How to achieve an annualized return of 40% through arbitrage on Polymarket?

By demonstrating arbitrage structures with live trading, this provides a clear reference for the increasingly intense arbitrage competition in the current prediction markets.

Original Title: Arbitrage in Polymarket. $30,000/month.

Original Author: @igor_mikerin

Translated by: Peggy, BlockBeats

Editor's Note: As the US election approaches, trading activity in prediction markets continues to heat up. On December 9, 2025, discussions on the X platform about Polymarket arbitrage focused on cross-platform price differences, automated trading bots, and hidden risks. As price gaps between Kalshi and Polymarket appear more frequently and the technical threshold rises, prediction markets are evolving from “betting venues” into true arbitrage infrastructure.

Short-lived opportunities, thin liquidity, rule discrepancies, and black swan events remain the main challenges. The author of this article demonstrates arbitrage structures with live trades, providing a clear reference for the increasingly fierce arbitrage competition in prediction markets.

The following is the original text:

About a month ago, I noticed some arbitrage opportunities on Polymarket.com. However, the platform’s liquidity was insufficient for me to further expand my positions, so I was considering returning to stock trading. That said, I still currently have about $60,000 invested in various markets on Polymarket. Most of these trades will expire after the election, at which point I will close all positions. Below, I will introduce these positions one by one, along with some free code for those interested in exploring this market.

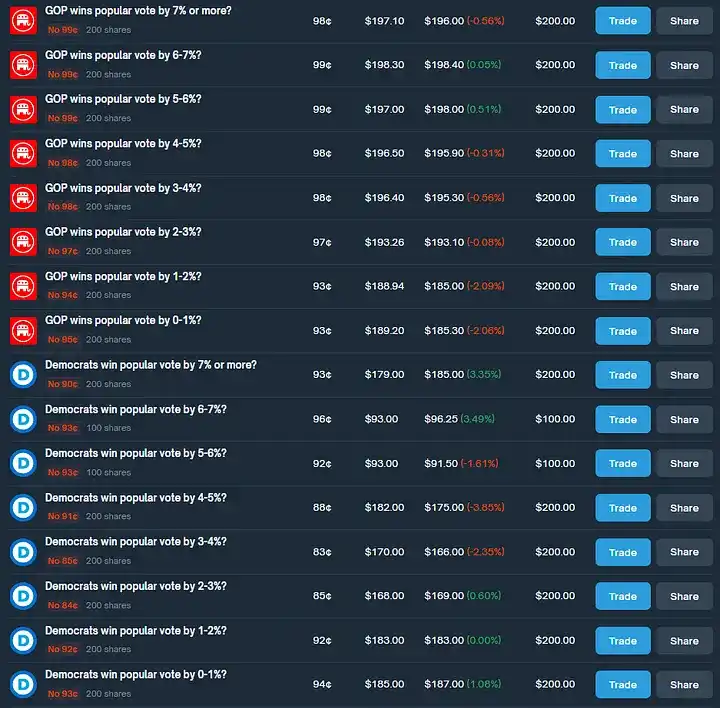

Arbitrage 1: Buy “Harris Elected President” and simultaneously buy all “Republican Wins by Different Electoral Vote Margins” outcomes

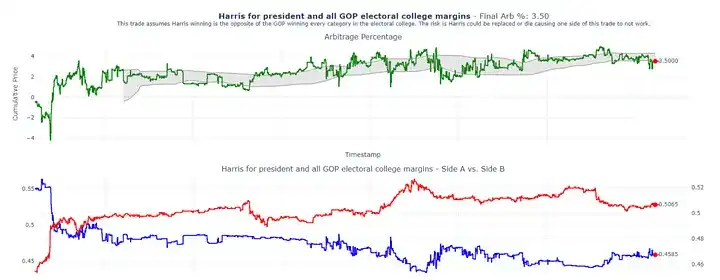

This strategy is quite straightforward: on one hand, bet on Kamala Harris winning the presidential election, and on the other, buy all possible Republican victory margins in the electoral college. Essentially, these two types of positions hedge each other. If the total price of both sides is less than 1, the difference is the locked-in yield—that is, the arbitrage space. As of today, the arbitrage margin for this trade is 3.5%, with 41 days left until the election. Annualized, this is roughly equivalent to a 41% annualized return.

The chart below shows how I constructed this trade. You can see that I bought nearly the same number of shares for almost all possible outcomes.

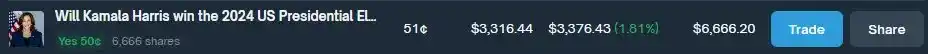

This is my position on Polymarket.com. You can see that I have bought almost the same number of shares for each possible outcome.

