CFTC Acting Chief Pham Eyes MoonPay Role Post-Selig Confirmation

Quick Breakdown

- CFTC Acting Director Vincent Pham plans to join crypto firm MoonPay once Mike Selig is confirmed as permanent chief.

- The move highlights the flow of talent from U.S. regulators to the private crypto sector amid policy shifts.

- Transition underscores questions over expertise migration in maturing digital asset oversight.

CFTC leadership shakeup accelerates crypto hiring trend

Caroline D. Pham, acting chief of the U.S. Commodity Futures Trading Commission (CFTC), will transition to crypto payments firm MoonPay once Mike Selig secures Senate confirmation as permanent director. This development follows Selig’s nomination by President Donald Trump, who was reelected in November 2024 and inaugurated in January 2025. Pham’s departure comes after a tenure marked by oversight of crypto derivatives and enforcement actions against platforms like Kraken, which recently expanded its EU services to include crypto-collateralised futures under MiCA rules.

I’m looking forward to a successful confirmation of Mike Selig as the @CFTC’s next chairman and a smooth transition once he is sworn in. The future is bright. Onward and upward 🚀

— Caroline D. Pham (@CarolineDPham) December 17, 2025

This shift positions MoonPay to leverage Pham’s regulatory insight to enhance compliance and expand on-ramps for Bitcoin (BTC) and Ethereum (ETH) purchases. Industry observers note the pattern echoes past moves, such as former CFTC commissioners joining firms like Coinbase, amid evolving U.S. policies post-2024 elections that favour clearer digital asset frameworks.

Pham’s expertise bolsters MoonPay amid competitive payments race

MoonPay, valued at over $3 billion following recent funding, focuses on fiat-to-crypto bridges supporting 160 countries and major chains like Solana and the Tether network. Pham joins as a key executive, bringing experience from CFTC probes into stablecoin issuers and DeFi protocols, paralleling Tether’s recent challenge to S&P downgrade over asset transparency. His role will likely sharpen MoonPay’s navigation of U.S. rules, especially as banks like SoFi launch crypto trading following the OCC clarification that national banks can execute riskless principal crypto trades, acting as intermediaries without market risk.

Critics raise “revolving door” flags, arguing that such transitions could soften enforcement, though proponents see it as an essential talent exchange in a sector that needs ex-regulator know-how. Selig’s confirmation, expected soon given Trump’s pro-crypto stance, will complete the handoff, potentially accelerating CFTC approvals for spot ETFs like Grayscale’s Chainlink product.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Stabilizes Near $128 as Support at $124 and Resistance at $134 Define Trading Range

