The Federal Reserve reduced interest rates by 25 basis points to a target range of 3.5% to 3.75%. While this easing of monetary policy is generally a bullish signal for risk assets, mixed comments from Chair Jerome Powell suggest a slower path forward, potentially delaying a full-blown market rally until 2026. This sets the stage for the Cardano price prediction, which shows steady but moderate growth.

The Fed cut interest rates

The Federal Reserve’s decision to cut interest rates by 25 basis points was widely anticipated, but the accompanying commentary from Chair Jerome Powell has injected a dose of realism into the markets.

Powell noted that in the near term, risks to inflation are tilted to the upside while risks to employment are to the downside, describing the scenario as a “challenging situation” with “no risk-free path for policy.”

These comments were not as hawkish as some feared, but they effectively quelled hopes for an immediate, aggressive rate-cutting cycle. Analysts, including Coinbureau founder Nic Puckrin, now expect the Fed to issue only one more rate cut in 2026 under Powell’s leadership.

Attention is turning to the Fed’s balance sheet policy and liquidity measures in early 2026. Data from the CME Group shows that only 24.4% of traders expect another cut at the next FOMC meeting in January 2026.

Rate cuts signal a buy: DeepSnitch AI is the target

DeepSnitch AI: Live utility for the coming liquidity

The latest rate cut is excellent news for the market’s long-term health, and it signals an opportunity in the AI and crypto sectors. While Bitcoin and Cardano price predictions wait for the full effects of the pivot, DeepSnitch AI is offering immediate value.

The market sucks for everyone except those who have the tools to move through it. DeepSnitch AI provides exactly that. Its SnitchFeed is live today. SnitchScan is also operational, auditing contracts to keep you safe from the volatility that Powell warned about. The team has deployed SnitchGPT. Moreover, there’s a staking program that is already generating dynamic yields for holders.

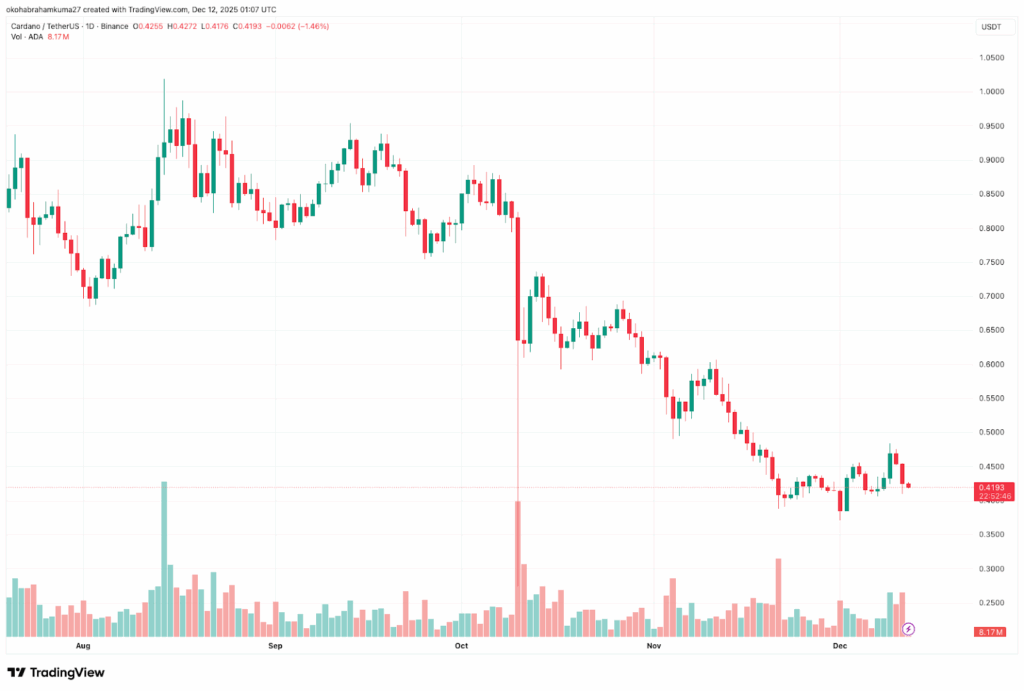

Cardano price prediction

The Cardano price prediction is supported by strong on-chain activity. Recently, a massive inflow of 750 million ADA to Binance was fully absorbed by buyers, indicating a demand at key liquidity zones. This resilience suggests that the Cardano network fundamentals remain healthy despite the broader market’s hesitation.

However, the Cardano ADA forecast shows a mature, slower-moving asset. Experts predict that in December 2026, the average trading price for ADA will be around $0.564. This represents a potential ROI of roughly 16% from current levels. Looking further out to 2027, the average price is expected to reach $0.99.

Swarm Network (TRUTH): AI sector outperformer

Swarm Network (TRUTH) recorded more than a 41% increase on the weekly chart as of December 11th, while the rest of the market lagged. This outperformance highlights the sector-specific demand for Artificial Intelligence cryptocurrencies.

The price prediction for TRUTH is bullish, forecasting a 177% rise to $0.06293 by December 2030. However, the token comes with “extremely high” volatility, making it a risky hold.

The bottom line

The Federal Reserve’s rate cut marks the beginning of a new chapter for the economy. While the path for the Cardano price prediction is steady, the environment is perfectly ready for high-utility newcomers.

FAQs

What is the Cardano price prediction for 2026?

The Cardano price prediction for 2026 forecasts an average price of $0.564. This suggests a period of consolidation and slow growth.

How does the Fed rate cut affect DeepSnitch AI?

Lower interest rates generally increase liquidity in the market, encouraging investors to seek higher returns in risk-on assets like crypto.

What is the ADA long-term outlook for 2027?

The ADA long-term outlook improves significantly by 2027, with analysts predicting an average trading price of $0.99.