Morning Brief | a16z Crypto releases annual report; crypto startup LI.FI completes $29 million financing; Trump says the rate cut is too small

A summary of important market events on December 11.

Compiled by: ChainCatcher

Key News:

- US OCC: 9 major banks previously refused to provide financial services to crypto companies

- Banmuxia: Bitcoin is expected to rise to $103,500 to $112,500 in the next month

- The Federal Reserve has lowered the benchmark interest rate by 25 basis points to 3.5%-3.75%

- Mitsubishi UFJ: The Federal Reserve's policy in the second half of next year will be complicated by leadership changes

- Crypto startup LI.FI completes $29 million financing, led by Multicoin and CoinFund

- CZ: Suggests that the woman who won the million-dollar lottery invest in Bitcoin or BNB for higher returns

- a16z Crypto Annual Report: Decentralized payment systems may see widespread adoption by 2026

What important events happened in the past 24 hours?

Crypto startup LI.FI completes $29 million financing, led by Multicoin and CoinFund

According to ChainCatcher, as reported by Fortune, crypto startup LI.FI announced the completion of a $29 million financing round, led by Multicoin and CoinFund, bringing its total funding to $52 million.

The company provides cross-blockchain price comparison and trade path optimization services for fintech enterprises, helping companies efficiently transfer assets across different blockchains. LI.FI has established relationships with over 800 partners, including Robinhood, Binance, and Kraken, with a monthly trading volume of $8 billion. The company plans to use the new funds to expand into areas such as perpetual futures, yield opportunities, and lending markets, as well as to increase its staff size.

Former Movement Labs co-founder launches $100 million crypto investment plan

ChainCatcher reports that former MOVE Labs co-founder Rushi Manche announced today the establishment of Nyx Group, with plans to invest up to $100 million to support crypto token projects.

This investment plan will provide liquidity and comprehensive operational support for projects preparing to launch tokens, including community building, financial management, and compliance guidance. Manche stated that Nyx Group aims to fill a "critical gap" in the current crypto market, especially as founders face difficulties in accessing capital. The team will adopt strict investment standards, supporting only founders in whom they have deep trust, with decisions made by an investment committee. Notably, Manche was previously terminated from Movement Labs due to a controversy involving market-making arrangements for 66 million MOVE tokens. For the new project, he emphasized that Nyx Group will be "the most founder-friendly partner," offering favorable terms and supporting long-term vision.

a16z Crypto Annual Report: Decentralized payment systems may see widespread adoption by 2026

ChainCatcher reports that a16z Crypto has released its annual report, covering areas such as stablecoins, tokenization, payments and finance, privacy, security, AI, and agents.

a16z disclosed that stablecoin trading volume in 2024 has reached $46 trillion, a figure 20 times that of PayPal and nearly three times that of Visa. The report also mentions that as the tokenization of traditional assets progresses, especially through crypto technology bringing US stocks, commodities, and indices onto the blockchain. Additionally, a16z envisions the integration of AI and crypto technology, predicting that decentralized payment systems will see widespread adoption by 2026.

US officials to hold key consultations on the "Crypto Market Structure Bill"

ChainCatcher reports, according to crypto journalist Eleanor Terrett, that US senators will continue consultations on the "Crypto Market Structure Bill."

In the afternoon, representatives from several leading industry companies will go to the White House to attend another meeting on market structure. Afterwards, the CEOs of Bank of America, Citigroup, and Wells Fargo will meet with senators to discuss issues such as restricting stablecoin issuers' affiliated companies from paying interest, as well as other outstanding issues.

He Yi: Being a Binance editor is a high-risk job, no need to look for angles in official V or editors

ChainCatcher reports that He Yi responded to a community question on X platform about "how to become a Binance editor," stating: "It's a high-risk job, one sent in, one under investigation, the one blackening my WeChat is being pursued, there's no need to look for angles in official V or editors, I won't look at these kinds of memes in the future."

US initial jobless claims for the week ending December 6 were 236,000, higher than expected

ChainCatcher reports that US initial jobless claims for the week ending December 6 were 236,000, the highest since the week ending September 6, 2025. This figure is higher than the expected 220,000 and the previous value of 191,000.

