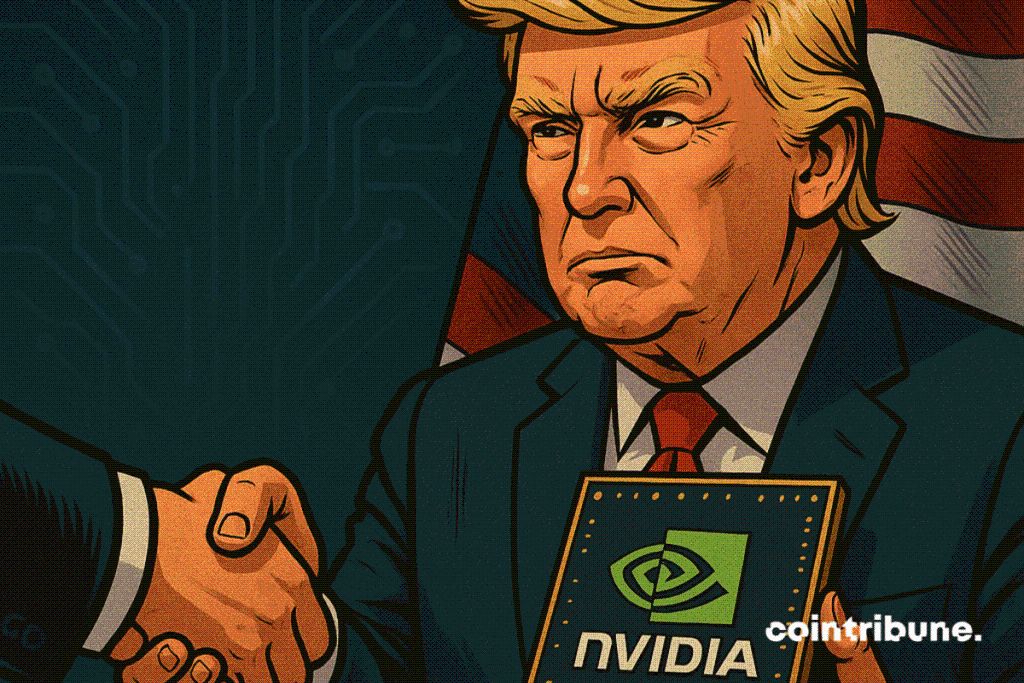

Crypto: Nvidia Courts Trump With a Charm Offensive That Pays Off

In 2025, Nvidia is no longer just a capitalization machine. The company has found another acceleration, this time political. Donald Trump, despite opposition from part of his own camp, chose to open a very costly door for it.

In brief

- Nvidia’s market capitalization has surged, and Trump has chosen to make the company a strategic partner, despite resistance within his own camp.

- Jensen Huang secured direct access to the White House and influenced the battle over chip exports to China.

- This standoff over “compute” shows how politics can steer liquidity and shape narratives in the crypto market.

Nvidia and Trump, an alliance that surprises Washington

Driven by demand for artificial intelligence and its global expansion, Nvidia has seen its capitalization soar to 4.68 trillion dollars . And at this level, Washington could no longer look away, crypto or not. Until recently, Jensen Huang was almost invisible in the corridors of power. Then everything accelerated, too fast for competitors, who are still searching for the formula.

The shift is embodied in a simple-to-summarize and complicated-to-digest agreement, crypto or not. The White House approved exports of H200 chips to China, after direct exchanges between Jensen and Trump. And the U.S. government would recover 25% of the sales.

Trump had even already said that he had never heard of Nvidia or Jensen. Yet, he ended up overriding voices from his MAGA coalition to let the company move forward. This is not a sentimental gesture. It is a power struggle decision, which markets, including crypto, take note of.

Jensen Huang, the calm method and direct access

The starting point lies in a meeting. Howard Lutnick, Secretary of Commerce, serves as a gatekeeper. Jensen obtains access to the president that resembles a direct line, with an implicit promise of total availability.

What strikes is the style. Jensen speaks little, but he establishes a logic. Nvidia is presented as a national asset, a key piece, almost a sovereignty tool. In a Washington obsessed with China, the message fits together effortlessly.

At the same time, Nvidia understands the unwritten rule of Trumpism. It requires something concrete, quickly. The company joins a consortium that promises to invest 500 billion dollars in the United States over four years, just to check the domestic production box.

Then come the images, those that sustain a relationship. Dinner at Mar-a-Lago, one million dollars per guest. At least six private meetings, direct calls, trips with the president to the United Arab Emirates, Saudi Arabia, and the United Kingdom. In July, a summit on the artificial intelligence action plan at the White House, Trump slips in a public compliment. Later, a ballroom project also receives Jensen’s contribution.

An export battle, and a signal for crypto

Jensen does not stop at the executive branch. He also pushes Congress. His argument is summed up in one sentence: banning U.S. sales does not stop China; it accelerates its alternatives. He cites Huawei as a replacement already ready to enter the breach.

Nvidia then professionalizes its presence . Tim Teter, head of legal, leads the offensive. The company stays away from large associations, hires a Republican lobbyist who passed through Ivanka Trump’s entourage, and focuses the debate on a single field: exports. Nvidia sells hardware, not models. It thus avoids taking on debates about employment or mental health, which stick to platforms.

Opposition exists on the other side. National security officials and think tanks oppose. Steve Bannon criticizes the H200 deal. Elizabeth Warren denounces too partisan closeness. A text aiming to restrict the H20 was abandoned, but a bipartisan project is now seeking to limit the administration’s maneuvering room to approve these sales.

In this saga, one detail sums up the power struggle. A first attempt to relaunch the H20s planned 15% tax for the United States, but Beijing rejected these less powerful chips. Nvidia pivots to the H200, more advanced, more desirable, more strategic.

And what about cryptocurrency ? It is not a bystander. When politics becomes a switch on global computing power, it also influences market narratives. The same capital that chases performance can move from stocks to tokens, then back, at the rhythm of Washington’s decisions. Liquidity follows. And price never waits for the end of debates.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

SCOR partners with Edison Chen to launch "The 888 Continuum"—a phased on-chain campaign where in-game "superpowers" unlock exclusive CLOT sneaker drops, gear, and digital collectibles.

SCOR announced today a major strategic partnership with creative director, cultural icon, and CLOT founder Edison Chen.