Expert: People Saying XRP Can’t Go Past $10 Really Haven’t Done Their Research

In a recent post, Jesse of Apex Crypto Insights directly addressed claims that XRP is structurally incapable of exceeding a price level of $10. His argument centers on what he views as a persistent misunderstanding of how value could emerge if XRP is used at scale within global financial infrastructure.

According to Jesse, dismissing higher price scenarios reflects a failure to examine transaction volumes handled by major financial institutions and central banks that are connected to Ripple’s network.

Jesse emphasized that debates around XRP’s valuation often rely on comparisons to Bitcoin’s market capitalization while overlooking fundamental differences in utility and intended use.

He argued that Bitcoin’s valuation has reached into the trillions despite limited transactional use in the traditional financial system, whereas XRP is positioned to support high-volume settlement activity tied to institutional flows.

People saying XRP can't go past $10 really haven't done their research. One Ripple partner (Bank of England) does more volume in one day than Bitcoin in a YEAR and it will use XRP to settle transactions. Wake up people!

— Apex Crypto Insights (NFA) (@APEXCONSULTNFA) December 17, 2025

Central Bank Volume as the Core Argument

A central element of Jesse’s position is his repeated reference to the Bank of England as a Ripple partner. He asserted that this single institution processes more transaction volume in a single day than Bitcoin processes over an entire year.

From his perspective, this comparison is critical because XRP is designed to serve as a settlement asset for such large-scale financial activity, rather than as a store-of-value narrative driven primarily by scarcity.

Jesse expanded this point by placing the Bank of England in a broader global context. With approximately 170 to 180 central banks worldwide, he suggested that even limited adoption across these institutions would represent transaction volumes far exceeding those currently observed in digital asset markets. Based on this reasoning, he argued that dismissing XRP’s ability to move beyond $10 ignores the scale of the financial systems it is intended to support.

Rebutting Claims of Irrelevance and Lack of Adoption

In the accompanying video, Jesse also rejected claims that XRP lacks real-world use or that it is a so-called “scam coin.” While clarifying that his remarks were not meant as an attack on Bitcoin, he maintained that focusing exclusively on Bitcoin’s market capitalization without considering utility creates a distorted view of value. He framed XRP as an asset aligned with institutional settlement needs, which he believes fundamentally alters how price potential should be evaluated.

Skepticism From Long-Term Observers

The post also drew a critical response from a user identified as Ullr, who expressed frustration rooted in long-term price performance. Ullr referenced expectations formed as early as 2018 and argued that, despite regulatory clarity, XRP remains significantly below its all-time high.

The commenter attributed this stagnation to what they described as ongoing suppression and repeated unmet expectations, noting that references to future adoption have not translated into sustained price appreciation.

This exchange highlights the divide between forward-looking valuation arguments based on projected utility and skepticism grounded in historical price action. Jesse’s position rests on anticipated institutional usage at scale, while critics point to the disconnect between those expectations and current market outcomes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor Stays Unfazed Amid Bitcoin’s Roller Coaster Ride as DeepSnitch AI Inches Closer to $1 Million in Presale Funding

These 21-year-old dropouts raised $2M to build Givefront, a fintech for nonprofits

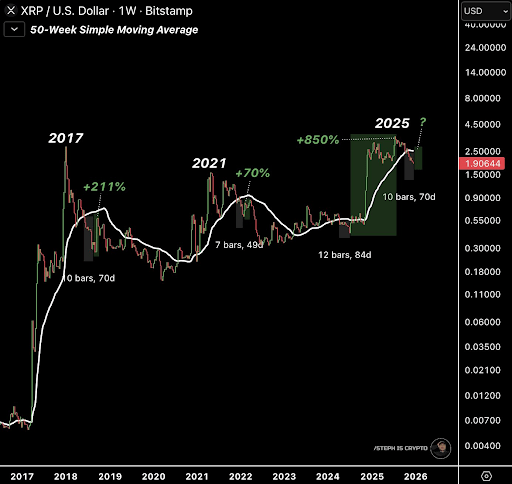

XRP Enters Historical Window That Has Previously Led To Triple-Digit Rallies

Which Cryptocurrency Has the Most Active Wallets? The List is Out, and Bitcoin Isn’t Number One