US CPI in Focus as Investors Weigh Fed’s January Rate Outlook

By:BeInCrypto

The United States (US) Bureau of Labor Statistics (BLS) will publish the all-important Consumer Price Index (CPI) data for November on Thursday at 13:30 GMT. The inflation report will not include CPI figures for October and will not offer monthly CPI prints for November due to a lack of data collection during the government shutdown. Hence, investors will scrutinize theannual CPI and core CPI prints to assess how inflation dynamics could influence the Federal Reserves (Fed) policy outlook. What to expect in the next CPI data report? As measured by the change in the CPI, inflation in the US is expected to rise at an annual rate of 3.1% in November, mildly above Septembers reading. The core CPI inflation, which excludes the volatile food and energy categories, is also forecast to rise 3% in this period. TD Securities analysts expect annual inflation to rise at a stronger pace than anticipated, but see the core inflation holding steady. We look for the US CPI to rise 3.2% y/y in November its fastest pace since 2024. The increase will be driven by rising energy prices, as we look for the core CPI to remain steady at 3.0%, they explain. How could the US Consumer Price Index report affect the US Dollar? Heading into the US inflation showdown on Thursday, investors see a nearly 20% probability of another 25-basis-point Fed rate cut in January, according to the CME FedWatch Tool. The BLS delayed official employment report showed on Tuesday that Nonfarm Payrolls declined by 105,000 in October and rose by 64,000 in November. Additionally, the Unemployment Rate climbed to 4.6% from 4.4% in September. These figures failed to alter the market pricing of the January Fed decision, as the sharp decline seen in payrolls in October was not surprising, given the loss of government jobs during the shutdown. In a blog post published late Tuesday, Atlanta Fed President Raphael Bostic argued that the mixed jobs report did not change the policy outlook and added that there are multiple surveys that suggest there are higher input costs and that firms are determined to preserve their margins by increasing prices. A noticeable increase, with a print of 3.3% or higher, in the headline annual CPI inflation, could reaffirm a Fed policy hold in January and boost the US Dollar (USD) with the immediate reaction. On the flip side, a soft annual inflation print of 2.8% or lower could cause market participants to lean toward a January Fed rate cut. In this scenario, the USD could come under heavy selling pressure with the immediate reaction. Eren Sengezer, European Session Lead Analyst at FXStreet, offers a brief technical outlook for the US Dollar Index (DXY) and explains: The near-term technical outlook suggests that the bearish bias remains intact for the USD Index, but there are signs pointing to a loss in negative momentum. The Relative Strength Index (RSI) indicator on the daily chart recovers above 40 and the USD Index holds above the Fibonacci 50% retracement of the September-November uptrend. The 100-day Simple Moving Average (SMA) aligns as a pivot level at 98.60. In case the USD Index rises above this level and confirms it as support, technical sellers could be discouraged. In this scenario, the Fibonacci 38.2% retracement could act as the next resistance level at 98.85 ahead of the 99.25-99.40 region, where the 200-day SMA and the Fibonacci 23.6% retracement are located. On the downside, the Fibonacci 61.8% retracement level forms a key support level at 98.00 before 97.40 (Fibonacci 78.6% retracement) and 97.00 (round level).

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Pepe Coin price eyes 30% dip as whales start capitulating

Crypto.News•2025/12/18 19:42

Solana Stabilizes Near $128 as Support at $124 and Resistance at $134 Define Trading Range