CZ: Suggests that the woman who won the million-dollar lottery invest in Bitcoin or BNB for higher returns

ChainCatcher reports that CZ referenced the news of Brenda, a 20-year-old lottery winner from Quebec, US, who refused a $1 million lump-sum payment and instead chose a $1,000 weekly lifetime annuity, suggesting she cash out and invest in Bitcoin or BNB for higher returns.

Assuming Brenda lives 100 years, the total annuity would be about $5,200,000 (not accounting for inflation), while investing $1 million in BTC (currently $90,000 per coin) or BNB ($865 per coin) would yield much higher returns. "Let's wait and see."

US OCC: 9 major banks previously refused to provide financial services to crypto companies

ChainCatcher reports, according to Cointelegraph, that the US Office of the Comptroller of the Currency (OCC) released preliminary investigation results on Wednesday showing that from 2020 to 2023, the nine largest US banks imposed financial service restrictions on politically sensitive industries such as cryptocurrency.

The OCC report pointed out that these banks made improper distinctions based on customers' legitimate business activities, either implementing restrictive policies or requiring enhanced scrutiny before providing services. Restricted industries included not only crypto issuers and exchanges, but also oil and gas exploration, coal mining, firearms, private prisons, tobacco, and adult entertainment.

Comptroller of the Currency Jonathan Gould criticized that large banks abuse government charters and market power. The OCC is continuing its investigation and may submit the findings to the Department of Justice. The banks under review include JPMorgan, Bank of America, Citibank, Wells Fargo, and other nine major national banks.

Banmuxia: Bitcoin is expected to rise to $103,500 to $112,500 in the next month

ChainCatcher reports that Chinese crypto analyst Banmuxia stated, "Bitcoin had a surge early this morning, but the magnitude was insufficient. It now appears that the rise from $80,500 is a leading wedge. At the same time, $89,000-$90,000 is a relatively strong support area. The market's projected upward range for the next month is $103,500-$112,500. The process may still be very turbulent."

The Federal Reserve has lowered the benchmark interest rate by 25 basis points to 3.5%-3.75%

ChainCatcher reports, according to Golden Ten Data, that the Federal Reserve has lowered the benchmark interest rate by 25 basis points to 3.5%-3.75%, marking the third consecutive meeting with a rate cut, in line with market expectations. The total rate cut for the year has reached 75 basis points.

ChainCatcher reports that the Federal Reserve cut rates by 25 basis points as expected, and US President Trump commented that the rate cut was too small and could have been larger.

ChainCatcher reports, Greeks.Live researcher Adam posted on social media that in the just-concluded Federal Reserve meeting, the expected 25 basis point rate cut was delivered, and the Fed announced it would restart the purchase of $4 billion in short-term US Treasury bills (T-bills). The dovish stance can effectively supplement liquidity in the financial system, which is undoubtedly a clear positive for the market.

However, it is too early to talk about restarting QE and a bull market. With Christmas and annual settlements approaching, this period is usually the time of lowest liquidity in the crypto market, with low market activity and very limited momentum for a bull market restart.

From crypto options data, more than 50% of options positions are currently piled up at the end of December, with BTC's maximum pain point at the $100,000 mark and ETH's at $3,200. The implied volatility for major expiries is all trending downward this month, and the market's expectation for volatility this month is gradually decreasing.

Overall, the crypto market is currently quite weak, with poor year-end liquidity and low market sentiment. A slow decline is the mainstream view in the options market, but at the same time, one should be wary of sudden bullish reversals triggered by unexpected positive news.

Anonymous tip: Tradoor project suspected of "rug pull", malicious manipulation led to 80% crash and team disappearance

ChainCatcher reports that TON ecosystem leveraged trading platform Tradoor is suspected to be in a "rug pull" crisis. According to community reports and on-chain data, the project manipulated market liquidity through high control, conducted obvious pump-and-dump operations, liquidated user positions, and caused the token price to plummet 80% in the early hours of December 1. The team then disappeared, and the airdrop was postponed to 2026.

Reports indicate that since Tradoor launched on Binance Alpha TGE on September 4, 2025, it has engaged in systematic manipulation. The project has a total supply of 60 million tokens, but only 10 addresses control 98%, with one address holding 75%. The circulating supply is minimal, and the DEX liquidity pool totals less than $1 million.

