UK FCA plans to simplify retail investment rules, allowing high-net-worth individuals to opt for higher-risk products

Foresight News reported that the UK's Financial Conduct Authority (FCA) has announced adjustments to retail investment rules to lower the investment threshold and encourage greater participation of UK residents in the capital markets. The policies include: eliminating complex information documents, so investment institutions no longer need to provide retail investors with a "Key Information Document (KID)", replacing it with a more concise "Product Summary"; wealthy individuals may voluntarily opt out of retail protection. Individuals with assets of £10 million or with investment experience can choose to be classified as professional investors, allowing them to invest in higher-risk products but without FCA consumer protection obligations; encouraging retail investors to enter the market. The investment rate of UK households is lower than in other countries, and the government is promoting residents to invest more savings into the market, including the recent reduction of the annual ISA tax-free allowance to £12,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock: The wave of capital flowing into AI infrastructure is far from peaking

US crypto stocks opened higher, with MSTR up 2.61% and BMNR up 4.9%.

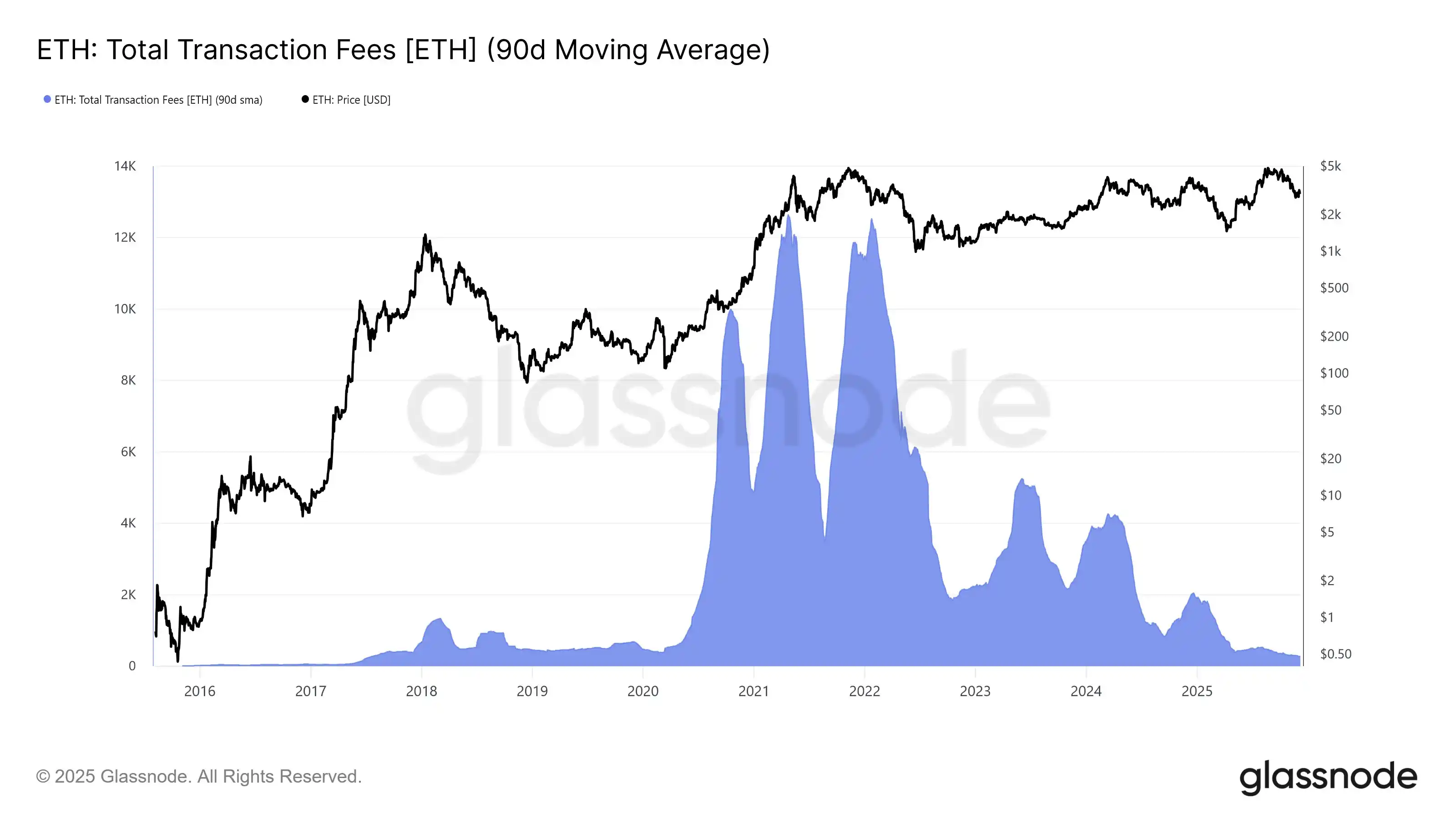

Ethereum network’s average daily total transaction fees hit the lowest level since July 2017

A certain whale address deposited 1.38 million USDT into HyperLiquid to open a 1x short position on HYPE.