Date: Sun, Dec 14, 2025 | 06:20 AM GMT

The broader altcoins market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10 . That correction dragged Ethereum (ETH) down by nearly 25% over the last 60 days, creating widespread bearish pressure across the market. This weakness has weighed heavily on major altcoins, including Cardano (ADA).

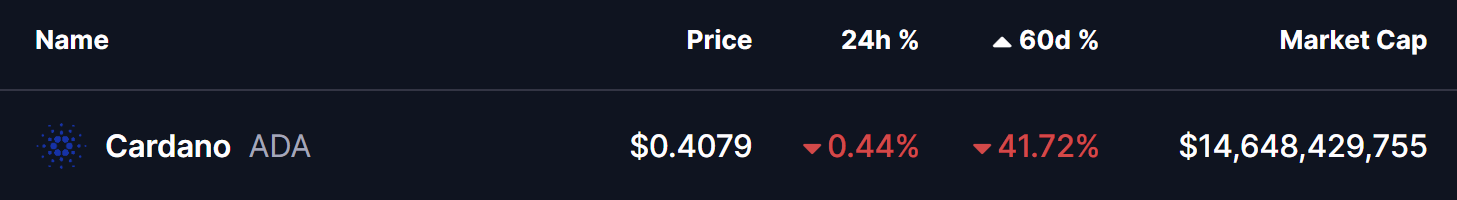

Over the same period, ADA has suffered a steep 41% decline. However, beneath the surface-level weakness, the weekly chart is beginning to reveal an important technical structure that could be positioning the token for a potential recovery phase.

Source: Coinmarketcap

Source: Coinmarketcap

Rising Wedge in Play

On the weekly timeframe, ADA continues to trade within a clearly defined rising wedge formation, characterized by a series of higher highs and higher lows compressed between ascending support and resistance trendlines. This structure suggests that while volatility has contracted, price remains in a long-term consolidation phase rather than a full trend breakdown.

The most recent rejection from the upper trendline near the $1.16 region during Q1 acted as a strong supply zone, halting bullish momentum and triggering a prolonged pullback. Since then, ADA has slipped below the 100-week moving average and is now retesting the lower boundary of the wedge — a level that has historically acted as dynamic support throughout previous market cycles.

Cardano (ADA) Weekly Chart/Coinsprobe (Source: Tradingview)

Cardano (ADA) Weekly Chart/Coinsprobe (Source: Tradingview)

Importantly, price action is currently respecting the rising support trendline near the $0.37 area. At the same time, momentum indicators such as the MACD are showing signs of stabilization after an extended bearish phase, hinting that selling pressure may be losing strength as buyers cautiously step back in.

What’s Next for ADA?

If the rising wedge structure continues to hold, a rebound from the current support zone followed by a reclaim of the 100-week moving average around $0.6294 would significantly strengthen the bullish case. Such a move would suggest that ADA has completed its corrective phase and could open the door for a push toward the upper resistance trendline of the wedge, currently projected near the $1.75 region.

That said, the bullish scenario remains conditional. ADA must continue to defend the lower boundary of the wedge to maintain this setup. A decisive weekly close below the rising support would invalidate the structure and expose the price to deeper downside risk, with the next major support zone sitting near $0.2867.

For now, ADA appears to be at a critical inflection point. The coming weeks will determine whether this long-term consolidation resolves to the upside with a rebound, or whether sellers regain control and push the token into a deeper corrective phase.