Hyperliquid Token Hits 7-Month Low as Market Share Collapses

With the token down almost 30% in a month, traders have turned sharply bearish, with some warning that HYPE could fall toward $10.

Hyperliquid’s HYPE token slid to a seven-month low as the market reacted to a steep decline in the protocol’s dominance and renewed concern over recent token movements.

According to BeInCrypto data, the token dropped more than 4% in the past 24 hours to $29.24, its weakest level since May.

Why is HYPE Price Falling?

CoinGlass data showed that the drop triggered more than $11 million in liquidations, adding to pressure on a market already turning cautious.

The shift marks a stark reversal for a protocol that once controlled the on-chain perpetuals market. Earlier in the year, Hyperliquid dominated the decentralized perpetuals market with near-total authority. However, that edge has faded.

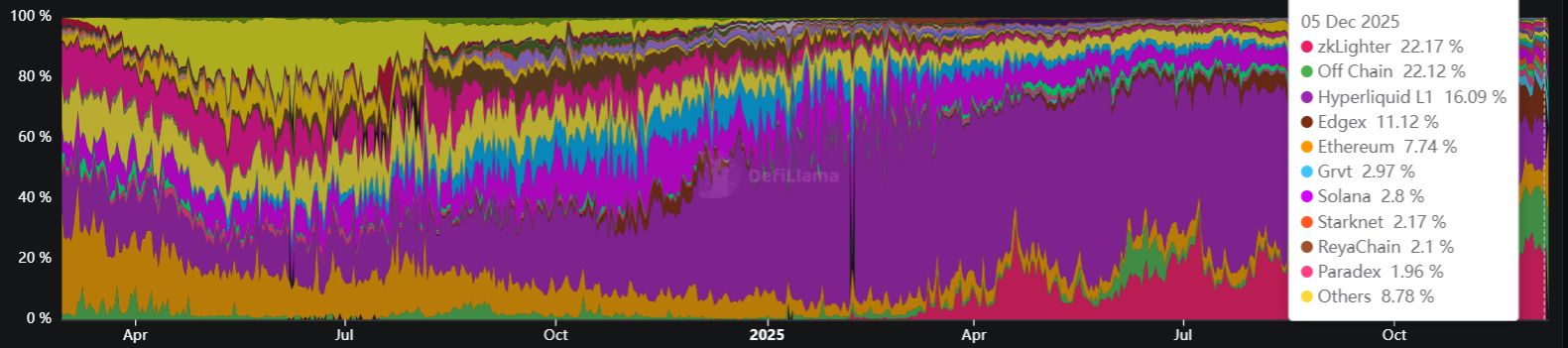

Data from DeFiLlama reveals a staggering erosion of its dominance, with the protocol’s share of the perpetuals market cratering from a peak of nearly 70% to less than 20% at press time.

Hyperliquid’s Falling Market Dominance. Source:

DeFiLlama

Hyperliquid’s Falling Market Dominance. Source:

DeFiLlama

This can be linked to the emergence of more aggressive rivals, such as Aster and Lighter, which have successfully siphoned volume through superior incentive programs.

As a result, investors are rapidly repricing HYPE and are no longer viewing it as the sector’s inevitable winner but as a legacy incumbent bleeding users.

Simultaneously, internal token movements have rattled confidence.

Blockchain analytics firm Lookonchain reported last month that team-controlled wallets unstaked 2.6 million HYPE, valued at roughly $89 million.

The HyperLiquid team recently unstaked 2.6M $HYPE($89.2M).Of that amount:1,088,822 $HYPE($37.4M) was restaked;900,869 $HYPE($30.9M) remains in the wallet;609,108 $HYPE($20.9M) was sent to #Flowdesk;1,200 $HYPE was sold for 41,193.45 $USDC.

— Lookonchain (@lookonchain) November 30, 2025

While the team restaked roughly 1.08 million tokens, the market fixated on the outflows.

A total of 900,869 HYPE remained liquid in the wallet, and another 609,108 HYPE, worth about $20.9 million, moved to Flowdesk, a prominent market maker. The project also sold an additional 1,200 tokens for about $41,193 in USDC.

These events have had a psychological toll on the community.

As a result, HYPE has shed nearly 30% of its value over the last 30 days, ranking as the worst-performing asset among the top 20 digital currencies by market capitalization.

Considering this, crypto traders have become significantly bearish on the token. Crypto trader Duo Nine has suggested that the token’s value could drop to as low as $10.

“Prepare mentally for such a scenario if you want to survive what’s coming,” the analyst stated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PENGU USDT Sell Alert: Is This a Turning Point for Stablecoin Approaches?

- PENGU/USDT's 2025 collapse triggered a $128M liquidity shortfall, exposing algorithmic stablecoin fragility and accelerating market shift to regulated alternatives. - USDC's market cap surged to $77.6B by 2025, while MiCA-compliant euro-stablecoins gained $680M in cross-border adoption amid regulatory clarity. - DeFi protocols adopted oracle validation and reserve-backed models post-PENGU, reducing exploit losses by 90% since 2020 through institutional-grade security upgrades. - Regulators now prioritize

Emerging Prospects in EdTech and AI-Powered Learning Systems: Ways Educational Institutions Are Transforming Programs and Enhancing Student Achievement

- AI is transforming education by reshaping curricula, enhancing student engagement, and optimizing institutional efficiency. - Universities like Florida and ASU integrate AI literacy across disciplines, offering microcredentials and fostering innovation. - AI tools like Georgia Tech’s Jill Watson and Sydney’s Smart Sparrow boost performance and engagement through personalized learning. - AI streamlines administrative tasks but faces challenges like ethical misuse and skill gaps, requiring structured train

Anthropological Perspectives on Technology and Their Impact on Education and Workforce Preparedness for the Future

- Interdisciplinary STEM/STEAM education integrates technology tools like AI and VR to bridge theory and real-world skills, driven by $163B global edtech growth. - U.S. faces 411,500 STEM teacher shortages and 28% female workforce representation gaps, prompting equity-focused programs like Girls Who Code. - STEM occupations earn $103K median wages (vs. $48K non-STEM), with 10.4% job growth projected through 2033, driving investor opportunities in edtech and workforce alignment. - Strategic investments in t

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov