Is Ethereum Price Headed Toward $3,700 Next? One Metric Hints at a Longer Wait

Ethereum price is up 6.7% in the past 24 hours and trades near $3,320. The move follows a breakout structure confirmed on December 3, which still points toward $3,710. But mixed signals now suggest the climb may take longer. Breakout Structure Holds as a Bullish Crossover Approaches The Ethereum price continues to move within the

Ethereum price is up 6.7% in the past 24 hours and trades near $3,320. The move follows a breakout structure confirmed on December 3, which still points toward $3,710.

But mixed signals now suggest the climb may take longer.

Breakout Structure Holds as a Bullish Crossover Approaches

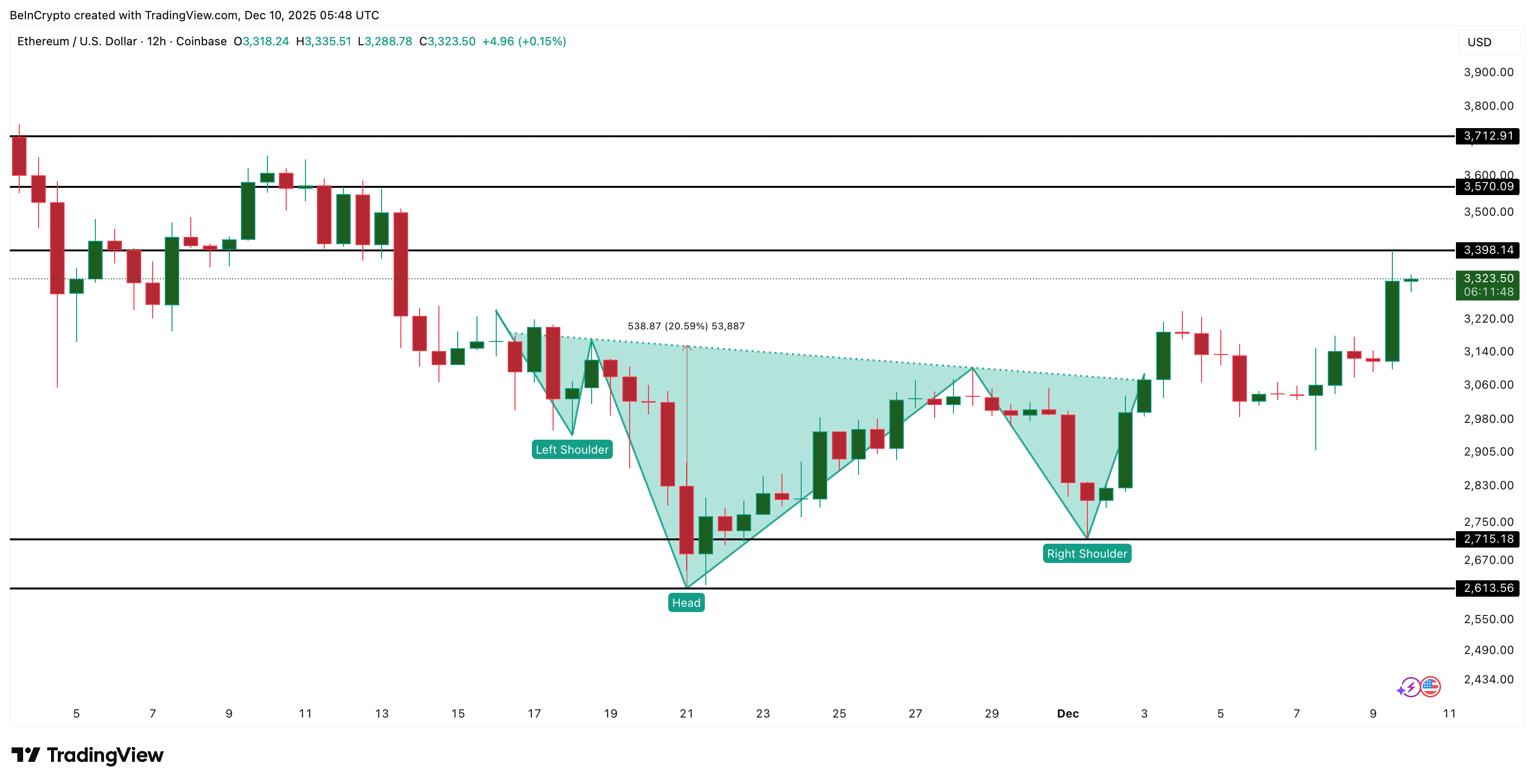

The Ethereum price continues to move within the same inverse head-and-shoulders breakout setup that formed in late November. The move stayed valid after December 3 because the right-shoulder support at $2,710 held. The structure weakens only if ETH drops under that level.

A key trigger now is the bullish crossover forming between the 20-period EMA (Exponential Moving Average) and the 50-period EMA. An EMA, or Exponential Moving Average, tracks price with extra weight on recent candles.

A bullish crossover usually hints that buyers are gaining strength and momentum may continue in the same direction. That trigger could push the ETH price higher, towards the projected target of $3,710.