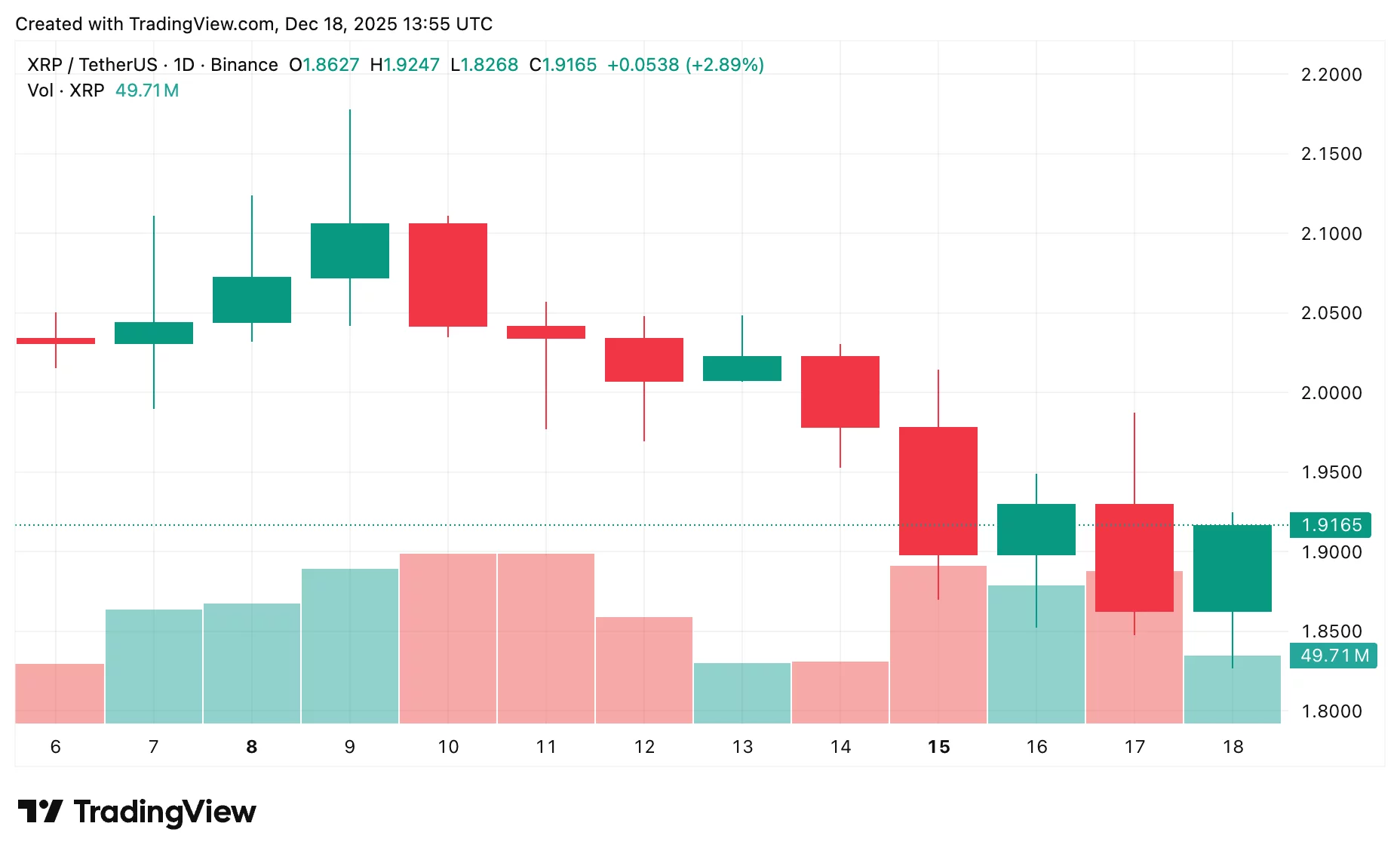

XRP price prediction: Will Ripple break $2 or slide lower?

XRP Faith Hits New Highs as Long-Term Holders Talk of a Historic Endgame

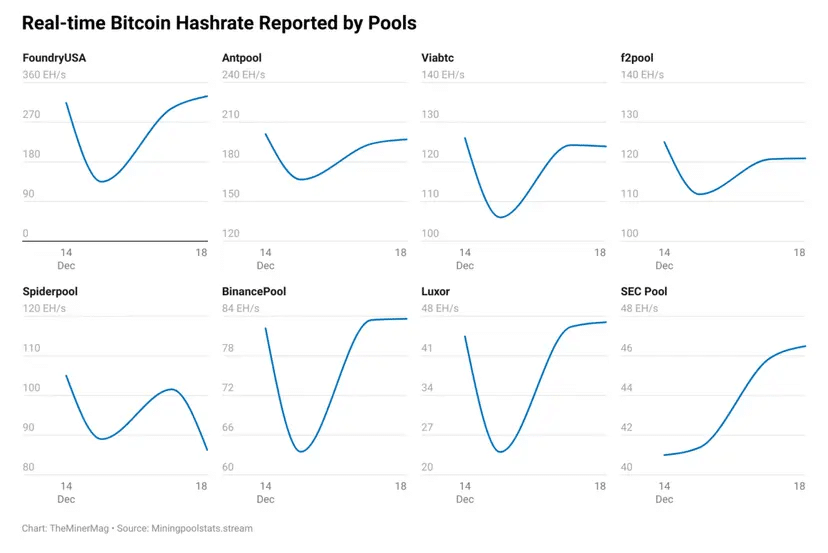

Bitcoin Mining Recovers Quickly After China Crackdown Claims, Network Metrics Stay Strong