This is a summary of my real-time orders on Polymarket. The average cost of these positions is 0.983, which means my expected return is 1 – 0.983 = 1.7%. The cost basis for my most recent trade is 0.979, corresponding to a yield of 2.1%.

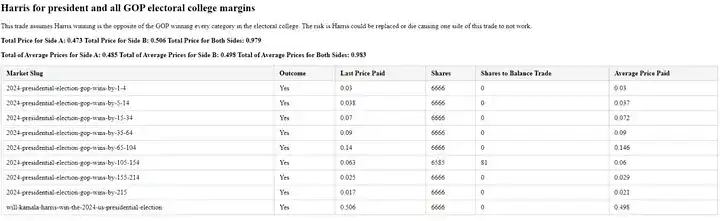

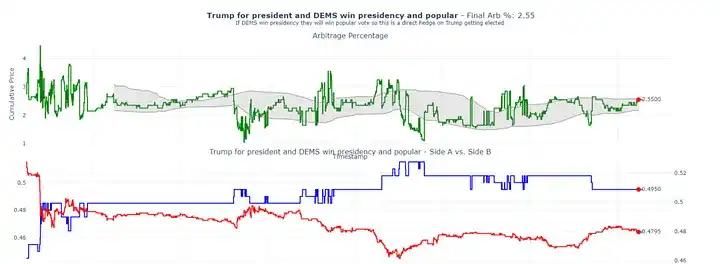

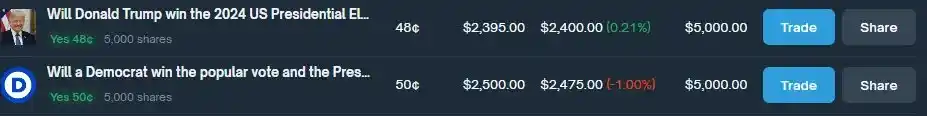

Arbitrage 2: Bet on Trump winning, and hedge with “Democrats win popular vote + win presidency”

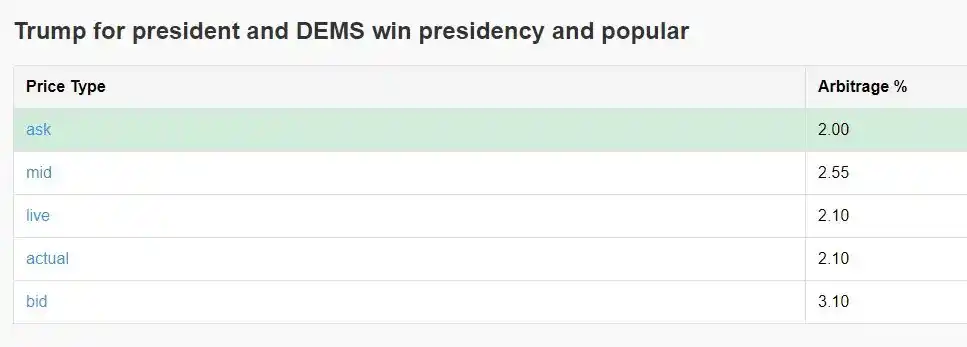

This strategy currently shows a 2.55% arbitrage margin. In this combination, we bet on Trump winning, while hedging by betting on the Democrats winning both the popular vote and the presidency. Although this is not a perfectly equivalent hedge (since it is possible for the Democrats to win the presidency without winning the popular vote), according to my model, the probability of this scenario is extremely low. Therefore, I consider this hedge structure to be robust.

The following are my actual trades. You can see that I hold the same number of shares on both sides of the bet.

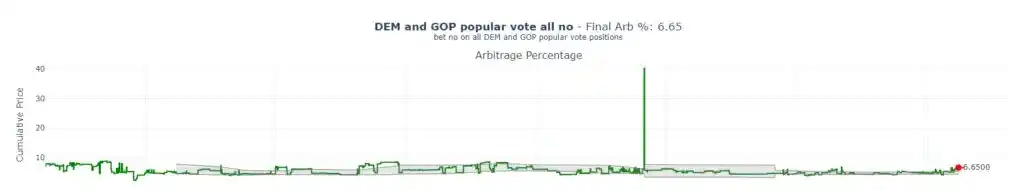

Arbitrage 3: Buy “No” for all possible Democratic and Republican popular vote outcomes

In this trade, I bought the “No” option for all possible popular vote outcomes. Currently, the arbitrage margin for this trade is 6.65%.

The following are my actual orders. Except for one of them, all other trades will win on election day. Therefore, the total profit from all winning positions in these trades (after deducting the one loss) needs to be greater than the amount of that loss.