Bullish Pattern With Looming Crossover:

TradingView

Bullish Pattern With Looming Crossover:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But this crossover will form only if sellers do not step in. One on-chain metric shows why caution remains.

Rising Paper Profits Create a Profit-Taking Window

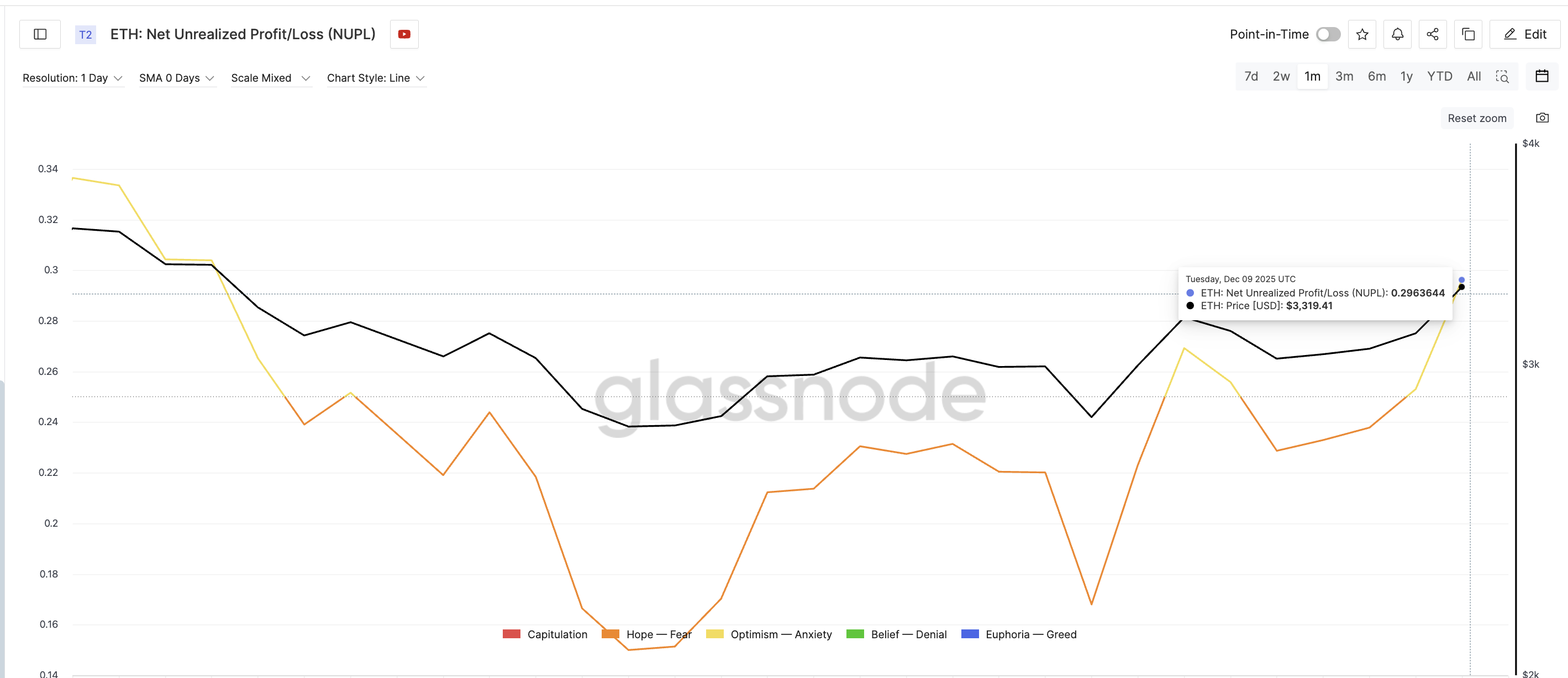

Ethereum’s Net Unrealized Profit/Loss (NUPL) measures the “paper profit” held by all ETH wallets. When NUPL rises, more holders have a reason to sell because they sit on larger unrealized gains.

ETH’s NUPL has now climbed to 0.296, pushing it into the Optimism–Anxiety zone. This is the highest reading since early November.

Paper Profits Rising Again:

Glassnode

Paper Profits Rising Again:

Glassnode

The last time NUPL reached a similar level — on December 3 — ETH fell about 5.2% within two days as holders booked profits.

A similar setup is visible now. Profitability is rising again while ETH sits near resistance. This increases the chance that some holders may sell before the bullish crossover finalizes. If that happens, the crossover may fail, and momentum could pause even though the breakout structure is still intact. That explains the longer wait time.

Key Ethereum Price Levels: What Opens the Path to $3,710 — and What Breaks It

If the bullish crossover completes and NUPL pressure stays limited, the Ethereum price has a clear upward path:

- A 12-hour close above $3,390 is the first signal

- The next resistance sits at $3,570

- Clearing $3,570 unlocks the full move toward $3,710, the measured 20% projection from the breakout point.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

If selling grows instead, the structure weakens. ETH remains valid above $2,710, but a move under $2,610 invalidates the setup and points to a deeper pullback.

For now, ETH sits between two forces: a bullish crossover that could push toward $3,710, and rising paper profits that may delay the move. The next few sessions will decide which side leads.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.