Bitcoin miners could boost corporate adoption as crypto treasury buys slow

Bitcoin miners, which can acquire the cryptocurrency at below-market costs, could be in the best position to shape corporate adoption as accumulation by crypto treasury companies slows, says BitcoinTreasuries.NET.

Bitcoin (BTC) treasury companies are projected to buy 40,000 BTC in the fourth quarter, the lowest since Q3 2024, BitcoinTreasuries.NET President Pete Rizzo said in a corporate adoption report released on Thursday.

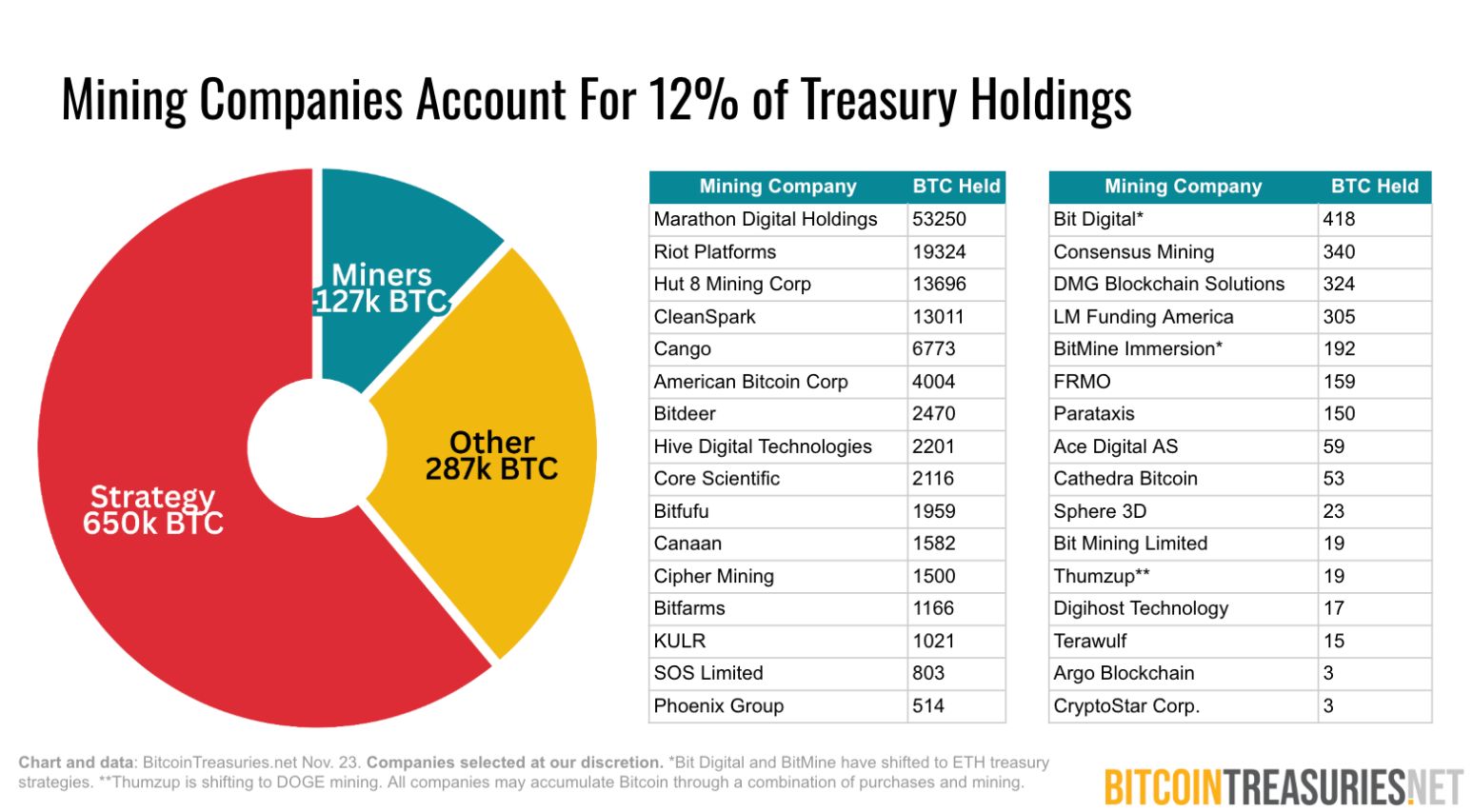

Despite the slowdown, Rizzo said Bitcoin mining companies continue to “anchor public‑market Bitcoin holdings” and accounted for 5% of new additions and 12% of aggregate public company balances in November.

