EquiLend Invests in Digital Prime’s Tokenet to Advance RWA Tokenization and Stablecoin-Collateralized Crypto Lending

COINOTAG News reports that EquiLend, a leading securities lending infrastructure firm managing a roughly $40 trillion lendable pool, has struck a strategic minority stake in Digital Prime Technologies, a regulated crypto-lending provider. The deal size was not disclosed. The investment signals a strategic push to capture value in real-world asset (RWA) tokenization and the wider digital asset market, anchored by demand for a compliant, transparent, and governable workflow that bridges traditional finance and crypto assets.

Under the agreement, the teams will leverage Digital Prime’s Tokenet institutional lending network to extend multi-custodian and multi-collateral lifecycle coverage, alongside risk exposure monitoring and institutional-grade reporting. Future phases target the integration of compliance stablecoins as collateral and the rollout of additional tokenized financial instruments, enhancing cross-asset liquidity and reporting fidelity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

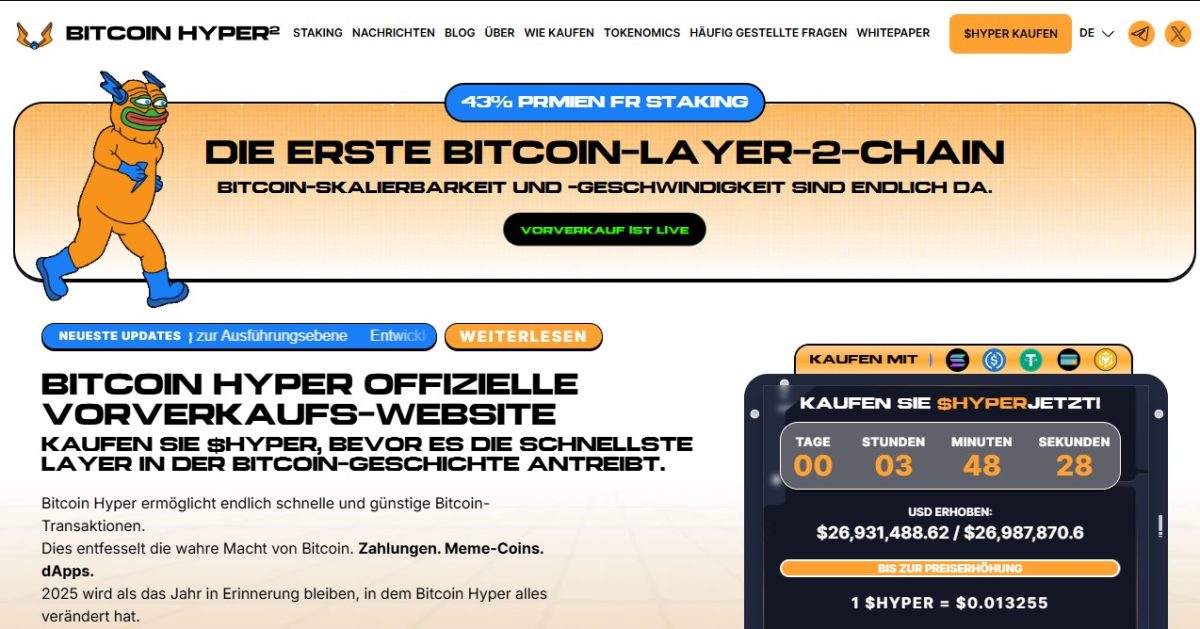

Bitcoin fällt auf 85.000 $ – Bitcoin Hyper Mega-Pump 2026

Russia Draws Firm Line on Digital Assets, Keeping Crypto Out of Domestic Payments

Warner Bros. Discovery rejects Paramount’s hostile bid, calls offer ‘illusory’

US Stock Market Drops as Dow Falls 0.12%, S&P 500 Dips 0.67%, Nasdaq Drops Over 1%