Zcash Leads in Hype — But Monero (XMR) Is Quietly Dominating Where It Matters

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR). Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth. XMR Outperforms ZEC in Many

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR).

Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth.

XMR Outperforms ZEC in Many Aspects Despite Lacking the Spotlight

In terms of daily spot trading volume in December, ZEC performed exceptionally well.

ZEC maintains a daily trading volume of nearly $1 billion. This level surpasses XMR and DASH, thanks to strong liquidity on major exchanges like Binance.

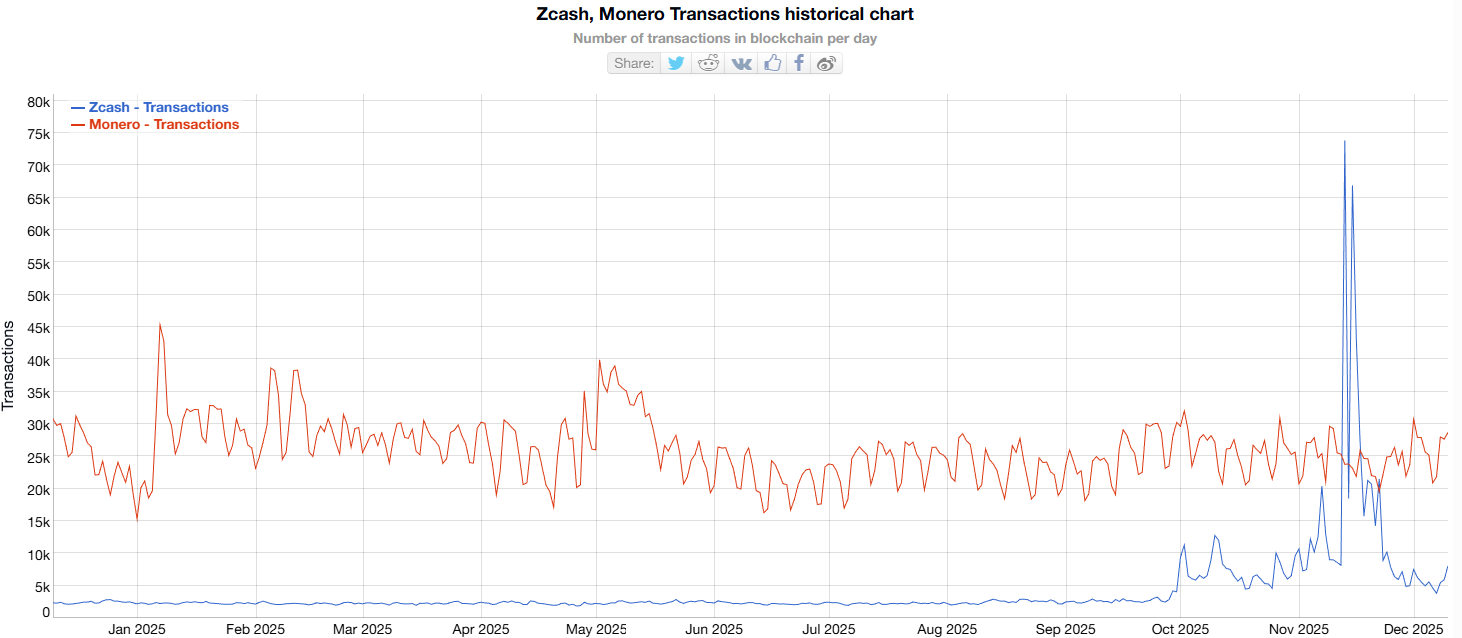

However, ZEC falls far behind in daily on-chain transactions. Data from BitInfoCharts shows XMR reaching an average of about 26,000 transactions per day. This figure is more than triple ZEC’s average of roughly 8,000 transactions per day.

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

The chart also indicates that XMR’s on-chain activity remains consistent over the long term. This trend reflects stable user behavior. In contrast, ZEC’s recent surge and sharp decline appear more like temporary excitement.

On-chain activity carries longer-term significance than spot volume. It reflects real usage patterns and user acceptance of XMR for anonymous transfers rather than short-term trading sentiment.

