Livio from Xinhuo Technology: The value of the Ethereum Fusaka upgrade is underestimated

Weng Xiaoqi: The strategic value brought by Fusaka far exceeds its current market valuation, making it worthwhile for all institutions to reassess the long-term investment value of the Ethereum ecosystem.

Source: FTChinese.com

In the late autumn of 2025, the global crypto asset market experienced a sharp correction, with price panic and liquidity concerns reaching the most "extreme" levels since 2022. However, while widespread pessimism enveloped the market, the public collectively overlooked another event of greater strategic significance—the Fusaka upgrade completed by Ethereum on December 3.

In previous years, Ethereum upgrades would always be hyped up six months in advance; this year, due to prevailing bearish sentiment, the upgrade barely entered the public's view. However, upon our analysis, Fusaka is not just a simple technical patch—it is an adjustment to Ethereum's economic model and ecosystem performance, systematically addressing the two core bottlenecks that have plagued it for years: "value capture" and "user experience."

What exactly was upgraded—widening and cheapening the "roads" for L2, plus "speed limit signs" and "guardrails".

The strategic significance of Fusaka lies in its complete elimination of the two core barriers for Ethereum to enter the global mainstream and application markets: excessively high costs and complex usage.

First, it brings a thorough cost revolution. The core mechanism of this upgrade can be vividly understood as "widening the highway" for L2 without significantly increasing the burden on the L1 mainnet, and drastically reducing the "toll fees" for passage.

This design allows L2 transaction fees to remain at extremely low levels over the long term, with the theoretical cost per transaction as low as about $0.001. This extreme cost advantage is a breakthrough for high-frequency business scenarios. Whether it's on-chain gaming, decentralized social, AI agent settlements, or the frequent settlements of RWA (Real World Assets) that financial institutions focus on, all now truly have the economic foundation to "run on-chain." At the same time, Fusaka also achieves a delicate balance for the L1 mainnet: by "speeding up" and "weight limiting" (setting transaction caps), it improves efficiency while optimizing node storage requirements, lowering hardware thresholds, and ensuring a balance between efficiency gains and decentralization.

Second, it achieves a leap in user experience, which is key to large-scale adoption. Fusaka solves the most criticized problem of blockchain technology: complex private key management. The upgrade natively supports the Passkey solution, enabling a leap from "memorizing mnemonic phrases" to "fingerprint unlocking." Users no longer need to write down or keep complex mnemonic phrases, but can directly use their phone's fingerprint, FaceID, and other security modules to complete signatures. This innovation brings wallet usage closer to that of everyday apps, and, combined with the pre-confirmation mechanism, makes the goal of "transferring funds as smoothly as using an app" even closer. The entire Ethereum ecosystem is moving from "technically usable" to "truly user-friendly," which is the key foundation for attracting more Web2 users and enabling mass-market applications.

Ethereum's economic model shifts from "hyperinflation" to "deflation"

Of course, the most underestimated aspect of the Fusaka upgrade by the market is its disruptive improvement to the Ethereum ETH token economic model, shifting Ethereum from "hyperinflation" to "mild inflation" or even "deflation."

To use an interesting analogy, if Ethereum was previously in an era of "warlords ruling their own territories," it has now entered an era of "market economy." The past economic relationship between L1 and various L2s was somewhat like the "king and feudal lords" of the Spring and Autumn period: nominally respecting the king, but in reality, the lords ruled independently, and the economic activity generated by L2 prosperity did not effectively feed back to the ETH asset itself through mainnet fees and burning. After the Fusaka upgrade, this relationship has been linearized and institutionalized, readjusting the economic model to a normal market logic—L2s have become tenants who must regularly and stably "pay taxes to the center," paying stable L1 fees for the security and data throughput provided by L1. Once L2 transaction volume and activity increase, this fee mechanism will directly convert into economic value capture for L1 (ETH).

