Ondo Finance, a blockchain platform focused on institutional-grade financial services, has come under pressure following the broader market decline over the past day.

Its native token, Ondo Finance [ONDO], fell by 10% within the last 24 hours.

Despite the pullback, investor activity and capital inflows continue to support the market. ONDO’s market capitalization stands at $1.27 billion, while the number of holders has climbed to an all-time high of 174,360.

Why ONDO fell

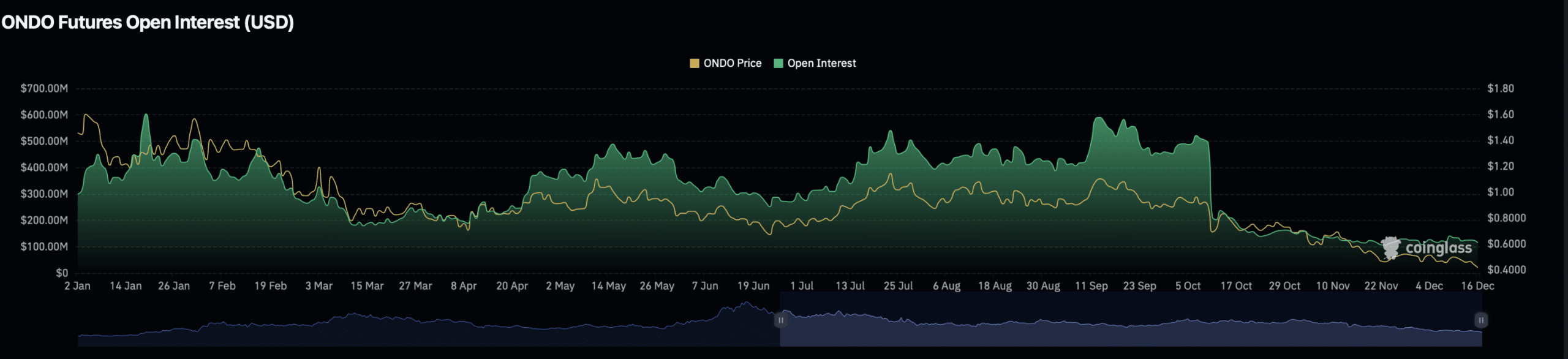

The recent decline appears to have been driven largely by a sharp liquidity outflow from the derivatives market.

Capital withdrawals over the past 24 hours reduced the circulating balance to roughly $110 million. Total capital outflows reached approximately $11 million, with nearly $1 million attributed to liquidations.

Source: CoinGlass

Sharp price declines accompanied by rising trading volume often indicate high-momentum selling. In ONDO’s case, trading volume increased by 46% to $204 million, according to CoinGlass.

This suggests that investors remain highly active, although the prevailing sentiment reflects bearish pressure in the short term.

