News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Jensen Huang appeared at the Kkanbu Chicken restaurant in Seoul and had a fried chicken dinner with the heads of Samsung Electronics and Hyundai Motor, unexpectedly sparking a frenzy in Korean "meme stocks."

Solana is actively transforming "blockchain technology" into foundational infrastructure, emphasizing its financial attributes and capacity to support institutional applications.

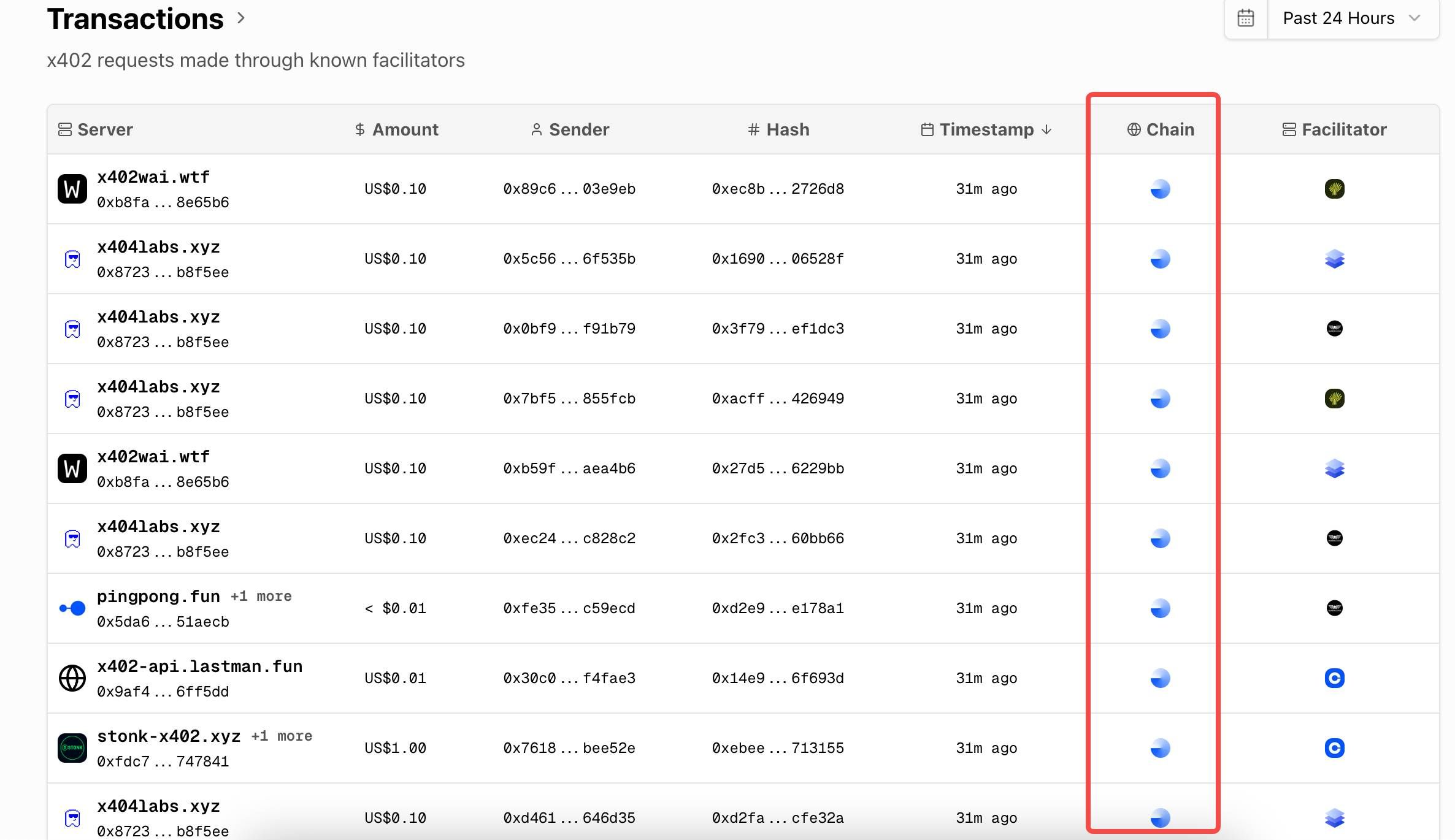

We have reviewed the BNB Chain and Solana-related x402 projects currently on the market to help everyone better identify assets in this narrative cycle.

The assets on the Sun Wukong platform have exceeded 100 millions. With its innovative user experience and ecosystem synergy, it is leading a new era of decentralized contract trading. Experts predict that the future will be characterized by the coexistence of DeFi and CeFi, but with decentralization taking the lead.

The Executive Chairman of Strategy made his debut in the Middle East.

- 16:03Faraday Future: Supports customers in the UAE to use crypto assets and fiat currency to pay for car purchases and after-sales servicesForesight News reported that Faraday Future, owned by Jia Yueting, announced that FX Super One received over 200 paid pre-orders within 48 hours after its ultimate launch event in the Middle East. At the event, FX announced that customers in the UAE are allowed to use both fiat currency and crypto assets to pay for car purchases and after-sales services.

- 16:03Two newly created wallets withdrew 2,000 BTC, worth approximately $220 million, from a certain exchange.Foresight News reported, according to monitoring by Lookonchain, two newly created wallets withdrew 2,000 BTC, worth approximately $220 million, from an exchange in the past two hours.

- 16:03If Bitcoin rebounds and breaks through $112,000, the cumulative short liquidation intensity on major CEXs will reach $819 millions.According to ChainCatcher, citing data from Coinglass, if bitcoin rebounds and breaks through $112,000, the cumulative short liquidation intensity on major CEXs will reach 819 million. Conversely, if bitcoin falls below $109,000, the cumulative long liquidation intensity on major CEXs will reach 685 million. Note: The liquidation chart does not display the exact number of contracts pending liquidation or the precise value of contracts being liquidated. The bars on the liquidation chart actually represent the relative importance, or intensity, of each liquidation cluster compared to adjacent clusters. Therefore, the chart shows the degree of impact when the underlying asset price reaches a certain level. A higher "liquidation bar" indicates that once the price reaches that level, there will be a stronger reaction due to a wave of liquidity.