Swiss Stake AG Seeks Continued Curve DAO Grant to Drive DeFi Innovation

Quick Breakdown

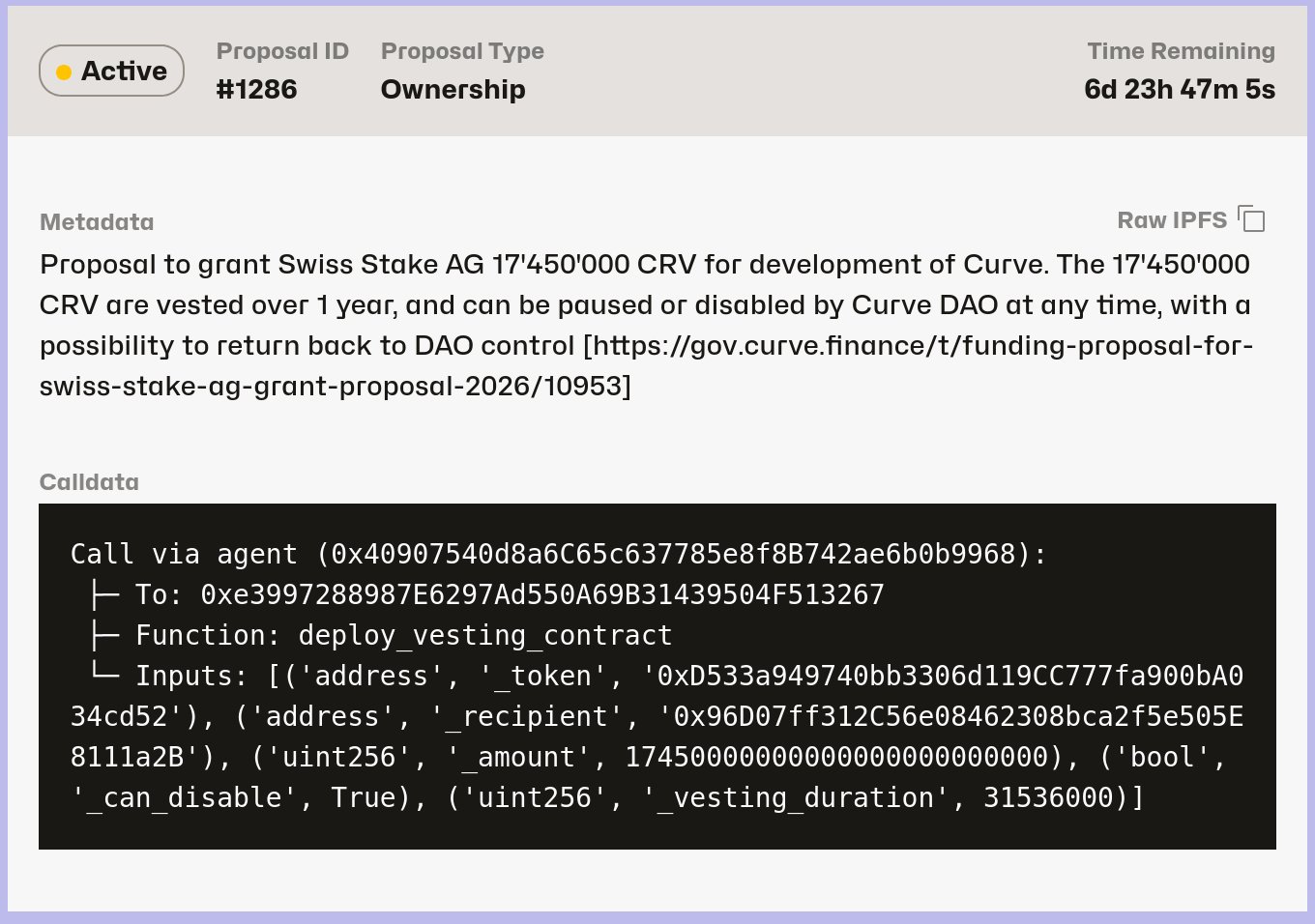

- Swiss Stake AG proposes a 12-month Curve DAO grant to fund DeFi development and ecosystem tools.

- Plans include launching Llamalend V2, FXSwap, and expanding cross-chain functionality.

- Grant supports software, research, infrastructure, and quarterly progress reporting for transparency.

Swiss Stake AG has submitted a proposal to secure a new 12-month grant from the Curve DAO, aiming to continue its pivotal role in developing and maintaining the Curve DeFi ecosystem. Since the project’s inception in 2020, Swiss Stake AG has been instrumental in building Curve’s software repositories, driving innovation across governance, cross-chain functionality, and ecosystem integrations.

The company highlighted the success of its 2024-2025 grant, which enabled advancements in Curve’s crvUSD ecosystem, cross-chain boost capabilities, and governance and user interface improvements. Deliverables, including open-source tools and the upcoming Llamalend V2, have strengthened liquidity coordination and improved capital efficiency for Curve users.

Grant objectives and development goals

For 2026, Swiss Stake AG plans to expand on prior progress by launching and scaling Llamalend V2 with support for LP and PT collateral, introducing admin fees for the DAO, and enabling multi-asset market creation. The proposal also includes developing FXSwap, positioning Curve as a venue for on-chain foreign exchange markets and low-volatility assets, including real-world assets such as gold.

Other objectives include broadening collateral options for crvUSD, advancing cross-chain deployments, enhancing front-end interfaces to improve the user experience, conducting AMM research on dynamic fees, and providing ecosystem tooling for developers. Security and infrastructure will remain a priority, with ongoing audits, stress tests, and optimization.

Funding and accountability

Swiss Stake AG requests a grant of 17,450,000 CRV tokens (approximately CHF 5.3 million) for the year, with funds allocated exclusively to software development, research, infrastructure, and ecosystem support. Unused funds will roll over, and all CRV tokens may be staked in approved liquidity projects, with yield reinvested into the project. The company will provide quarterly progress reports to the Curve community, ensuring transparency and accountability.

In a related development, Orca DAO has introduced a governance proposal to enhance the sustainability and performance of its decentralized exchange protocol, including staking unused treasury assets on Solana and implementing a long-term ORCA token buyback program.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the UK’s New Crypto Policing a Step Toward Regulation or Restriction?

Analysts Find Reasons Behind Most Recent Bitcoin Price Crash Towards $86,000