Ethereum Holds Support As Smart Money Steps In – What This Means For Price

Ethereum is holding firm above key support as smart money steps in, hinting at growing confidence beneath the surface. With bullish signals and steady inflows aligning, the market now watches whether this stability can spark a meaningful upside move.

ETH Coils Below $3,200 Ahead Of A Decisive Move

AltCoin Việt Nam, in a recent post, highlighted that ETH is positioned at an extremely tense moment on its chart, signaling that the asset is preparing for a major directional move. This immediate pressure is being fueled by a significant bullish divergence that has just appeared on the chart, marking the first time the signal has materialized in over a month.

The analyst reinforced the expectation of high volatility by referencing historical data. Their research shows a consistent history of 9–16% price volatility whenever ETH falls below the $3,200 level. Given that the price is currently fluctuating tightly around the $3,100 mark, this historical context provides a clear signal that a sharp volatility explosion may be imminent.

Adding overwhelming conviction to the bullish case is the recent action of market movers. AltCoin Việt Nam reported that a single super large whale just opened a leveraged long position totaling a massive $392 million (equivalent to 120,094 ETH). This colossal bet on the upside demonstrates a firm, high-conviction among institutional players.

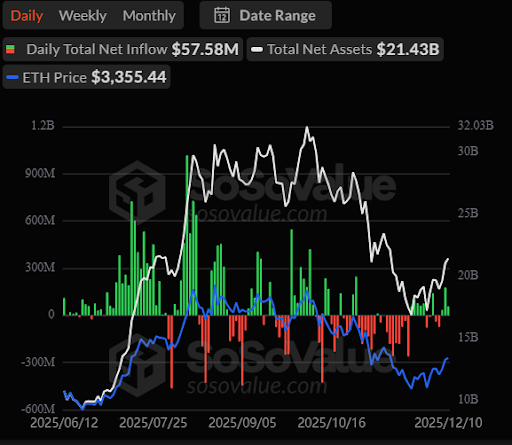

Furthermore, the institutional framework continues to provide a reliable underlying demand. The Spot Ethereum ETF market is still actively attracting substantial capital inflows, totaling over $250 million this week. BitMine Technologies also purchased an additional 33,504 ETH (valued at $112 million) today, highlighting persistent institutional accumulation.

Considering the confluence of technical divergence, historical volatility context, and massive whale and institutional purchasing, the market faces a critical juncture. AltCoin Việt Nam posed the final question: Can ETH break out strongly and immediately confirm the uptrend, or will it need to retest lower support levels before initiating the expected explosive rally?

Buyers Step In As Ethereum Defends Key Support

According to crypto analyst The Boss, ETH has shown a highly encouraging response from a key technical area. Ethereum has reacted positively with the $3,091 support zone, and is currently holding firmly above this level, which is a strong signal that short-term buying pressure remains resilient and active in the market.

As long as the price stays above the green line, the analyst confirms that the primary focus remains the upside, validating the potential for a move toward the resistance zone marked by the blue line. The Boss emphasized the importance of these structural defense moves, concluding that such strong reactions from established support levels are vital signals for confirming the validity of the current structure and providing clear direction of the prevailing trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.