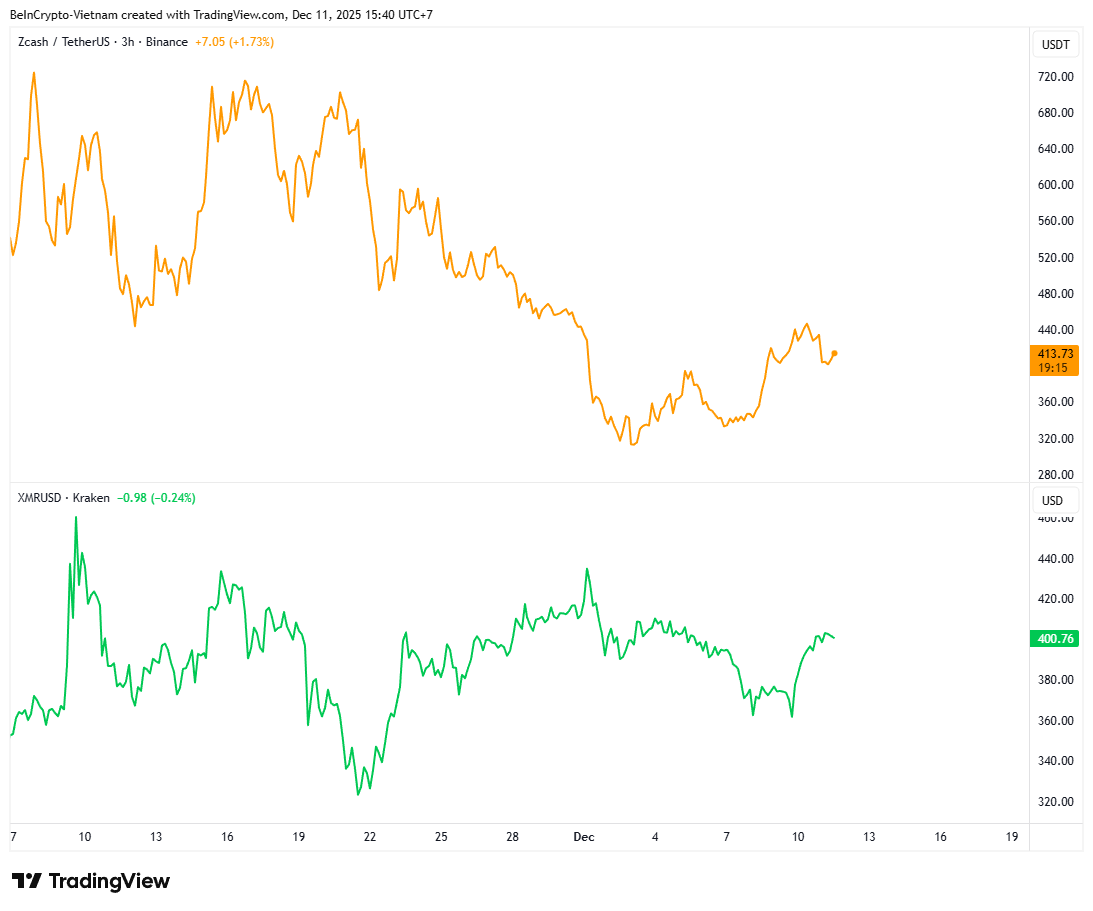

Additionally, ZEC’s price fluctuates due to increased volatility resulting from speculative trading. XMR’s price movement remains more stable.

TradingView data shows that ZEC has fallen by more than 40% over the past month. Many analysts now suggest the possibility of a bubble pattern. Meanwhile, XMR declined by roughly 12%.

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

From this perspective, ZEC suits traders who chase the privacy coin narrative and aim for quick profits during extreme FOMO cycles. The downside is deeper price drops and longer recovery periods.