User analysis shows that Tradoor's GitHub has not been updated for nearly half a year, with no product development, making it a "token shell" project. The team has owed employees wages for over four months, and core members have disappeared from public channels.

It is reported that Tradoor's actual controllers are former Huobi Research Institute derivatives head Weng Yiming (Paul) and options head Xu Tong (Stacy). Paul launched the ZKEX project in 2023, which was suddenly shut down without explanation, earning him the nickname "old rug" in the community. In 2024, the two teamed up again to launch Tradoor, raising millions of dollars by packaging the project with a foreign team, and later listing on Binance Alpha and Bitget through intermediaries. After TGE, Paul sidelined the core team, used $TRADOOR as collateral to borrow at high interest from market makers like Wintermute, and after the market crash in October, switched to new funding partners like ju.com, continuing high-control pump-and-dump operations until the project disappeared.

ChainCatcher reporters attempted to verify with Tradoor's official X account and Telegram on December 10, but received no response within 12 hours as of press time.

Hong Kong Securities Association and SFC exchange views on virtual assets and new financial products, plan to clarify the role of market makers

ChainCatcher reports that the Hong Kong Securities and Futures Professionals Association officially announced it had held a meeting with the Hong Kong SFC, focusing on the development and regulation of the virtual asset industry and new financial products. The meeting mainly interpreted the latest policies, discussed compliance standards and OTC regulation, and explored the application of tokenized securities and the development path of derivatives.

At the same time, the meeting also discussed optimizing asset transfer processes, clarifying the role of market makers, and improving company upgrade mechanisms, aiming to jointly promote the industry's sound development.

Mitsubishi UFJ: The Federal Reserve's policy in the second half of next year will be complicated by leadership changes

ChainCatcher reports, Mitsubishi UFJ stated that the Federal Reserve lowered rates by 25 basis points with a 9-3 vote and acknowledged that the labor market is gradually cooling, with Powell also emphasizing significant downside risks facing the labor market.

On inflation, the Fed noted that if no new tariffs are imposed, goods inflation may peak in Q1 2026, but persistent inflation risks remain. Powell signaled that rate hikes are not the base case, and FOMC members are divided between keeping rates unchanged and cutting rates.

The latest dot plot median shows the Fed will only cut rates once in 2026, a stance more hawkish than the market's expected easing of about 55 basis points (or slightly more than two cuts). Powell also emphasized that the Fed is currently "in a favorable position" and can patiently observe the development of the US economy.

Looking ahead, policy prospects in the second half of next year may be complicated by changes in Fed leadership, increasing market uncertainty. (Golden Ten Data)

