Banding Together in the Bear Market to Embrace Investors! Crypto Tycoons Gather in Abu Dhabi, Calling the UAE the "New Wall Street of Crypto"

As the crypto market remains sluggish, industry leaders are pinning their hopes on investors from the UAE.

Amid a sluggish crypto market, industry leaders are pinning their hopes on investors from the UAE. During a series of meetings last week—from the Bitcoin Middle East conference to exclusive “whale-only” beach club soirées and champagne parties aboard superyachts—crypto executives actively sought contact with representatives of UAE sovereign wealth funds. The UAE’s interest in crypto continues to rise: last week, Binance received full approval from Abu Dhabi’s financial regulator to operate its global trading platform from the region.

Written by: Zhao Ying

Source: Wallstreetcn

Crypto industry giants are gathering in Abu Dhabi, urgently seeking capital injections to revive a slumping market. As Bitcoin has lost momentum since October and the industry faces an unexpected winter, key figures—from MicroStrategy founder Michael Saylor to Binance founder Changpeng Zhao—have appeared in the UAE capital, hoping to secure funding from the region’s deep-pocketed investors.

According to a Wall Street Journal report on Sunday, during a series of meetings last week, crypto executives rushed between venues—from the Bitcoin Middle East conference to exclusive “whale-only” beach club soirées and champagne parties on superyachts—actively seeking contact with representatives of UAE sovereign wealth funds. It is reported that representatives of UAE sovereign wealth funds, managing $330 billions in assets, were present at these events.

The UAE’s interest in crypto continues to heat up. Last week, Binance received full approval from Abu Dhabi’s financial regulator to operate its global trading platform from the region. In November, a division of sovereign wealth fund Mubadala disclosed that it had tripled its Bitcoin investment, building a position worth about $518 million, while also holding another $567 million in Bitcoin positions via ETFs.

Venture capital firm RockawayX referred to the UAE as the “new Wall Street of digital finance” in its presentation; the firm just announced it would be acquired by a company backed by Abu Dhabi investors. However, industry insiders caution that securing UAE funding typically requires years of relationship-building and a commitment to local business, rather than simply “parachuting in to grab cash and leave.”

Industry Giants Bet on Middle Eastern Capital

Facing a sluggish market, crypto industry leaders are pinning their hopes on UAE investors. At the Bitcoin Middle East conference, MicroStrategy founder Michael Saylor said he has been pitching plans to “hundreds of investors” in the Gulf region—including sovereign wealth funds—to accumulate more digital assets through various financial instruments. The company’s stock price has dropped by more than half since mid-year.

Saylor’s presentation depicted MicroStrategy as a Bitcoin-powered space rocket, aiming for a “$20 trillion vision.” The president of Metaplanet, a Japanese hotel operator turned Bitcoin accumulator, stated on stage that the company is seeking to raise funds through a new preferred stock program called “MARS.” The company’s stock price has also seen a sharp decline.

Other participants seeking opportunities include Dominari Holdings, the Trump family’s preferred investment bank, and the investment securities division of Korea’s Hanwha Group, which stated plans to make Abu Dhabi its regional hub for crypto products.

US Policy Setbacks Drive Capital Outflows

The downturn in the crypto market has caught the industry off guard. Many participants had expected Trump’s full support for the industry to accelerate adoption and deliver unlimited returns. However, while US stock markets remain near historic highs, Bitcoin lost momentum in October, and a series of market liquidations hit traders and exchanges hard.

Trump’s crypto legislative agenda has also faced setbacks, as some Democratic lawmakers have put the brakes on new bills to create a regulatory framework for digital asset markets. This policy uncertainty has further driven industry capital to seek opportunities overseas.

In contrast, the UAE’s interest in crypto continues to grow. Earlier this year, a UAE state-backed investment firm purchased $2 billion worth of Binance shares, providing crucial funding for the world’s largest crypto exchange.

Abu Dhabi Builds Crypto Finance Hub

The UAE is systematically positioning itself as a global crypto hub. The Abu Dhabi government is attracting crypto startups to set up in its financial center by offering early-stage funding, free office space, and other incentives.

Kristiina Lumeste, founder of Abu Dhabi venture capital firm Klumi Ventures, said: “Liquidity, decision-makers, and infrastructure are all here.” The firm is raising a $100 million crypto-focused fund from local investors.

At the Abu Dhabi Finance Week conference, executives from US blue-chip crypto companies Coinbase and Circle mingled with Wall Street figures—including Bridgewater founder Ray Dalio and Blackstone CEO Steve Schwarzman—as well as representatives from traditional banking giants like UBS and HSBC. The Crown Prince of Abu Dhabi attended the opening ceremony, and senior executives from Mubadala and other sovereign wealth funds also participated in the event.

Localization Key to Securing Investment

Despite the many opportunities, securing UAE funding is no easy feat. Basil Al Askari, co-founder of Mubadala-backed Abu Dhabi crypto brokerage MidChains, pointed out that many foreign newcomers hope to strike quick deals and return home.

He observed that some make “rookie mistakes,” assuming he works for a major UAE investment institution simply because he looks Emirati and wears traditional robes. Al Askari emphasized that, with few exceptions, convincing sovereign wealth funds or large family offices to invest usually requires years of relationship-building and a commitment to developing local business.

RockawayX Chief Growth Officer Samantha Bohbot said: “They’re not looking for people who parachute in, grab the money, and leave. You need to have a real stake and stick it out.” The company has established its headquarters and a local crypto project incubator in the UAE, and later announced it would be acquired by a company backed by Abu Dhabi investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

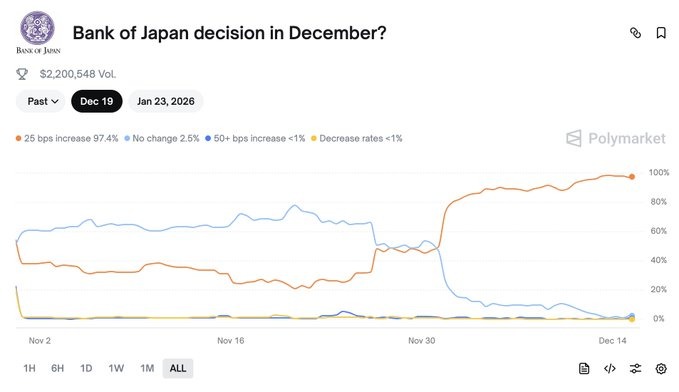

Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

“Quantum Threat to Bitcoin Is Decades Away”, Says Adam Back

Ethereum Founder Vitalik Buterin Wants Algorithm Transparency on X

“Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says