News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Paxos has submitted a proposal to support Hyperliquid’s launch of the USDH stablecoin on its platform. The company plans to use 95% of the interest generated by its reserves backing USDH to repurchase HYPE and redistribute it back to ecosystem initiatives. Paxos Labs has also acquired Molecular Labs in a bid to accelerate stablecoin adoption in the Hyperliquid ecosystem.

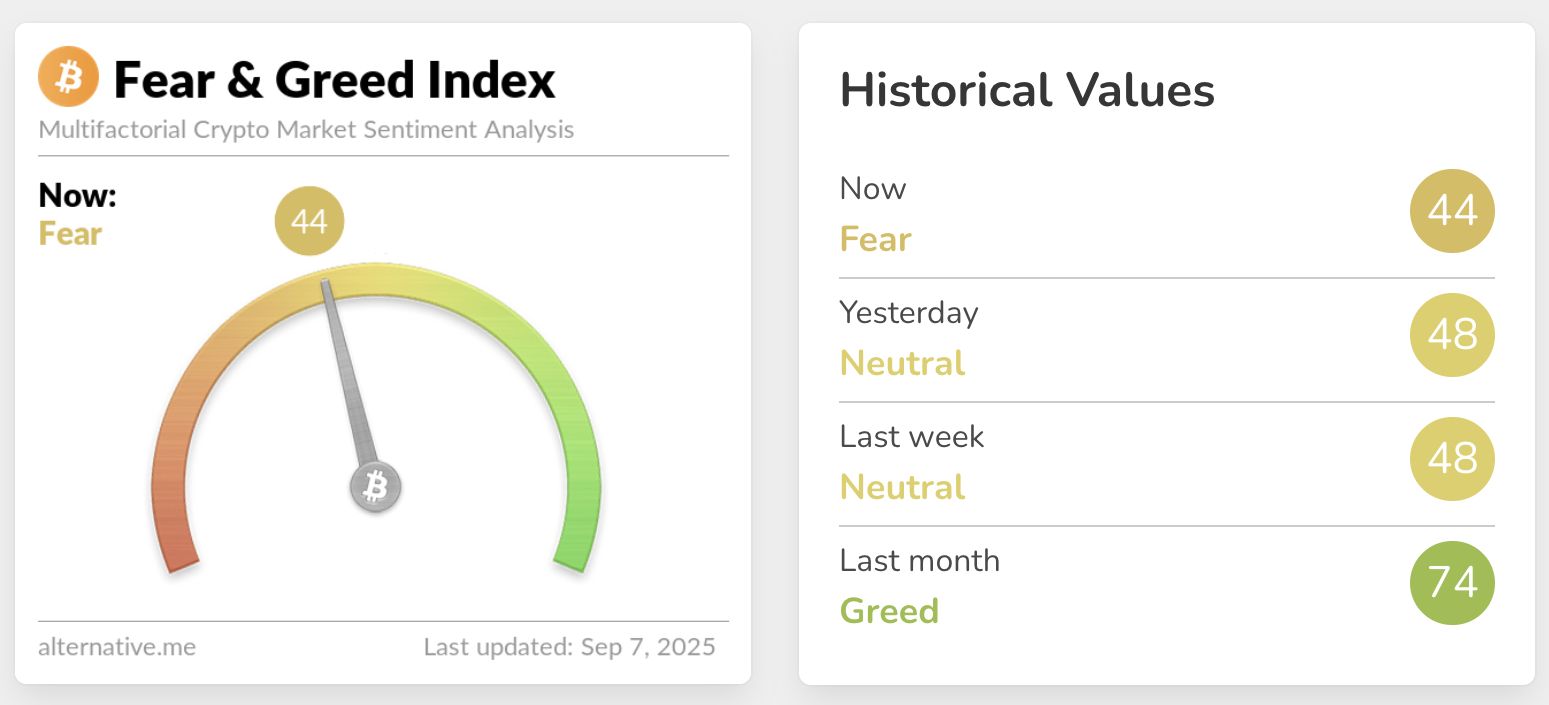

Share link:In this post: Crypto sentiment has moved into the fear region as investors are now holding off from taking more risks. Santiment has highlighted the focus on larger-cap tokens, noting that traders are presently not open to risks. Analysts and traders question the near-term direction of some of these major assets.

The crypto market is in a stagnant state, but bitcoin's stability and the altcoin season index indicate opportunities. Here are the top three altcoins worth buying right now.

- 15:07Hassett: There are currently no plans to reform the Federal ReserveChainCatcher news, according to Golden Ten Data, the Director of the US White House National Economic Council, Hassett, stated, "I currently have no plans to reform the Federal Reserve."

- 14:17Avenir currently allocates more than 80% of its portfolio to Bitcoin.According to a report by Jinse Finance, The Bitcoin Historian has released the latest news: the trading firm Avenir, with a scale of 1.3 billions USD, currently allocates more than 80% of its investment portfolio to bitcoin (BITCOIN).

- 14:12Analyst: September Rate Cut Almost Certain, Options Traders Expect Stable Stock MarketJinse Finance reported that as a Federal Reserve rate cut in September has almost become a foregone conclusion, options traders generally expect the stock market to remain stable ahead of Thursday's CPI data release. The logic behind the market's expectation of a rate cut lies in the stagnation of U.S. employment growth and the need to stimulate the economy. Weak employment data on Friday further reinforced expectations of a 25 basis point rate cut. Although U.S. stocks fell slightly and the fear index rose marginally, it still remained below the key level of 20. Options traders expect the S&P 500 Index to experience about a 0.7% two-way fluctuation after the CPI is released on Thursday.