Meme Hot List

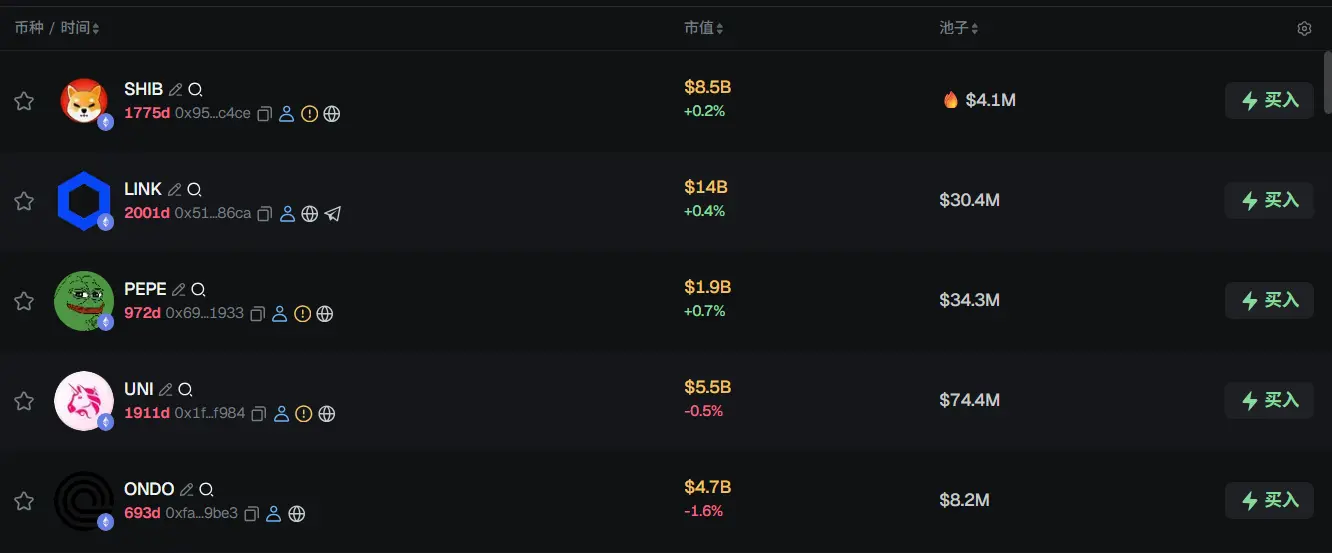

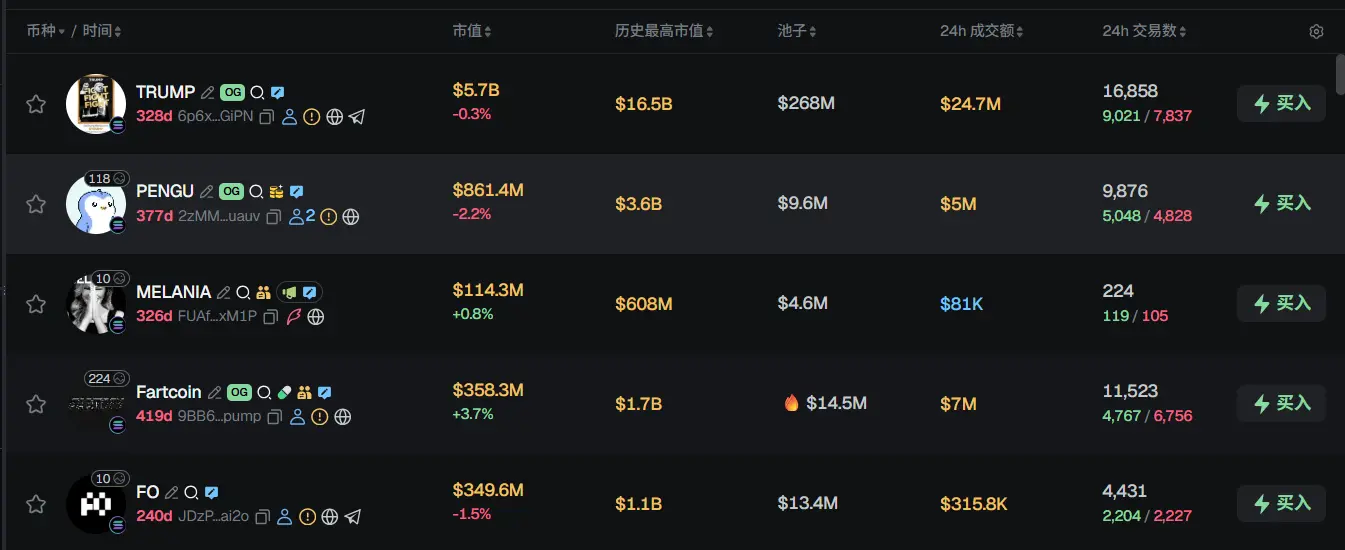

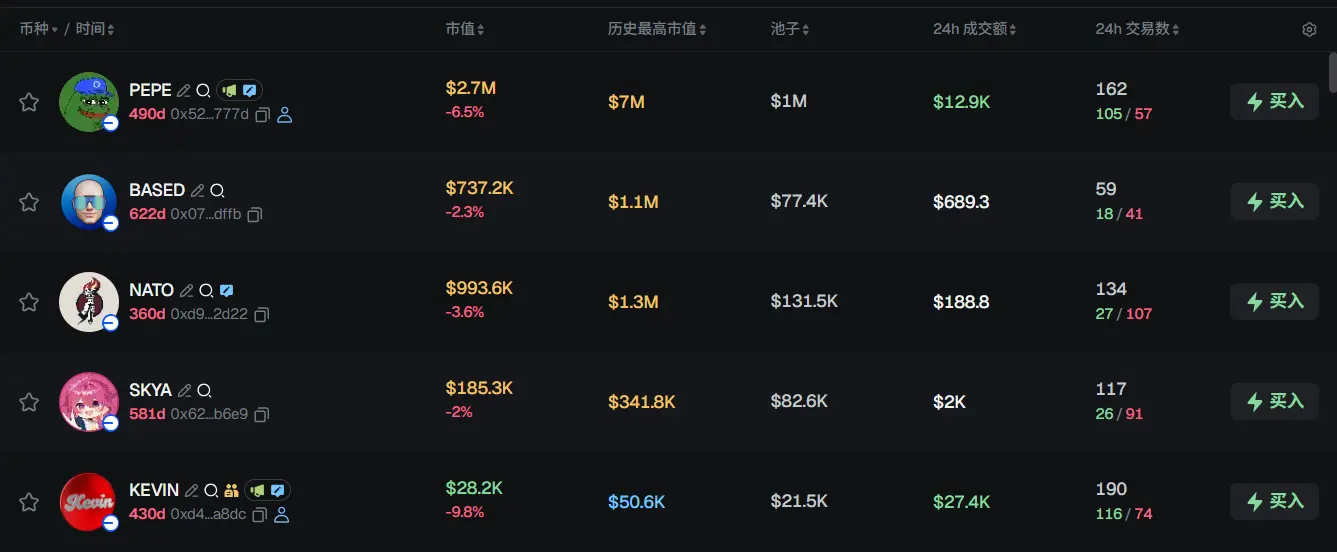

According to data from the Meme token tracking and analysis platform GMGN, as of 09:00 on December 12 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, MELANIA, Fartcoin, FO

The top five trending Base tokens in the past 24h are: PEPE, BASED, NATO, SKYA, KEVIN

What are some great articles worth reading from the past 24 hours?

Full text of the Federal Reserve decision: 25 basis point rate cut, $40 billion in Treasury purchases within 30 days

On December 11, the Federal Reserve voted 9-3 to lower the benchmark interest rate by 25 basis points to 3.50%-3.75%, marking the third consecutive meeting with a rate cut. The policy statement removed the description of the unemployment rate as "low." The latest dot plot maintains the forecast for a 25 basis point rate cut in 2026.

In addition, the Federal Reserve will purchase $40 billion in Treasury bills within 30 days starting December 12 to maintain adequate reserve supply.

Trump takes control of the Federal Reserve: The impact on Bitcoin in the coming months

Trump is taking over the Federal Reserve in a way that is much faster, deeper, and more thorough than anyone expected. It's not just about replacing the chair, but about redefining the boundaries of monetary system power, shifting the dominance of long-term interest rates, liquidity, and the balance sheet from the Fed back to the Treasury. The central bank independence that has been treated as an "institutional iron law" for decades is quietly being loosened.

This is why, from the Fed's rate cut expectations to ETF capital flows, from MicroStrategy and Tom Lee's contrarian buying, all seemingly scattered events are actually converging on the same underlying logic: the US is ushering in a "fiscal-dominated monetary era."

