How “Diamond Hands” in Solana Meme Coins Struggle to Recover Their Investments

The Solana meme coin ecosystem is attractive, but it is also filled with risks. Many investors plan to trade in the short term. Yet rapid price swings forced them to become “diamond hands” unwillingly. Can they recover their losses? The following reasons show why this is difficult. Why Solana Meme Coin Investors Face Slim Chances

The Solana meme coin ecosystem is attractive, but it is also filled with risks. Many investors plan to trade in the short term. Yet rapid price swings forced them to become “diamond hands” unwillingly.

Can they recover their losses? The following reasons show why this is difficult.

Why Solana Meme Coin Investors Face Slim Chances of Breaking Even

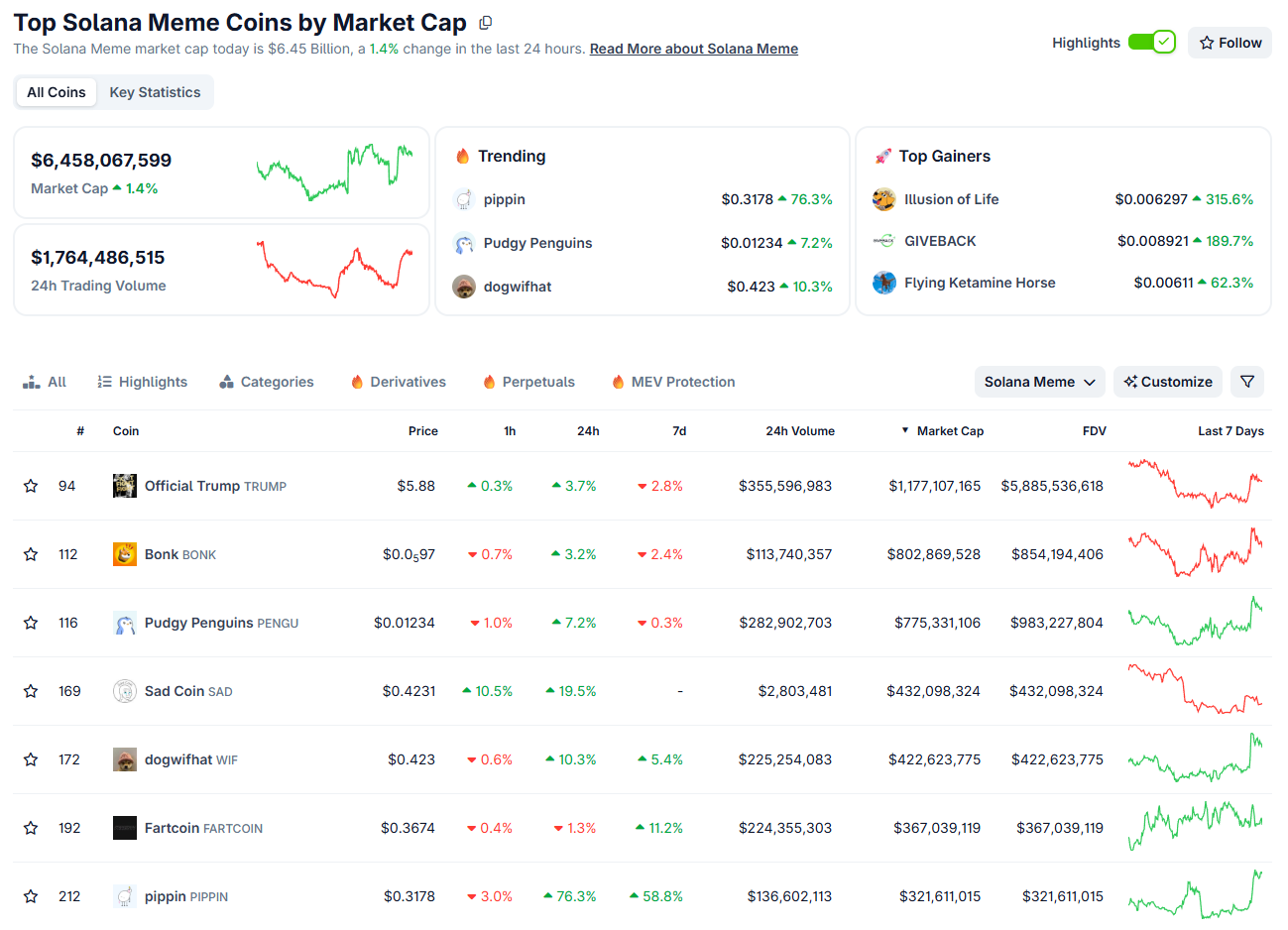

CoinGecko reports that the total market capitalization of Solana meme coins is approximately $6.45 billion, with a daily trading volume of over $1.7 billion.