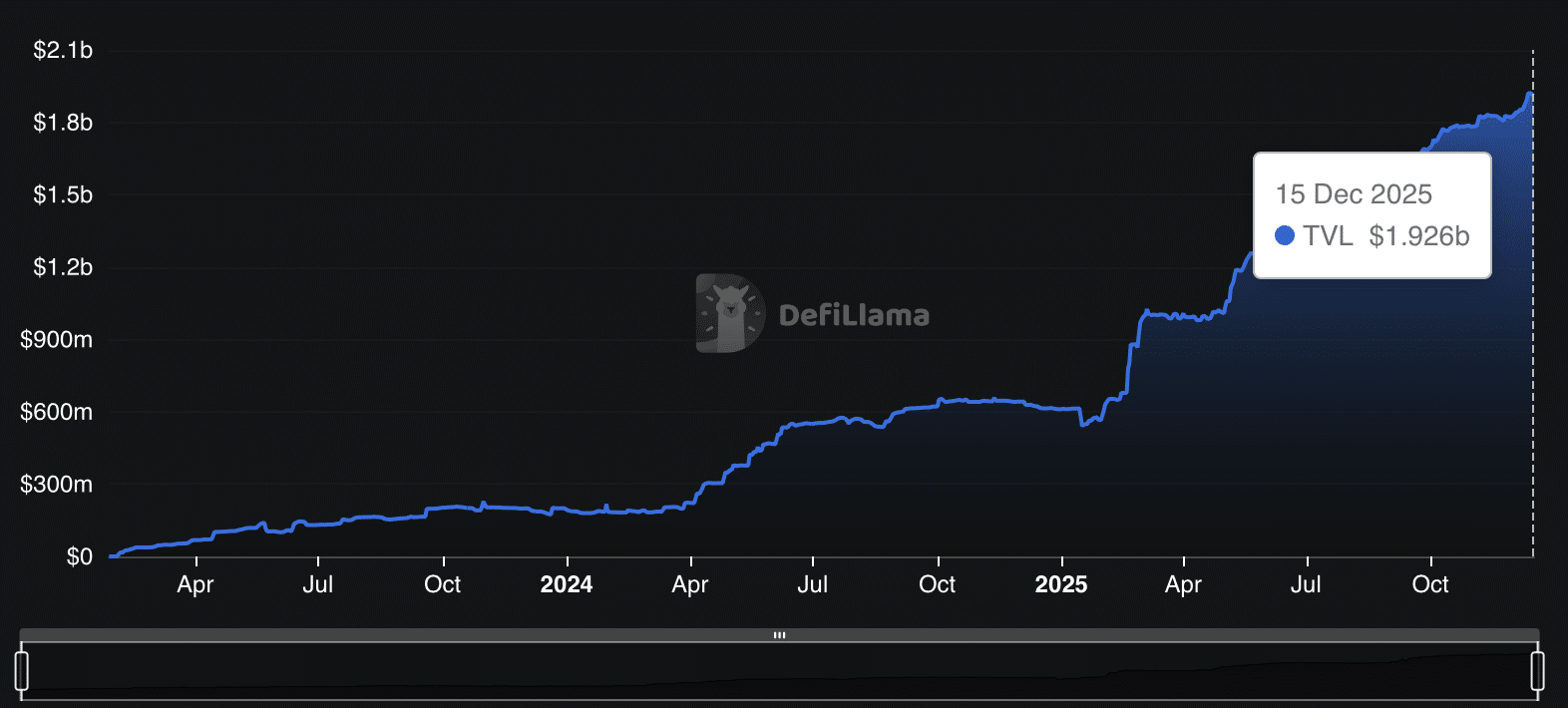

On-chain liquidity continues to rise

On-chain inflows continued to strengthen. Notably, Total Value Locked on Ondo Finance has surged to an all-time high of $1.926 billion as of the 15th of December.

Rising TVL typically signals renewed capital inflows from long-term investors. This trend indicated that participants were increasingly committing funds to the protocol despite recent price weakness.

Source: DeFiLlama

In simple terms, investors are depositing ONDO to earn yield through liquidity pools while positioning for potential future price appreciation. This strategy allows them to benefit from both yield generation and price upside.

In December alone, the protocol generated $2.24 million in fees, according to DeFiLlama.

Rising fees often reflects increased platform usage, signaling growing demand for ONDO and contributing to underlying buying pressure.

If on-chain activity continues to build at this pace, ONDO could benefit meaningfully from current market conditions, potentially supporting a price rebound.

