What Does the Russell 2000 Breakout Signal Mean for Bitcoin and Altcoins?

The Russell 2000 Index, which comprises approximately 2,000 small-cap companies, has long served as a barometer of investor appetite for growth and high-risk equities. Analysts quickly noticed its correlation with the crypto market. When risk-on sentiment spreads into the crypto market, it can help push Bitcoin and altcoins higher. The details below illustrate how this

The Russell 2000 Index, which comprises approximately 2,000 small-cap companies, has long served as a barometer of investor appetite for growth and high-risk equities. Analysts quickly noticed its correlation with the crypto market.

When risk-on sentiment spreads into the crypto market, it can help push Bitcoin and altcoins higher. The details below illustrate how this dynamic unfolds.

Russell 2000 Flashes a Breakout Signal, Raising Hope for Crypto

If the S&P 500 represents large-cap blue-chip companies, the Russell 2000 focuses on small-cap stocks.

The index is not as famous as the S&P 500 or the Dow Jones. However, it remains important, especially for investors who seek higher risk. This risk appetite aligns closely with many crypto investors.

In December, the Russell 2000 recorded a major turning point when it broke above a long-term resistance level. This move often signals strong upside momentum.

The breakout is considered a clear risk-on signal. This suggests that capital is shifting back to riskier assets, which can serve as fuel for Bitcoin (BTC) and altcoins.

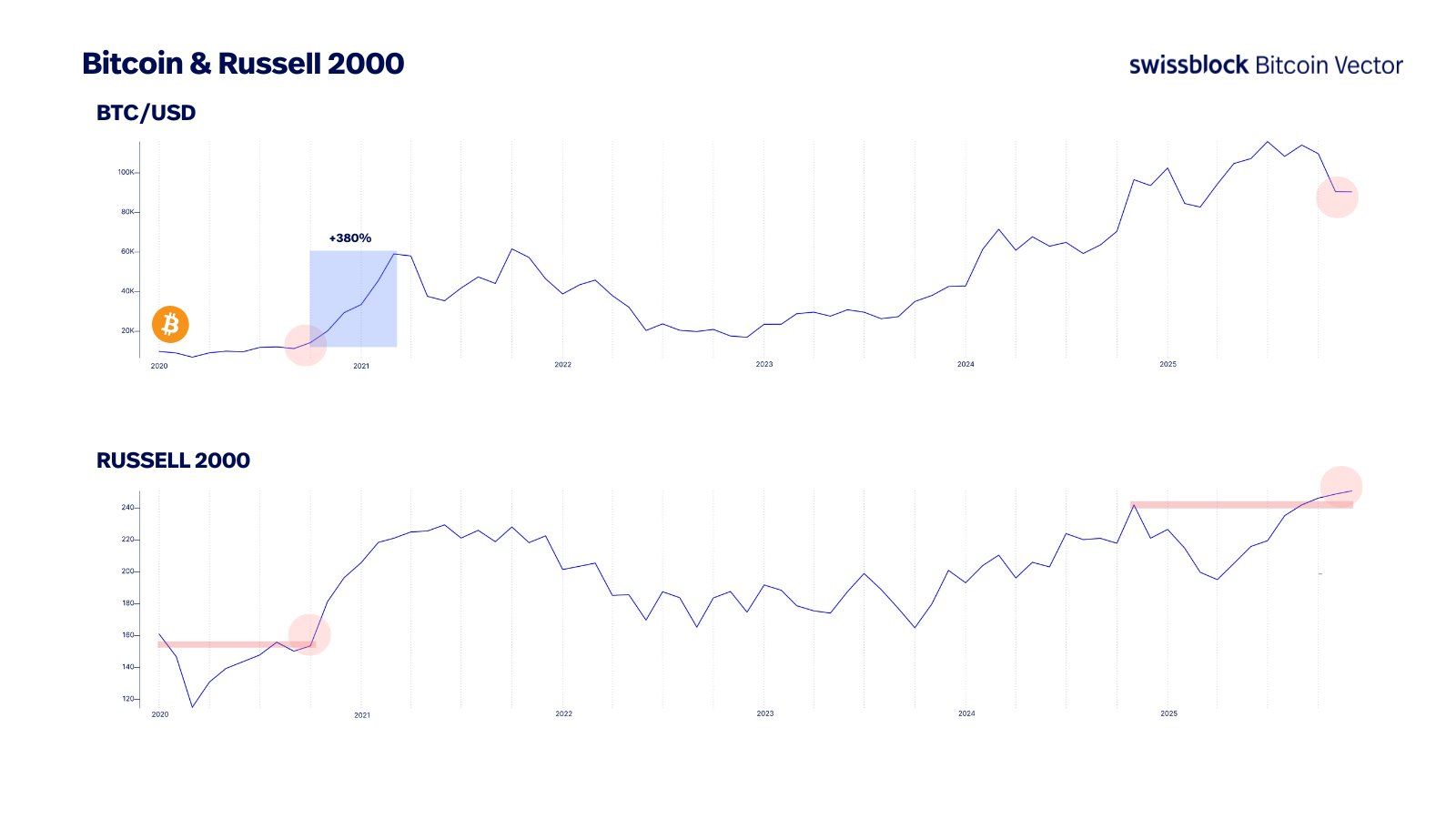

Bitcoin vs Russell 2000. Source:

