News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

2025 Digital Asset Treasury Company (DATCo) Annual Report

ChainFeeds·2025/11/07 03:32

[English Long Tweet] Beyond Simple Betting: A New Expression for Prediction Markets

ChainFeeds·2025/11/07 03:32

Vitalik: Sorting Out the Differences Among Various L2s

L2 projects will become increasingly heterogeneous.

Vitalik Buterin·2025/11/07 03:02

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Cointribune·2025/11/07 00:48

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling

Cointribune·2025/11/07 00:48

36 Days of Shutdown in the USA: The Crypto Bill Threatens to Derail for Good

Cointribune·2025/11/07 00:48

Render (RENDER) Holds Key Support — Could This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/11/07 00:45

JPMorgan sees Bitcoin as more attractive than gold after price dip

Coinjournal·2025/11/07 00:24

Dogecoin faces $0.15 test as analysts predict a massive price ‘burst’ ahead

Coinjournal·2025/11/07 00:24

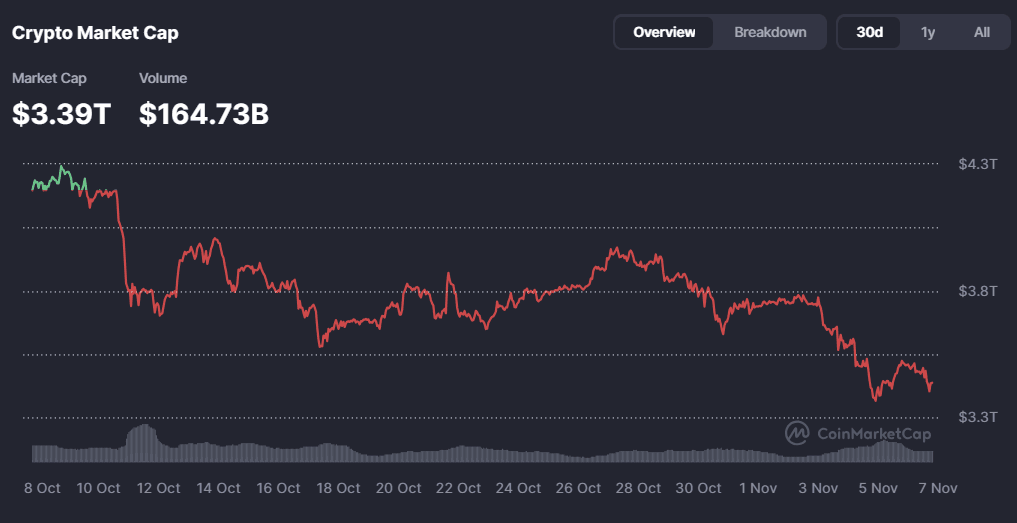

Why Is the Crypto Market Flat Today? November 6, 2025

Cryptoticker·2025/11/07 00:12

Flash

- 05:03Elixir: The official 1:1 deUSD to USDC redemption channel is now openOn November 7, Elixir announced that the team has completed the redemption of approximately 80% of all deUSD holders (excluding the Stream portion). Currently, Stream holds about 90% of the deUSD supply (approximately $75 million), and Elixir's remaining collateral assets are mainly Morpho loans issued to Stream. All remaining deUSD and sdeUSD holders (including LPs from AMM and lending platforms) can exchange their tokens for USDC at a 1:1 ratio. Elixir has taken a snapshot for this purpose and launched an official redemption page. At the same time, the minting and redemption functions for deUSD have been closed. Official reminder: deUSD no longer has any value, please do not purchase or invest further, and users are warned to only submit redemption requests through official links and to beware of scam websites.

- 04:59Yesterday, the spot Ethereum ETF saw a net inflow of $9.09 million, ending a six-day streak of net outflows.According to ChainCatcher, monitored by Trader T, yesterday's net inflow for Ethereum spot ETFs was $9.09 million. Among them, BlackRock's ETHA contributed $4.59 million, Fidelity's FETH saw an inflow of $4.95 million, Bitwise's ETHW had an inflow of $3.08 million, while Grayscale's ETHE had a net outflow of $3.53 million. There was no capital movement for 21Shares' TETH, Invesco's QETH, Franklin's EZET, Van Eck's ETHV, or Grayscale mini's ETH on the same day.

- 04:46Elixir: deUSD is officially invalid, and the USDC compensation process will be initiated for all deUSD and its derivative holders.ChainCatcher news, according to Elixir's official Twitter, the stablecoin deUSD has been officially retired and no longer holds any value. The platform will initiate a USDC compensation process for all holders of deUSD and its derivatives (such as sdeUSD). The affected parties include lending platform collateral providers, AMM LPs, Pendle LPs, and others. Elixir also warns users not to purchase or invest in deUSD through AMMs or other channels.