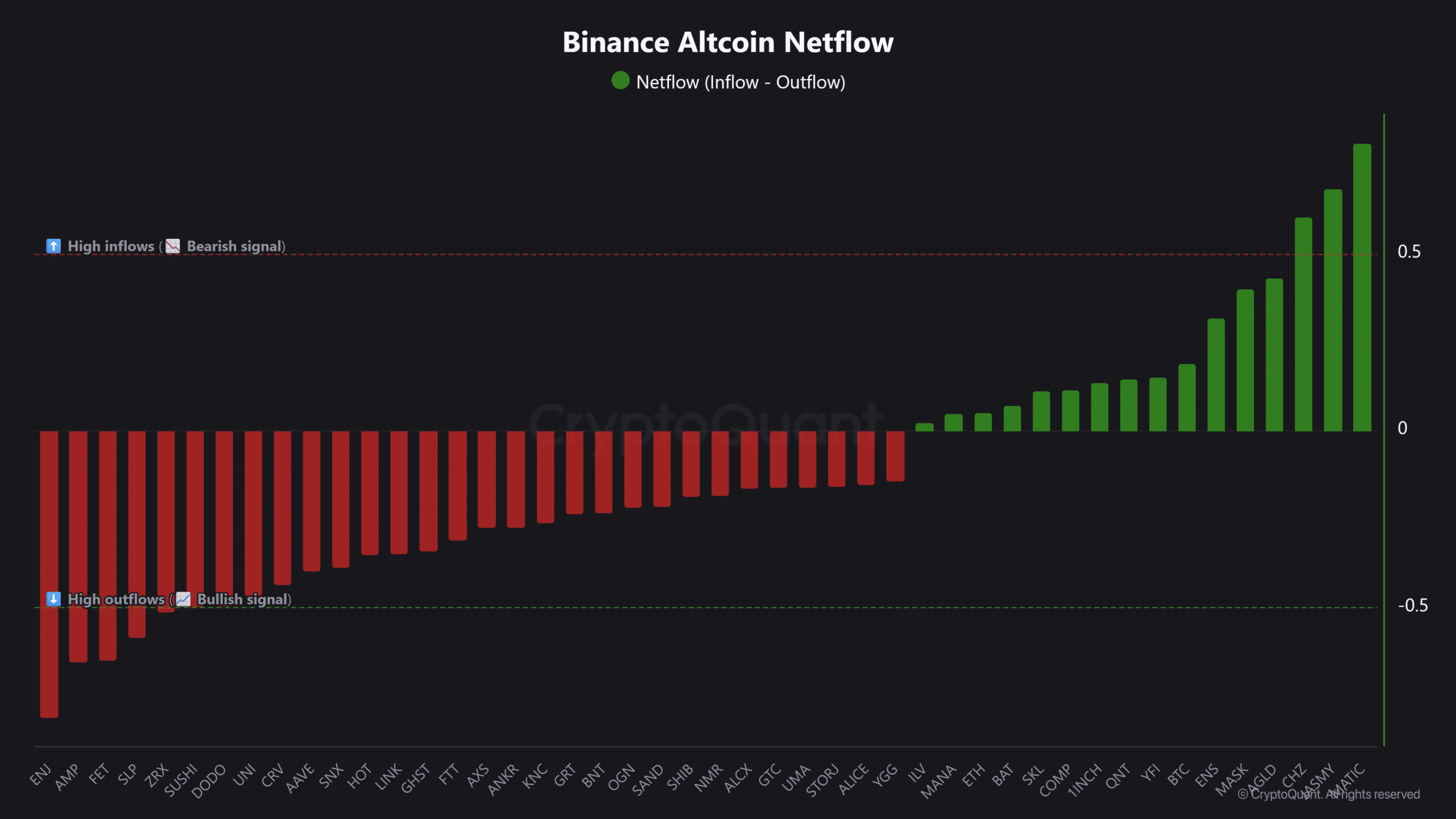

Binance investors step in

Binance traders are also showing renewed interest, offering early signs of a possible price recovery.

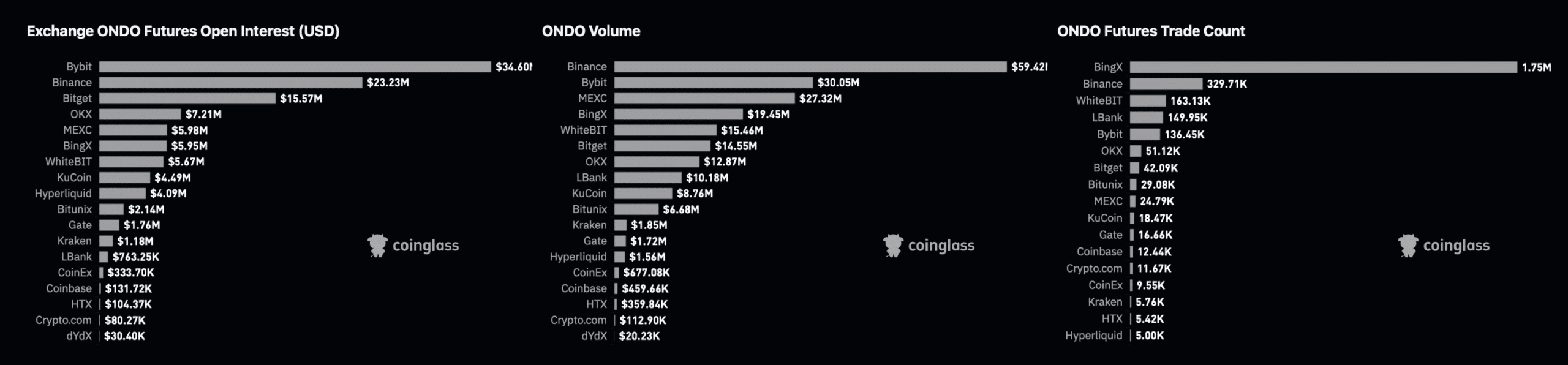

CoinGlass data shows notable capital inflows on Binance, reflected in rising derivatives trading volume for ONDO.

With net volume turning bullish and Binance accounting for the second-largest Open Interest in ONDO derivatives at $22.23 million, market positioning suggests improving sentiment.

Source: CoinGlass

The broader derivatives market also reflects a bullish shift, with the funding rate rising to 0.0044%. This indicates stronger demand for long positions and continued capital inflows.

If this trend persists, ONDO’s prospects for a rebound remain tilted to the upside.

Final Thoughts

- Off-chain data shows that ONDO has recorded a significant liquidity outflow of $11 million from the derivatives market.

- On-chain data, however, shows rising liquidity inflows, with TVL reaching an all-time high of $1.926 billion.