Be sure to read the rules carefully

An important tip: always read the rules of each market carefully. Some positions may look like arbitrage opportunities but may hide significant risks. For example, if a candidate is assassinated, even if you think you have built a “robust arbitrage,” you could still lose all your principal.

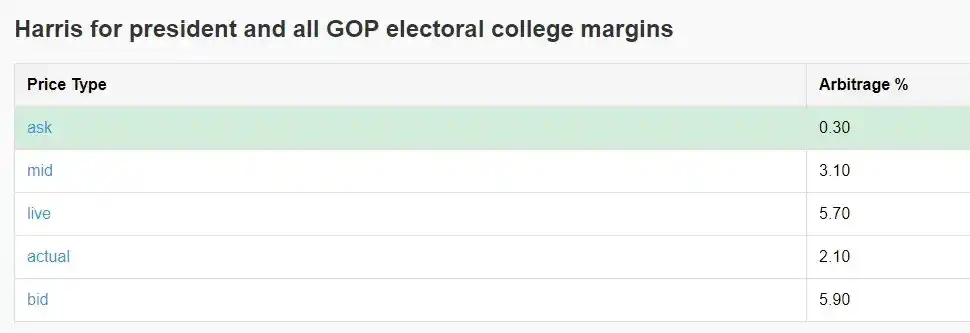

Price differences matter

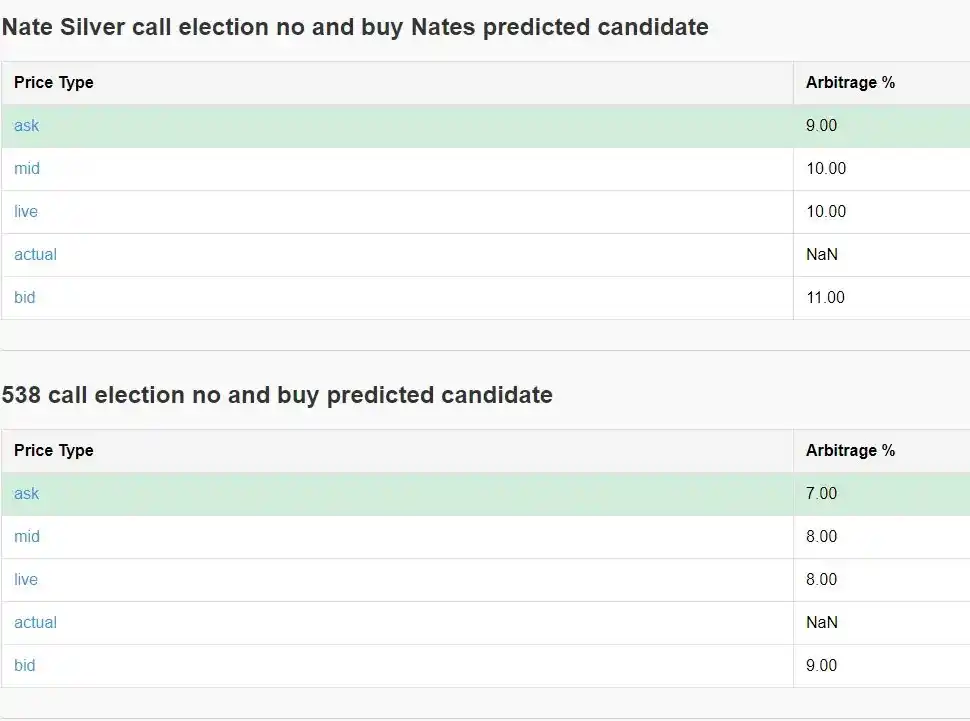

One of the biggest challenges I encountered is market impact. Due to low platform liquidity, once I place an order, I often push the entire market price in my direction. This causes discrepancies between the bid, ask, mid, real-time price, and actual transaction price. Below are typical examples from the trades mentioned earlier.

Good luck!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interpretation of ZAMA Dutch Auction Public Sale: How to Seize the Last Interaction Opportunity?

ZAMA will launch a sealed-bid Dutch auction based on fully homomorphic encryption on January 12, selling 10% of its tokens to achieve fair distribution, with no front-running and no bots.

Standard Chartered Bank lowers its 2025 Bitcoin price forecast to $100,000.

Why is the current macro environment favorable for risk assets?

In the short term, risk assets are viewed positively due to AI capital expenditures and strong consumer spending among the wealthy, which support earnings. However, in the long term, structural risks stemming from sovereign debt, demographic crises, and geopolitical restructuring must be closely monitored.