News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

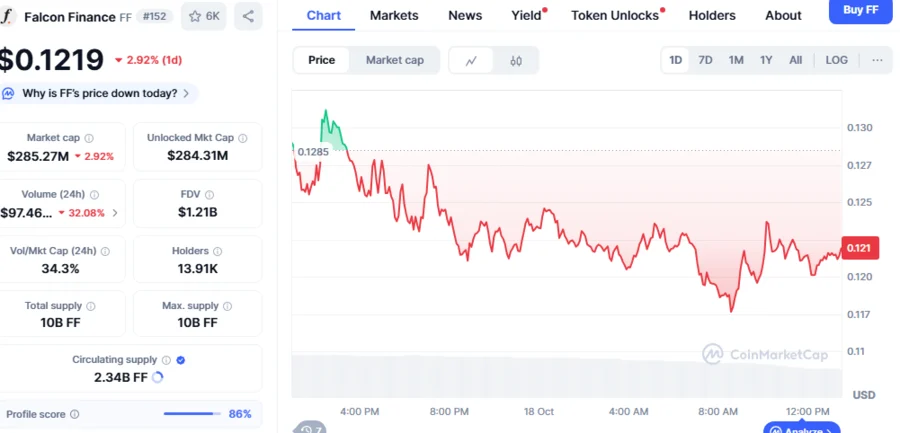

Whales Turn to FF Token Accumulation Amid Falcon Finance’s 37.9% Price Slump

CryptoNewsNet·2025/10/19 11:45

Japan’s FSA weighs allowing banks to hold Bitcoin, other cryptos: Report

CryptoNewsNet·2025/10/19 11:45

XRP, SOL Break Ahead with Bullish Reset in Sentiment as Bitcoin and Ether Stay Stuck in the Gloom

CryptoNewsNet·2025/10/19 11:45

Ripple (XRP) Chief Legal Officer Responds to Criticisms Directed at the Industry

CryptoNewsNet·2025/10/19 11:45

Are Bitcoin Miners Now Abandoning BTC to Work on Artificial Intelligence? Industry Members Respond

CryptoNewsNet·2025/10/19 11:45

Prediction Markets Shift Against Bitcoin

Cointribune·2025/10/19 11:45

Trust Wallet Token (TWT) To Rise Further? Key Harmonic Pattern Hints Potential Upside Move

CoinsProbe·2025/10/19 11:42

SPX6900 (SPX) Testing Crucial Support – Can It Defend from a Breakdown?