“Because miners can acquire BTC at an effective discount to spot markets via block production, their balance sheets may become increasingly important in supporting corporate adoption, especially if other treasuries pause or slow purchases,” he said.

Miners already among top Bitcoin holders

On average, miners generate about 900 Bitcoin per day, according to Bitbo and MARA Holdings has the second largest Bitcoin stash among public companies, with a stash of 53,250 Bitcoin.

Riot Platforms is the seventh largest public Bitcoin holder, with 19,324, while Hut 8 Mining is ninth with 13,696.

Rizzo said that the “summer buying frenzy” from crypto treasury companies has eased, but “demand has not vanished.”

“Public corporations appear to be normalizing to a slower, more selective cadence as they digest recent purchases and reassess risk,” he added.

November a stress test for treasury companies

In November, Bitcoin’s price sank below $90,000 for the first time since April, which created one of the first true stress tests for the Bitcoin capital markets era, Rizzo said.

Roughly 65% of buyers purchased Bitcoin above current market prices and now have unrealized losses.

Related: Businesses are absorbing Bitcoin 4x faster than it is mined: Report

“Bitcoin’s late‑November drawdown pushed spot prices toward $90,000, dragging many 2025 buyers into the red. For the 100 companies where cost basis could be measurable, about two‑thirds now sit on unrealized losses at current prices,” he said.

“This does not yet point to widespread distress, but it does force risk committees and boards to confront the downside of averaging into elevated prices and relying on long-term upside to validate treasury decisions.”

Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Significant Price Decline in Late November 2025: Is the Market Overreacting or Does This Present a Contrarian Investment Chance?

- ChainOpera AI (COAI) plummeted 90% in late 2025 due to CEO resignation, $116M losses, and regulatory ambiguity from the CLARITY Act. - Market panic and 88% supply concentration in top wallets amplified the selloff, while stablecoin collapses worsened liquidity risks. - Contrarians highlight C3 AI's 26% YoY revenue growth and potential 2026 regulatory clarity as signs of mispriced long-term AI/crypto opportunities. - Technical indicators suggest $22.44 as a critical resistance level, with analysts warning

Hyperliquid (HYPE) Price Rally: An In-Depth Look at Protocol Advancements and Liquidity Trends

- Hyperliquid's HYPE token surged 3.03% amid HIP-3 upgrades enabling permissionless perpetual markets and USDH stablecoin launch. - Protocol innovations boosted liquidity by 15% but failed to halt market share erosion to under 20% against competitors like Aster. - Structural challenges persist through token unstaking, unlocks, and OTC sales, yet HyENA's $50M 48-hour volume signaled renewed engagement. - Whale accumulation of $19.38M near $45-46 and HYPE buybacks aim to stabilize price, though long-term suc

ChainOpera AI Token Plummets Unexpectedly: Is This a Warning Sign for Crypto Investors Focused on AI?

- ChainOpera AI's 96% value collapse in late 2025 exposed critical risks in centralized, opaque AI-driven crypto projects. - 87.9% token concentration in ten wallets enabled manipulation, while untested AI algorithms and lack of audits eroded trust. - Regulatory ambiguity from delayed U.S. CLARITY Act and EU AI Act created fragmented frameworks, deterring institutional participation. - Post-crash trends prioritize decentralized governance, auditable smart contracts, and compliance with AML/KYC protocols fo

Modern Monetary Theory and the Transformation of Cryptocurrency Valuation Models in 2025

- Modern Monetary Theory (MMT) reshaped crypto valuation in 2025, transitioning digital assets from speculative tools to institutional liquidity instruments amid low-yield environments. - Central banks and 52% of hedge funds adopted MMT-aligned CBDCs and regulated stablecoins, with BlackRock's IBIT ETF managing $50B as crypto gained portfolio diversification status. - Regulatory divergence (e.g., U.S. CLARITY Act vs. New York BitLicense) created volatility, exemplified by the Momentum (MMT) token's 1,300%