Cryptonewsland•2025/12/18 19:33

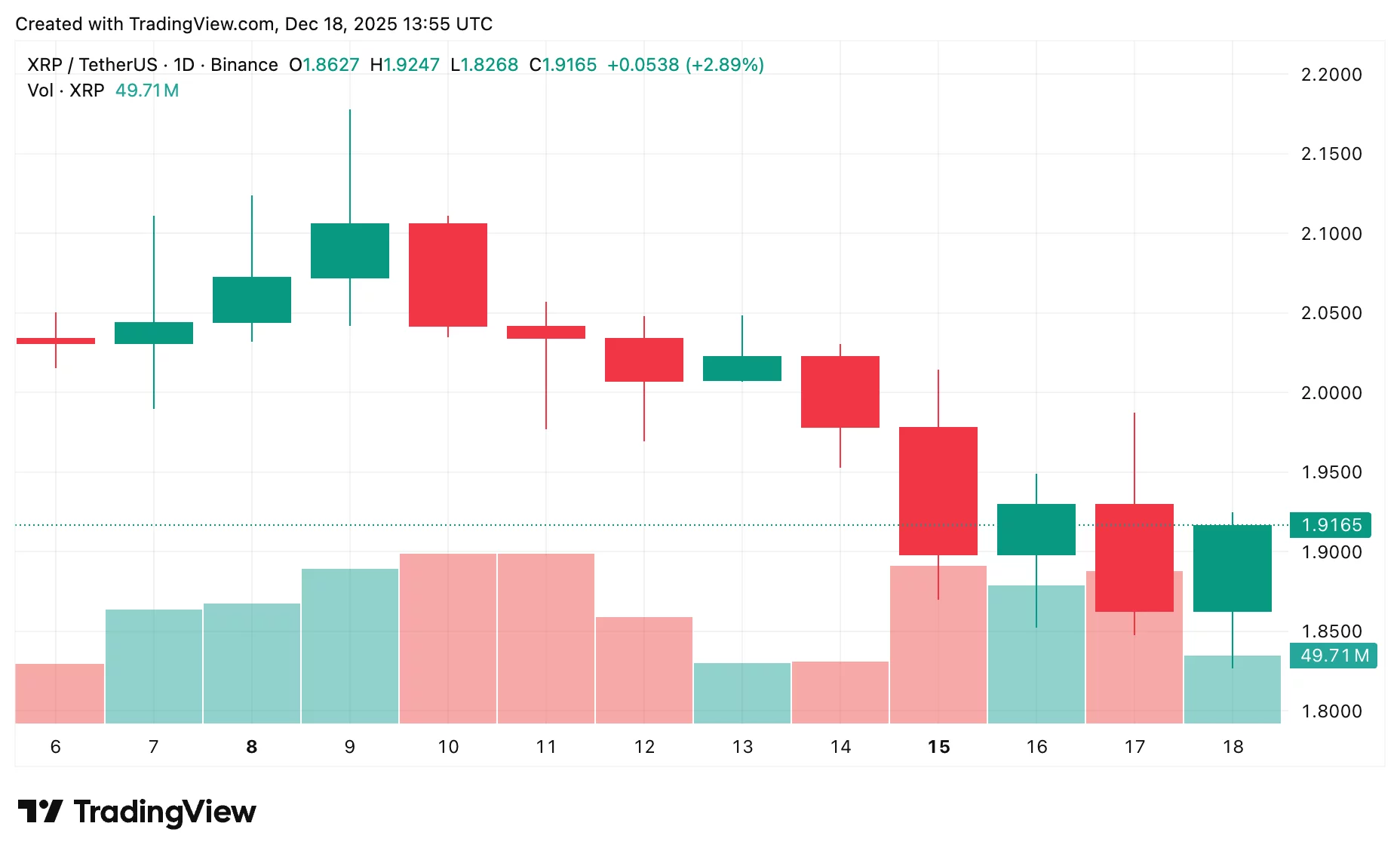

XRP price prediction: Will Ripple break $2 or slide lower?

Crypto.News•2025/12/18 19:33

XRP Faith Hits New Highs as Long-Term Holders Talk of a Historic Endgame

Newsbtc•2025/12/18 19:18

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$84,684.32

-1.29%

Ethereum

ETH

$2,788.71

-0.84%

Tether USDt

USDT

$0.9996

+0.01%

BNB

BNB

$822.25

-1.81%

XRP

XRP

$1.81

-2.11%

USDC

USDC

$0.9999

-0.01%

Solana

SOL

$118.04

-3.08%

TRON

TRX

$0.2788

-0.16%

Dogecoin

DOGE

$0.1206

-3.89%

Cardano

ADA

$0.3499

-4.37%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now