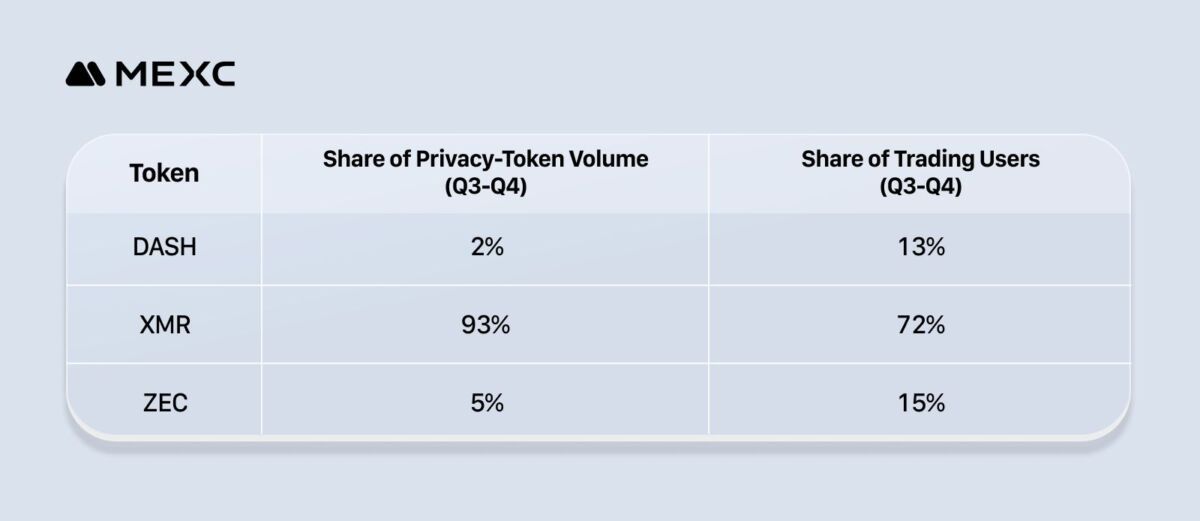

Furthermore, the latest report from MEXC Research reinforces XMR’s position. Over longer timeframes, XMR demonstrates superior trading volume and user activity compared to ZEC and DASH.

“Despite ZEC and DASH posting record-high trading volumes, Monero remains an asset of choice among privacy coin traders, accounting for 93% of total trading volume in Q3–Q4 and 72% of users in this segment,” MEXC Research reported.

The report also notes that growing interest in privacy assets reflects users’ increasing need for anonymity as regulators strengthen capital controls.

Therefore, regardless of holding ZEC or XMR, investors can continue to benefit next year. Experts predict privacy coins will remain a dominant market narrative in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean

The Growing Significance of Financial Well-Being in Planning for Lasting Wealth

- Financial wellness is redefining long-term wealth planning by integrating personal well-being with financial outcomes. - Intentional habits and AI-driven tools boost resilience, reducing behavioral underperformance by 2.5% annually. - Debt management via sustainable finance mitigates risks, especially in developing economies with robust policies. - Early financial education and four-quadrant frameworks balance objective metrics with subjective well-being. - Technology and financial therapy bridge gaps, e

The Rise of Liquid Clean Energy Markets and Their Impact on Investment Opportunities

- Global energy transition accelerates liquid clean energy markets, reshaping institutional investment strategies with ESG-aligned assets. - U.S. DOE and private firms advance infrastructure, including fusion and hydrogen projects, addressing scalability and reliability. - RESurety’s CFTC-approved CleanTrade platform boosts transparency and liquidity in clean energy derivatives, enabling $16B in trading. - Institutional investors diversify portfolios with clean energy derivatives, leveraging ESG compliance

Anthropology-Inspired Advancements in Higher Education: The Impact of Cross-Disciplinary Research on Student Success and Institutional Worth

- Farmingdale State College integrates anthropology with STEM/edtech to cultivate critical thinking and cross-disciplinary skills, aligning with evolving workforce demands. - Its Anthropology Minor (15 credits) and STS program emphasize cultural context, societal implications of technology, and data-driven problem-solving for STEM-aligned careers. - Partnerships like the $1.75M Estée Lauder collaboration and $75M Computer Sciences Center demonstrate how interdisciplinary approaches attract investment and a