Trend Research: The "Blockchain Revolution" in Progress, Ethereum Continues to Surge

In an environment of extreme fear, where funding and sentiment have not fully recovered, ETH still finds itself in a rather good buying "dip zone."

Original Title: "The Ongoing 'Blockchain Revolution,' Ethereum Continues to Rise"

Original Source: Trend Research

Since the market crash of 1011, the entire crypto market has been lackluster, with market makers and investors suffering heavy losses. Recovery of funds and sentiment will take time. However, what the crypto market lacks the least is new volatility and opportunities. We remain optimistic about the future because the trend of mainstream crypto assets merging with traditional finance into new formats has not changed. Instead, it has rapidly built a moat during the market downturn.

1. Strengthening Wall Street Consensus

On December 3, U.S. SEC Chair Paul Atkins stated in an interview with FOX at the NYSE: "In the next few years, the entire U.S. financial market may migrate to the blockchain."

Atkins stated:

(1) The core advantage of tokenization is that if assets exist on the blockchain, ownership structure and asset attributes will be highly transparent. Currently, listed companies often do not know who their shareholders are specifically, where they are located, or where their shares are.

(2) Tokenization also aims to achieve "T+0" settlement, replacing the current "T+1" transaction settlement cycle. In principle, the on-chain delivery versus payment (DVP) / receipt versus payment (RVP) mechanism can reduce market risk, enhance transparency, and the time difference between current clearing, settlement, and fund delivery is one of the sources of systemic risk.

(3) Tokenization is seen as an inevitable trend in financial services, with major banks and brokerages already moving towards tokenization. It may only take the world less than 10 years... perhaps a few years later it will become a reality. We are actively embracing new technologies to ensure that the United States maintains its leading position in cryptocurrency and other areas.

In fact, Wall Street and Washington have already built a deep capital network deeply integrating into crypto, forming a new narrative chain: U.S. political and economic elites → U.S. Treasury Bonds → Stablecoins / Crypto Custody Companies → Ethereum + RWA + L2

From this chart, you can see the Trump family, traditional bond market makers, the Treasury Department, tech companies, and crypto companies intricately linked together, with the green oval line becoming the backbone:

(1) Stablecoin (USD-backed assets behind USDT, USDC, WLD, etc.)

The majority of reserve assets consist of Short-Term US Treasuries and bank deposits held through brokerages like Cantor.

(2) US Treasuries

Issued and managed by Treasury/Bessent, used by Palantir, Druckenmiller, Tiger Cubs, among others, as a low-risk rate base asset, also sought after by stablecoins/treasury companies for yield.

(3) RWA

From US Treasuries, mortgages, accounts receivable to housing finance, all tokenized through Ethereum L1/L2 protocols.

(4) ETH & ETH L2 Equity

Ethereum serves as the main chain for RWA, stablecoins, DeFi, AI-DeFi, while L2 equity/token represents a claim on future transaction volume and fee cash flow.

This chain expresses:

USD Credit → US Treasuries → Stablecoin Reserves → Various Crypto Treasuries/RWA Protocols → Ultimately settling on ETH/L2.

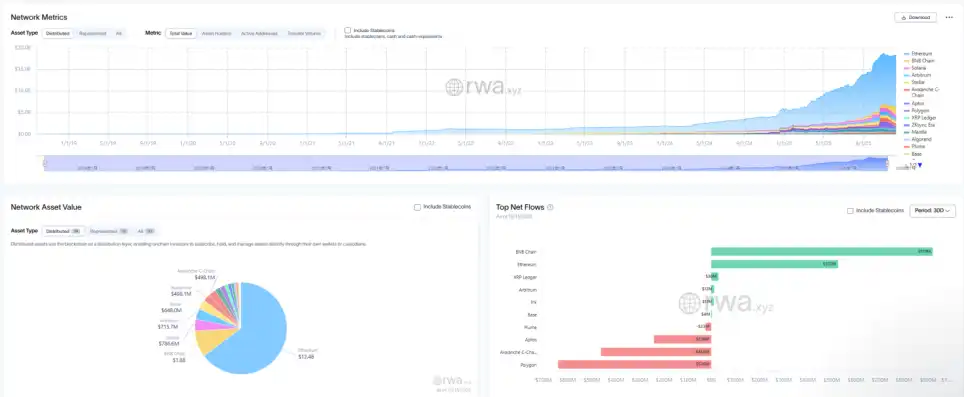

Looking at RWA's TVL: Compared to other public chains in a downtrend in 1011, ETH is the only one that quickly recovered from the drop and rose, currently at 124 billion in TVL, accounting for 64.5% of the total crypto market cap.