CoinsProbe·2025/10/19 11:42

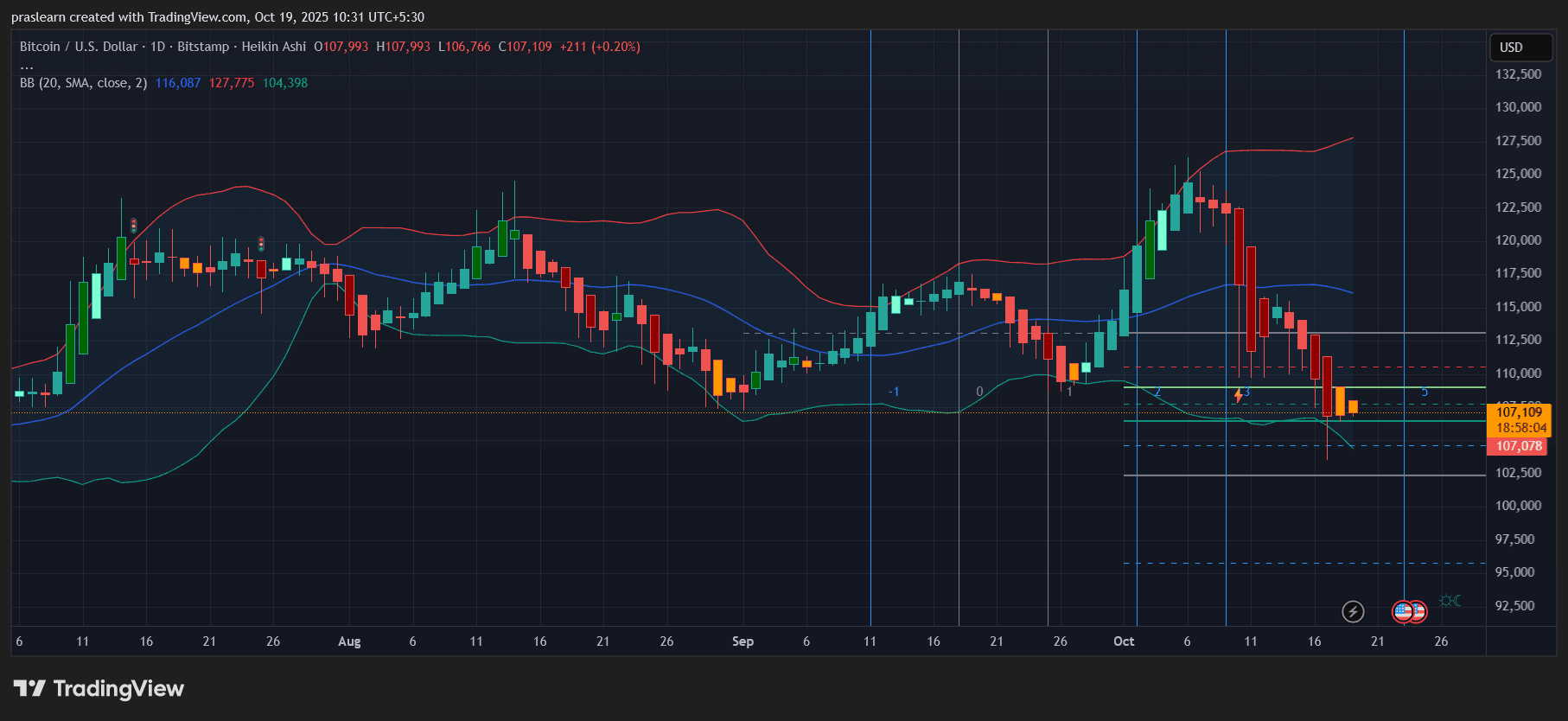

Is Bitcoin’s $100K Floor at Risk as the Fed Struggles to Find Its “Neutral” Rate?

Cryptoticker·2025/10/19 11:21

Bitcoin Consolidates Near $107K: Analysts Have THIS Bitcoin Prediction...

Cryptoticker·2025/10/19 11:21

Flash

- 11:41Vitalik responds on how to improve the evaluation methods for crypto technology performance to ensure hardware independence, suggesting the use of publicly available hardware.ChainCatcher reported that Ethereum co-founder Vitalik Buterin previously suggested that developers in the fields of zero-knowledge proof (ZK) and fully homomorphic encryption (FHE) should adopt more practical performance evaluation metrics. He proposed using the "efficiency ratio," which is the ratio of encrypted computation time to original computation time, instead of the traditional "operations per second" metric. However, some community users raised concerns about how to ensure hardware independence. In response, Vitalik Buterin stated that publicly available hardware can be used, and the geometric mean of the capital expenditure in US dollars per operation per second and the energy consumption per operation in joules, both for encrypted and original computations, would serve as a reasonable first-pass metric.

- 11:28Andrew Kang increased his short positions to $77.97 million, with unrealized losses of approximately $1 million.According to Jinse Finance, monitored by AI Aunt, the short positions associated with AndrewKang have increased to $77.97 million, including $46.86 million in ETH shorts and $31.14 million in BTC shorts. The current total position has an unrealized loss of $990,000; meanwhile, his ENA long position has an unrealized profit of $2.97 million.

- 11:12Data: A certain whale deposited $2.91 million USDC into Hyperliquid and opened long and short positions worth approximately $70 million.According to ChainCatcher, monitored by Lookonchain, a whale (0x579f...e5ff) deposited 2.91 million USDC into Hyperliquid over the past two days and established positions totaling approximately 70 million USD. These include shorting 232 BTC (worth 25 million USD), shorting 5,810 ETH (worth 22.7 million USD), and going long on 44.79 million ENA (worth 21.3 million USD).