Wall Street's 30 years of experience decoded: Horse racing, poker, and Bitcoin's asymmetric opportunities

He inadvertently trained me to use Bayesian methods to predict the probability of future outcomes. I've used this skill in every decision in my life, especially during my 30+ years on Wall Street.

Now, this analytical framework has led me to the most mispriced bet of my career: Bitcoin.

When I use the horse racing odds method my father taught me to analyze Bitcoin, I see it as a 3:1 odds asset, but many of the smartest people I know give it 100:1 odds or even think it's worthless.

A brief history of the crypto future: Seven major trends to reshape the industry narrative by 2026

In a nutshell: Blockchains that are deliberately designed, finely tuned, and built and optimized based on underlying primitives for specific application scenarios will truly explode in the next year or two.

The developers, users, institutions, and capital recently entering the chain are very different from previous cycles. They each have distinct cultures and preferences (that is, their definition of "user experience"), and these preferences are often more important than abstract concepts like "decentralization" or "censorship resistance." Sometimes these needs fit with existing infrastructure; sometimes, they require completely different chain structures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Unlikely To Hit $100K By Year-end, Say Prediction Markets

Rare Funding Rate Event Stuns XRP Market

Revealed: The $500M Gamble of a Bitcoin OG’s Massive Leveraged Positions

Unlock Billions: Anza’s Bold Plan to Slash Solana Account Creation Fees by 90%