However, the seven leading meme coins — TRUMP, BONK, PENGU, WIF, FARTCOIN, and PIPPIN — account for about 70% of the total market cap. Their combined daily volume covers 75% of the sector’s liquidity.

Top Solana Meme Coins by Market Cap. Source:

CoinGecko

Top Solana Meme Coins by Market Cap. Source:

CoinGecko

This liquidity concentration keeps most remaining meme tokens stuck with low trading volume. Their ability to recover becomes limited.

A report from Stalkchain shows that major ecosystem tokens such as PUMP, MELANIA, PENGU, SOL, and TRUMP all have unlock schedules in December. These dilution events cause large-cap tokens to bleed and drag down the entire sector.

The situation worsens as scams spread. Thesis.io analyzed 109 newly issued Solana tokens last week. 68.8% quickly became scams, and only 18.3% showed “potential.” Even within the potential group, 39.1% of individuals fell victim to scams within seven days.

Furry market analyst @ThesisDog brings the alpha. We’re dissecting the daily Solana action to reveal exactly where Meme Flow is heading in the first week of December.▸ Out of 109 alerts, 68.8% degraded into Scam, while only 18.3% maintained genuine Potential.→ This yields a… pic.twitter.com/Cmt4XZfSRw

— Thesis.io (@thesis_io) December 8, 2025

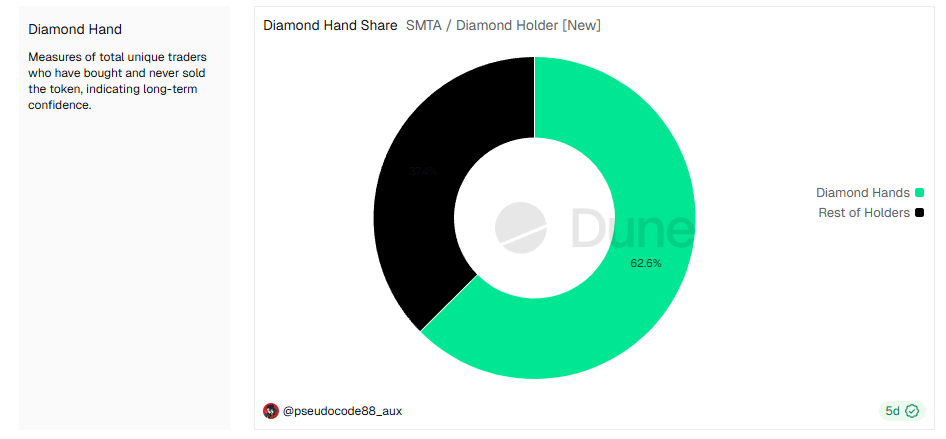

Dune data shows that more than 62% of Solana meme coin holders qualify as “diamond hands,” meaning they bought tokens and have never sold any.

Solana Meme Token Holders. Source:

Dune

Solana Meme Token Holders. Source:

Dune

Whether they became holders by accident or by long-term conviction, their chances of breaking even shrink for the reasons above.

Is There Any Hope?

A small positive signal exists. The meme coin market has shown early signs of recovery, although the momentum remains weak.

The most optimistic scenario would be fresh capital flowing into the entire ecosystem. This could lift both large meme coins and smaller low-cap tokens.

If no new capital enters, capital may shift from large-cap to small-cap stocks. This rotation could give underwater holders a chance to exit.

“PUMP, TRUMP, BONK, WIF, PENGU, FARTCOIN and USELESS hold most of the memecoin liquidity on Solana. So when money moves out of them, it has to go somewhere, and that’s when small caps and new tokens start pumping,” Stalkchain predicts.

However, searching for opportunities in meme coins remains a high-risk bet. Proper portfolio allocation is necessary so that the entire portfolio does not become overly dependent on these tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov

Navigating the Fluctuations of AI Tokens: Insights Gained from the ChainOpera AI Downturn

- ChainOpera AI's (COAI) 2025 token crash from $44.90 to $0.52 highlights systemic risks in AI-driven crypto projects due to centralized governance and regulatory ambiguity. - The CLARITY Act's regulatory framework created short-term volatility while exposing fragility in AI-linked tokens like algorithmic stablecoins xUSD and deUSD. - Investors must prioritize diversification, technical due diligence (e.g., EY six-pillar model), and compliance tools to mitigate risks in volatile AI crypto markets. - Succes

MMT and the Renewed Interest in Modern Monetary Theory within Policy Discussions

- Modern Monetary Theory (MMT) resurges in policy debates, challenging traditional fiscal rules by prioritizing resource availability and inflation risks over revenue constraints. - U.S. policymakers reject formal MMT adoption but align pragmatically with its principles through infrastructure investments and municipal bond financing. - MMT advocates argue debt sustainability is overstated, while critics warn of inflationary risks and fiscal misallocation in supply-constrained economies. - Global infrastruc

Tether fails with €1.1 billion offer for Juventus Turin