II. Ethereum Value Capture Exploration

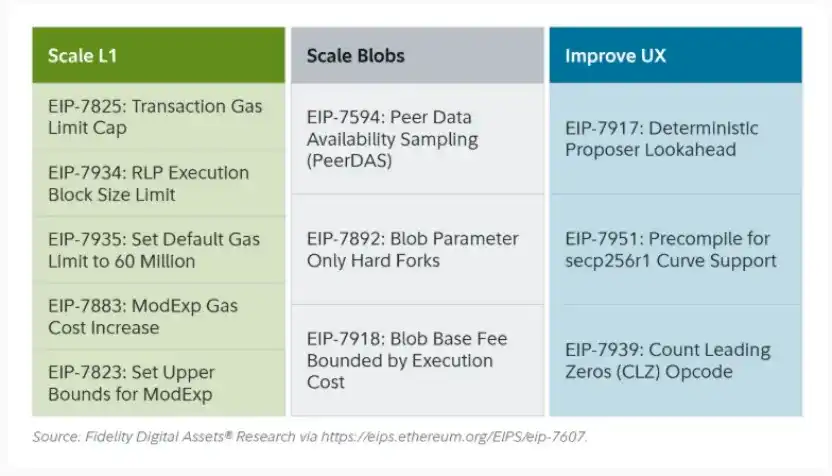

The recent Ethereum Fusaka upgrade did not cause much of a market stir, but from the perspective of network structure and economic model evolution, it was a "milestone event." Fusaka not only expanded through EIPs like PeerDAS but also attempted to address the issue of insufficient L1 mainnet value capture since L2 development.

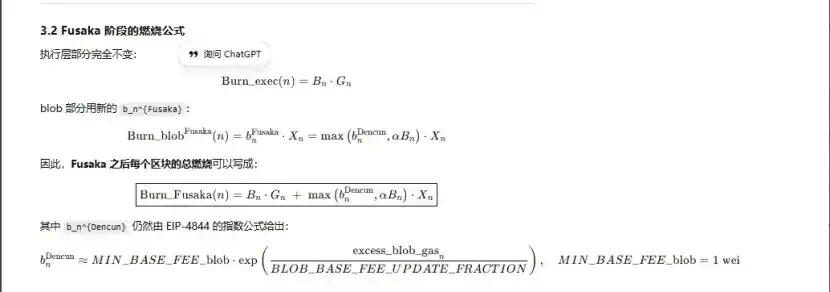

Through EIP-7918, ETH introduced a blob base fee to establish a "dynamic base rate," tying its floor to the L1 execution layer base fee, requiring that blobs pay a DA fee at a unit price of about 1/16 of the L1 base fee; this means Rollups can no longer occupy blob bandwidth almost cost-free in the long term, with corresponding fees flowing back to ETH holders in a burn mechanism.

The Ethereum full upgrade is related to "burning" three times:

(1) London (single-tier): Only burns the execution layer, ETH began experiencing structural burning due to L1 usage.

(2) Dencun (dual-tier + independent blob market): Burns the execution layer + blob, L2 data written to blob also burns ETH, but the blob portion is almost 0 in times of low demand.

(3) Fusaka (dual-tier + blob linked to L1): To use L2 (blob), one must pay a fee of at least a fixed ratio of the L1 base fee and it will be burned, mapping L2 activity to ETH burning more stably.

