Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently

I. Key News Highlights

Federal Reserve Updates

Fed Officials Say Policy is Well-Positioned, Inflation Expected to Moderate Further

-

New York Fed President Williams stated that monetary policy is in a sound position, expecting inflation to continue falling toward target levels through 2026.

-

Fed Governor Miran emphasized in a speech that current housing inflation is an aftereffect of past supply-demand imbalances, not a current issue.

-

Market Impact: These statements reinforce investor expectations for gradual easing, potentially alleviating short-term interest rate volatility, but attention should be paid to tonight's employment data at 21:30 for guidance on future policy decisions.

International Commodities

Gold Prices Edge Higher, Crude Oil Under Pressure

-

Gold rose to $4,306.84 per ounce, up 0.01% for the day and 6.43% month-to-date.

-

Crude oil fell to $56.66 per barrel, down 1.36% for the day and 5.34% month-to-date.

-

Market Impact: Gold benefits from falling Treasury yields and optimistic interest rate outlook, while crude oil is dragged down by geopolitical factors and demand concerns, potentially intensifying energy sector volatility.

Macroeconomic Policy

Fed Maintains Gradual Rate-Cut Path, Economic Data in Focus

-

Last week, the Fed lowered the benchmark rate by 25 basis points to the 3.50%-3.75% range, with the committee assessing that reserve balances have reached ample levels and initiating short-term Treasury purchases.

-

With rising economic uncertainty, investors are focusing on this week's employment report to gauge policy space.

-

Market Impact: The policy framework supports economic growth, but risks from trade friction and rising inflation may constrain stock market upside potential, requiring vigilance on chain effects on consumption and investment.

II. US Stock Market Review

Index Performance

-

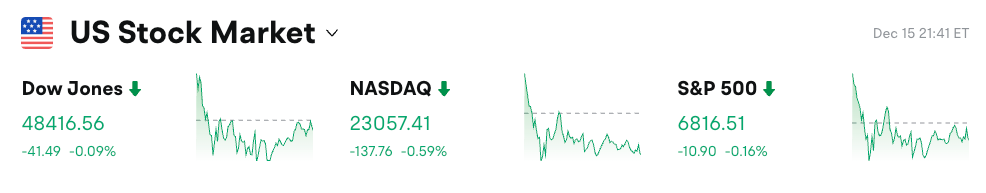

Dow Jones: Down 0.5% to close at 48,458.05 points, weakening for the second consecutive day, dragged down by healthcare and consumer stocks.

-

S&P 500: Down 0.16% to 6,816.34 points, with technology and energy sectors leading declines and moderate overall trading volume.

-

Nasdaq: Down 0.59% to 23,057.41 points, mainly driven by selling pressure in AI-related stocks, highlighting growth stock sensitivity.

Tech Giant Dynamics

-

Apple: Minor adjustment, affected by overall tech sector weakness, primarily due to market scrutiny of AI investment returns.

-

Amazon: Slight decline, with stable logistics and e-commerce demand, but trade policy uncertainty weighing on sentiment.

-

Alphabet: Held steady, up 64% year-to-date, benefiting from strong search and cloud business, though short-term volatility increased.

-

Meta: Minor decline, with optimistic advertising revenue expectations but constrained by regulatory attention.

-

Microsoft: Up 0.35%, supported by cloud service demand, though AI spending concerns emerged.

-

Nvidia: Up 0.73% to $176.29, with strong chip demand, but intensifying competition poses concerns.

-

Tesla: Retreated amid volatility, with optimistic EV sales outlook but affected by supply chain and policy variables.

Overall, the Magnificent Seven showed clear divergence, with Broadcom plunging 5.59% dragging down indices, driven by cautious sentiment on AI investment and individual stock earnings responses.

Sector Movement Analysis

Technology Sector down 1.2%

- Representative Stock: Broadcom, down 5.59%.

- Driving Factors: Revised AI chip demand expectations, plus post-earnings selling pressure, highlighting valuation bubble risks.

Energy Sector down 0.8%

- Representative Stock: Chevron, down 1.5%.

- Driving Factors: Lower crude oil prices intertwined with geopolitical supply concerns, suppressing sector rebound momentum.

Industrial Sector down 0.7%

- Representative Stock: Boeing, down 1.2%.

- Driving Factors: Trade policy uncertainty and supply chain disruptions affecting manufacturing order expectations.

III. In-Depth Stock Analysis

Ford Motor - Massive EV Impairment Charge

Event Overview: Ford announced an impairment charge of approximately $19.5 billion, mainly targeting electric vehicle investments, reflecting higher-than-expected EV business transformation costs. The company stated this move aims to adjust EV strategy to match changing market demand while maintaining profitability from combustion engine vehicles. After the impairment, Ford expects full-year profits to be significantly pressured, but cash flow remains robust.

Market Interpretation: Institutional views diverge, with Goldman Sachs viewing this as an industry-wide adjustment signal, while Morgan Stanley sees it as an opportunity to clean up baggage, expecting EV sales to recover in 2026.

Investment Insights: Short-term stock price pressure warrants caution, but long-term transformation potential remains, suitable for value investors to watch.

Broadcom - Significant Stock Pullback

Event Overview: Broadcom stock plunged 5.59% to $339.81, continuing last week's selling pressure, mainly due to concerns about slowing AI chip order growth. While the company's recent earnings beat expectations, supply chain bottlenecks and intensifying competition exposed problems, with flat full-year revenue guidance disappointing the market.

Market Interpretation: Analysts widely lowered price targets, with Barclays noting increased chip cycle volatility, but Citi maintained a buy rating, emphasizing long-term 5G and data center demand.

Investment Insights: Current valuation attracts growth investors, but AI investment cycle turning points need monitoring.

Nvidia - Modest Gain

Event Overview: Nvidia rose 0.73% to $176.29, benefiting from strong GPU demand. The company's latest product line expanded to enterprise-level AI applications, with quarterly shipments reaching new highs, but facing supply chain constraints and export control challenges.

Market Interpretation: UBS is bullish on its dominant position, expecting 30% revenue growth in 2026, but JPMorgan warns of overvaluation risks.

Investment Insights: Strong position supports long-term holding, with diversified allocation advisable for short-term volatility.

UnitedHealth - Dragging Down Dow

Event Overview: UnitedHealth, as a Dow component, declined significantly, ranking at the bottom for full-year performance, mainly affected by healthcare policy adjustments and rising costs. The company's Q3 profits fell, but membership growth remained steady.

Market Interpretation: Institutions lowered expectations, with Bain analysis stating healthcare reform will intensify competition, but Goldman Sachs views this as a buying opportunity.

Investment Insights: Strong defensive attributes, suitable for positioning after policy clarity.

Nike - Weak Performance

Event Overview: Nike dragged down the Dow for the full year, with cumulative stock price declines due to weak consumption and inventory buildup. The company adjusted supply chain strategies, but Asia-Pacific market recovery remained slow.

Market Interpretation: Analyst consensus is neutral, with Credit Suisse noting significant brand repositioning potential, but short-term profitability pressure persists.

Investment Insights: Wait for demand rebound signals, cyclical investors may watch closely.

IV. Today's Market Calendar

Data Release Schedule

Disclaimer: The above content is organized by AI search, with human verification only for publication, and does not constitute any investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH Eyes $2,800 as Whales Dump and Ethereum ETFs See $234M Outflows

Algorand Price Prediction 2025-2030: Will ALGO Finally Reach the Coveted $1 Milestone?

Grayscale Predicts 2026 as a Breakthrough Year for Crypto Markets

Bitcoin long-term holdings hit an 8-month low—has the market shifted?