and confidence. Technology supports growth, but fiscal populism is on the rise and trust in currency is gradually eroding. Trade protectionism and speculative AI-driven finance are intensifying market volatility. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

- 06:56Bitcoin financial services and infrastructure platform Aureo completes 10 BTC seed round financingAccording to ChainCatcher, bitcoin financial services and infrastructure platform Aureo has announced the completion of a seed round financing of 10 BTC, with venture capital firm Early Riders participating. The company currently offers bitcoin purchasing and storage services. The new funds will be used to launch institutional-grade custody web and mobile applications, as well as to develop wallet integration APIs that support third-party deposits and withdrawals.

- 06:50Bitwise: If only 3%-4% of funds flow from gold into bitcoin, the price of bitcoin could double from its current level.Jinse Finance reported, according to Cointelegraph, Bitwise stated that if just 3% to 4% of gold funds rotate into Bitcoin, it could potentially double the Bitcoin price from its current level.

- 06:50Pepperstone: Unless there is a macroeconomic downside risk, the potential for further gains in US Treasury bonds will diminish.Jinse Finance reported that during the Asian trading session, U.S. Treasury yields edged lower, with the 10-year Treasury yield further falling below 4%. Pepperstone analyst Michael Brown stated in a report: "I find it difficult to justify the two-year (U.S. Treasury yield) dropping significantly below 3.50% or the 10-year (U.S. Treasury yield) dropping significantly below 4.00%, because the U.S. is outperforming other countries, inflation remains high, and overall risk appetite is positive." He said that unless there are major, potentially unexpected macroeconomic downside risks, the room for further gains in U.S. Treasuries is expected to diminish, especially for long-term bonds. (Golden Ten Data)