This institutionalized "taxation" brings an underestimated invisible buyback mechanism for ETH. The fees paid by L2s are burned, which essentially constitutes a stable, endogenous "buyback" mechanism for the ETH token. Although the burn amount paid by L2s was previously very low, after Fusaka's extreme fee reduction and stimulation of L2 activity, L2 transaction volume will grow exponentially, significantly increasing L1 burn volume. We estimate that related fees alone could bring an additional 3,000–10,000 ETH burned per year, equivalent to giving ETH a long-term buyback mechanism tied to business volume. Fusaka's design allows ETH supply to adjust with business usage, providing a healthier and more resilient valuation foundation than a simple deflation narrative.

The current ETH scaling solution is correct and resolute. Combined with subsequent upgrades, the overall TPS of the Ethereum L2 ecosystem has the potential to reach the 10,000 level, or even 100,000+ in the long term, with network gas fees being very user-friendly. This means ETH will no longer be just the "network usage fee for DeFi" and a "deflationary asset in narratives," but will gradually become the risk center and settlement layer equity of the entire L2 economy. This elevation of strategic status is the strongest long-term value support brought by Fusaka.

Conclusion: Anchoring Core Value and Embracing the Era of Change

We believe that the strategic value brought by Fusaka far exceeds its current market pricing, and all institutions should re-examine the long-term investment value of the Ethereum ecosystem. The Ethereum Fusaka upgrade is a significant underlying economic model transformation in the crypto asset industry. Its extreme fee reduction and leap in user experience are the "final push" for large-scale Web3 commercialization. Institutions focused on long-term value and foundational innovation will ultimately gain the upper hand in the next wave of industry transformation.

Original link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

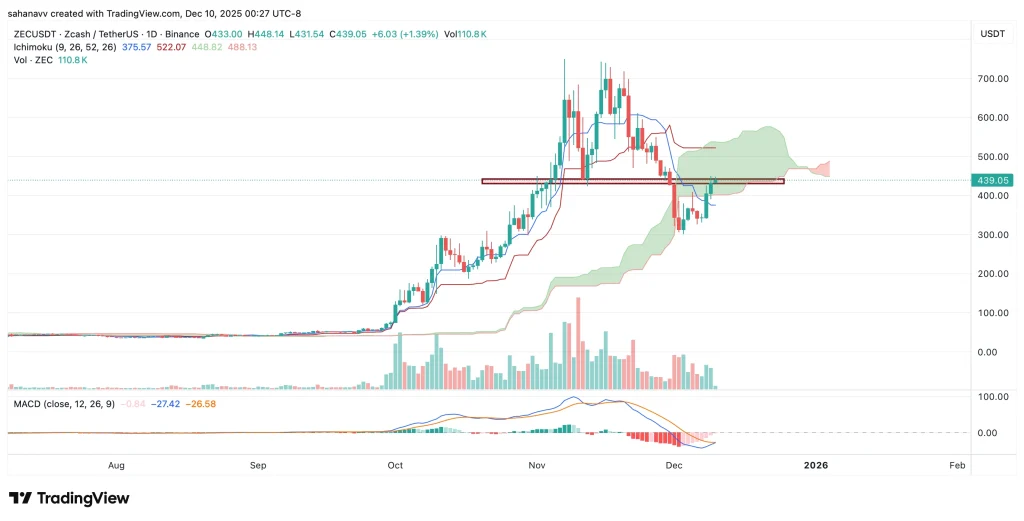

Zcash Price Analysis: ZEC Rally Faces Its First Test After Fee Proposal Surge—Will it Reach $500?

Hyperliquid Whale Game: Some Make a Comeback Against the Odds, Others Lose Momentum

The largest IPO in history! SpaceX reportedly seeks to go public next year, aiming to raise over 30 billion and targeting a valuation of 1.5 trillion.

SpaceX is advancing its IPO plan, aiming to raise significantly more than $30 billion, which could make it the largest public offering in history.