The US OCC confirms that banks have the authority to engage in riskless principal crypto asset transactions.

Jinse Finance reported that the US Office of the Comptroller of the Currency (OCC) today issued Interpretive Letter 1188, confirming that national banks are permitted to engage in allowable banking activities related to riskless principal crypto asset transactions. Such transactions involve the bank acting as principal in a crypto asset transaction with one client while simultaneously entering into an offsetting transaction with another client. The bank acts as an intermediary, does not hold a crypto asset inventory, and operates in a manner similar to a broker acting as an agent. As with any activity, national banks must conduct these activities in a safe and sound manner and comply with applicable laws.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

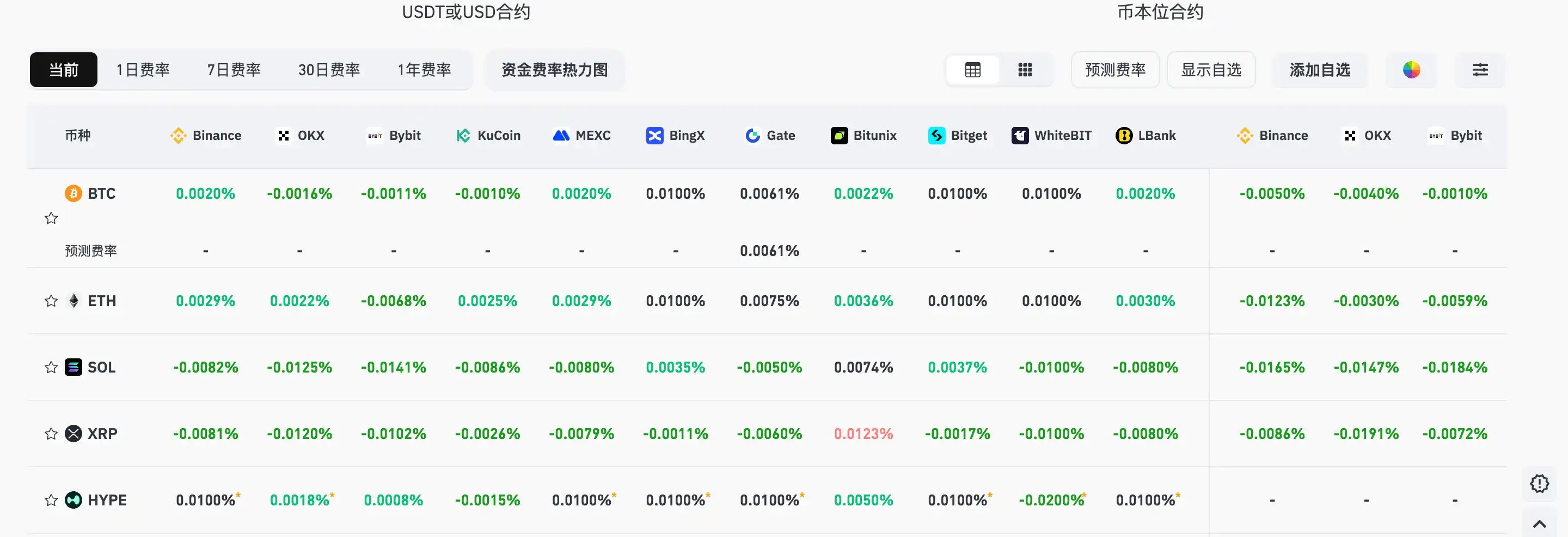

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.

Some Meme coins continue to rise during the market pullback, with JELLYJELLY surging 37% against the trend.