Bitcoin vs Russell 2000. Source:

The Bitcoin Vector — an institutional Bitcoin report published by Swissblock — noted that in late 2020, the Russell 2000 broke through new highs and later turned that level into support. Bitcoin surged 380% after that.

“Last time this setup appeared, BTC delivered over 390% upside. This time the structure is different, but we’re starting from an environment that precedes liquidity expansion. And when liquidity turns, risk assets take the lead,” Bitcoin Vector stated.

Negentropic, co—founder of Glassnode, added that the Russell 2000 breakout signals a broad return of investors to risk assets.

Several analysts also believe this is a bullish sign for altcoins.

“Russell 2000 is the biggest indicator for Altseason, and it’s about to hit a new all-time high,” Ash Crypto said.

By comparing the altcoin market capitalization with that of the iShares Russell 2000 ETF — a fund that tracks US small-cap equities — analyst Cryptocium highlighted a correlation. Altcoin market cap (OTHERS) often surges when the iShares Russell 2000 ETF breaks above its previous all-time high.

Altcoin Market Cap vs iShares Russell 2000 ETF. Source:

Altcoin Market Cap vs iShares Russell 2000 ETF. Source:

This pattern has appeared twice: once in 2017 and again in 2021. It now suggests a potential altcoin boom in 2026.

But a Deeper Look Reveals Internal Weakness

A closer look inside the Russell 2000 rally shows a different picture.

Analyst Duality Research noted that, although the index rose in 2025, small-cap ETFs within the index still recorded net outflows of approximately $19.5 billion this year. This contrasts sharply with past rallies, which have typically been accompanied by strong ETF inflows.

The Russell 2000 is up more than 13% year-to-date and over 40% off its April lows, yet small-cap ETFs have still recorded roughly $20 billion in net outflows this year.

— Duality Research

This perspective weakens the bullish argument for a tight correlation between the Russell 2000 and the crypto market. If risk-on sentiment fails to last and the breakout turns into a false move, that negative shift may spread and extend the bearish mood in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ICP Surge: Unpacking a 30% Jump and Its Driving Factors

- ICP surged 30% in late October 2025 amid speculation and institutional adoption, driven by Microsoft/Azure partnerships and AI upgrades like Caffeine. - On-chain data shows 35% growth in active addresses but 91% fewer token transfers during downturns, highlighting fragile retail-driven momentum. - TVL hit $237B via asset tokenization, yet dApp engagement dropped 22.4%, signaling volatility despite 40+ tech upgrades including Chain Fusion. - Analysts project $11.15–$88.88 price ranges by 2030, contingent

The Rise of a Structured Market for Clean Energy Derivatives and Its Influence on Institutional Investors

- CFTC's 2025 approval of CleanTrade and other platforms as SEFs transformed the opaque clean energy derivatives market into a transparent, institutional-grade ecosystem. - CleanTrade's $16B notional trading volume in two months highlights surging demand for standardized instruments, attracting BlackRock and Goldman Sachs to hedge decarbonization risks. - ESG-driven institutional investment in renewables reached $75B in Q3 2025, with global clean energy derivatives projected to grow from $39T to $125T by 2

The Rise of a Fluid Clean Energy Marketplace: How CleanTrade is Transforming Institutional Investment in Renewable Resources

- CleanTrade's CFTC-approved SEF platform transforms VPPAs, PPAs, and RECs into institutional-grade renewable energy commodities. - The platform addresses historic market issues like illiquidity and opacity, enabling $16B in notional trading volume within two months. - Industry giants Cargill and Mercuria validate clean energy as a serious asset class through strategic participation in the regulated market. - By aligning financial and ESG goals, CleanTrade creates scalable alpha opportunities as global cle

Clean Energy Market Dynamics and Investment Prospects: The Role of CFTC-Approved Platforms in Facilitating Institutional Participation

- CFTC-approved platforms like CleanTrade are transforming clean energy markets by standardizing derivatives and centralizing trading infrastructure, boosting institutional liquidity and transparency. - CleanTrade’s SEF designation in September 2025 enabled $16B in notional trades within two months, converting illiquid assets like RECs into tradable commodities with ESG-aligned risk management tools. - Institutional demand surged as 70% of large asset owners integrated climate goals, with IRA-driven clean