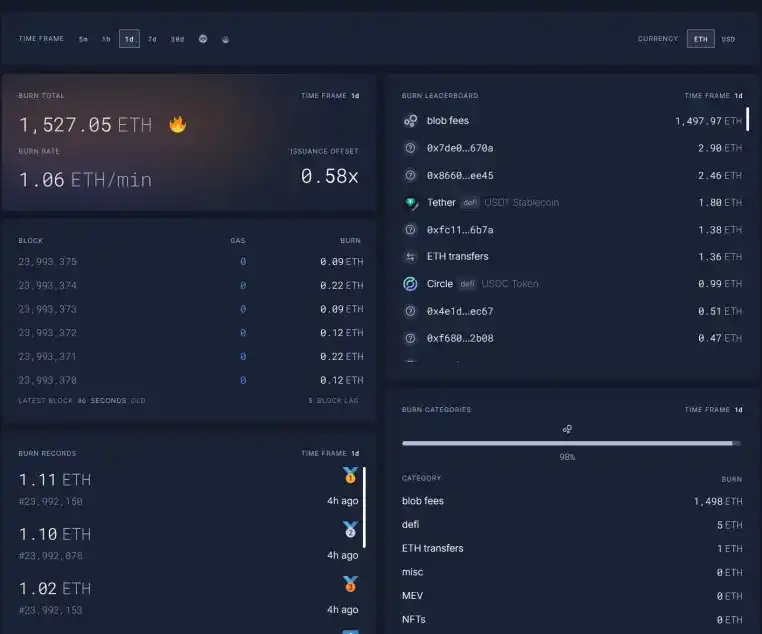

Currently, the blob fees at 23:00 on 12.11 for 1 hour have reached 569.63 billion times the fees before the Fusaka upgrade, burning 1527 ETH in a day. Blob fees have become the highest contributing part to the burning, up to 98%. As ETH L2 becomes more active, this upgrade is expected to bring ETH back to deflation.

III. Ethereum Technical Strength

During the 1011 drop, ETH's futures leverage positions were thoroughly cleared, ultimately reaching spot leverage positions. Meanwhile, many lacked faith in ETH, causing many ancient OGs to reduce positions and flee. According to Coinbase data, speculative leverage in the crypto sphere has dropped to a historic low of 4%.

In previous ETH short positions, an important part came from traditional Long BTC/Short ETH pair trades, especially when this pair usually performs well in past bear markets. However, an unexpected event occurred this time. The ETH/BTC ratio has maintained a sideways resistance trend since November.

ETH currently has a trading platform stock of 13 million coins, approximately 10% of the total supply, at a historic low. With the Long BTC/Short ETH pair becoming ineffective since November and extreme market panic, there may gradually be "short squeeze" opportunities.

As the 2025–2026 interaction approaches, both the US and China have already sent friendly signals regarding future monetary and fiscal policies:

The US will be proactive in the future, with tax cuts, interest rate reductions, relaxed crypto regulations, while China will appropriately loosen, focusing on financial stability (suppressing volatility).

In the scenario of relatively loose expectations in both the US and China, suppressing asset downside volatility, and with ETH still in a good buying "dip zone" during extreme panic when funds and emotions have not fully recovered, ETH remains in a favorable position.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clash of Titans: Global Opinion Leaders Debate the Future Path of Bitcoin

Trend Research: The "Blockchain Revolution" is underway, remaining bullish on Ethereum

In a scenario of extreme fear, where capital and sentiment have not yet fully recovered, ETH is still in a relatively good buying "strike zone."

Should You Still Believe in Crypto

No industry has always been right along the way, until it truly changes the world.

Trending news

MoreClash of Titans: Global Opinion Leaders Debate the Future Path of Bitcoin

[Bitpush Daily News Highlights] Ripple, Circle, and three other crypto companies receive conditional bank license approval in the US; Tether submits an all-cash acquisition offer, aiming for full control of Serie A giant Juventus and pledges to inject 1 billion euros; Moody’s plans to launch a stablecoin rating framework, with reserve asset quality as the core indicator; Fogo cancels its $20 million token presale, mainnet launch will switch to airdrop distribution.

![[Bitpush Daily News Highlights] Ripple, Circle, and three other crypto companies receive conditional bank license approval in the US; Tether submits an all-cash acquisition offer, aiming for full control of Serie A giant Juventus and pledges to inject 1 billion euros; Moody’s plans to launch a stablecoin rating framework, with reserve asset quality as the core indicator; Fogo cancels its $20 million token presale, mainnet launch will switch to airdrop distribution.](https://img.bgstatic.com/multiLang/image/social/96c285805bf77c355ca73a8b952ce0b91765614780984.png)