Ethereum (ETH) price has strengthened against Bitcoin (BTC) in the past few days. The large-cap altcoin, with a fully diluted valuation of about $408 billion, surged over 3% on Wednesday, December 10, to trade above $3,427 at press time.

Ahead of the last FOMC meeting of 2025, BTC price hovered around $92.4k. As such, the ETH/BTC pair has edged over 7% in the past three days to hover about 0.0367 during the mid North American trading session.

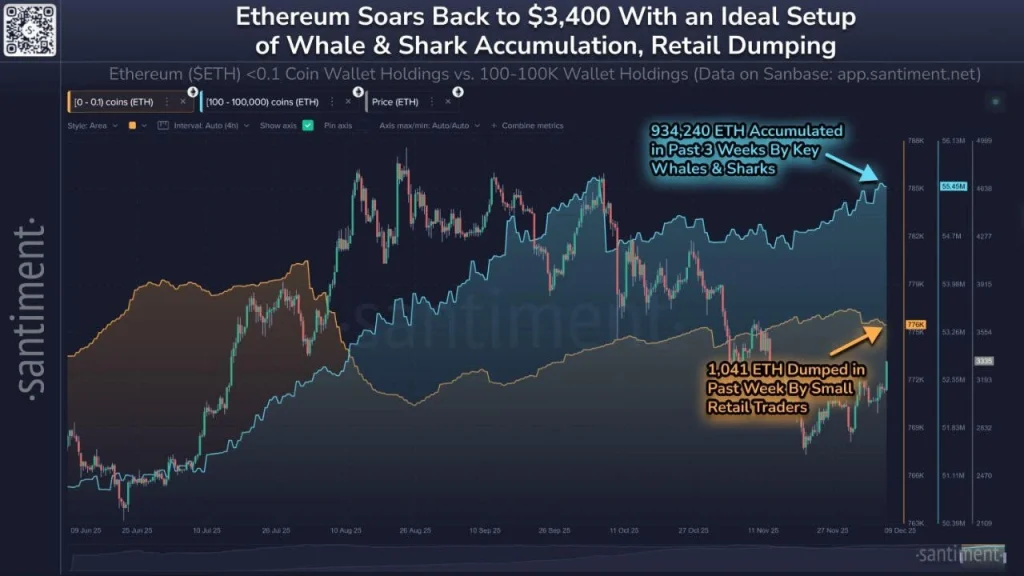

According to onchain data analysis from Santiment, the recent Ether price surge above $3,400 has been fueled by a renewed demand from whales amid retail dumping. During the past three weeks, Ethereum’s whales and sharks, with an account balance of between 100 and 100k coins, added 924,240 ETH, thus currently holding around 55.45 million coins.

On the other hand, retail investors, with an account balance of below 0.1 ETH, have sold 1,041 coins in the past week. Historically, Santiment has shown that a renewed demand from whales amid capitulation of retail investors has resulted in a bullish outlook.

The ongoing bullish thesis for Ethereum has signaled a potential parabolic rally for altcoins in the near term. Moreover, capital rotation from Bitcoin to Ethereum and the wider altcoin market has surged fueled by a clearer regulatory outlook.

According to Tom Lee, a major Ethereum believer and holder through BitMine, the ETH price is likely to reach $12k on average and $22k on the upside in the coming months. Such a scenario would trigger a parabolic rally for the wider altcoin market.