XRP FUD Peaks as Ripple Announces ‘One-Stop Shop’ for Crypto Infrastructure

After a 31% XRP price drop over the past two months, on-chain analytics platform Santiment reported that the crowd sentiment has fallen into its most intense fear, uncertainty and doubt phase since October.

Related: XRP Ledger Velocity Spikes to 2025 High as Market Absorbs Ripple’s $101M Transfer to Binance

Santiment Data: The Contrarian Signal

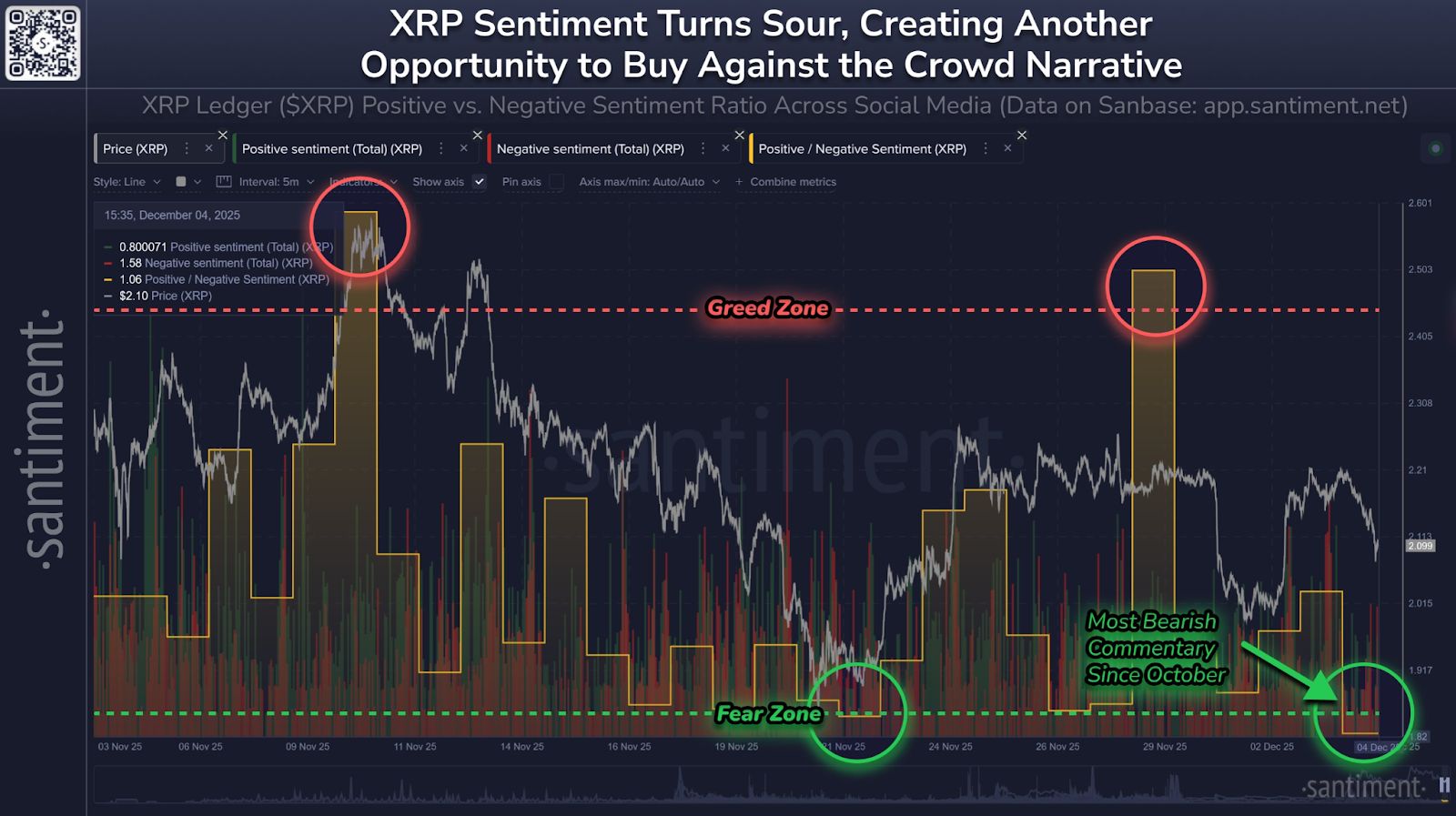

Analytics firm Santiment released data confirming the sentiment washout. Their “Weighted Social Sentiment” chart flashed multiple green circles; markers indicating days where bearish commentary overwhelmingly drowned out bullish theses, pushing the asset deep into the “Fear Zone.”

Such levels of fear were seen last on November 21st which preceded a sharp 22% within three days. Shortly after that rally, excessive optimism hit the market, and XRP prices stalled as greed replaced fear.

XRP Sentiment Returns To Deep Fear Zone

Notably, the red circles on Santiment’s chart coincided with market tops and overheated signals. Today, social sentiment has again collapsed to the same level of extreme negativity, creating conditions that some traders view as a contrarian entry zone.

This creates strong opportunities for traders who prefer to act against crowd emotions.

Ripple’s ‘One-Stop Shop for Digital Asset Infrastructure’

As per an announcement, Ripple, the firm behind XRP, has invested a whopping $4 billion into the broader digital asset ecosystem. However, 2025 stands out as a turning point for fintech with four major acquisitions, each aimed at building a unified, end-to-end crypto infrastructure stack.

Ripple wants to create a complete operating system for global value movement, including liquidity, custody, payments, treasury, prime brokerage and settlement, delivered under one roof.

GTreasury integrates enterprise-level treasury intelligence directly into Ripple’s rails. Palisade expands Ripple Custody into high-speed wallet provisioning for rapid, high-frequency asset movement.

4 major acquisitions. 1 goal:

— Ripple (@Ripple) December 4, 2025

With GTreasury, Rail, Palisade, and Ripple Prime, we’re building the one-stop shop for digital asset infrastructure – custody, liquidity, treasury, payments & real-time settlement under one unified platform.

We are building…

Meanwhile, Rail adds virtual accounts, stablecoin payments and automated back-office functions and Ripple Prime completes the equation with institutional-grade execution and financing for dozens of assets, including XRP and RLUSD.

XRP Price Analysis: Criticals Levels Ahead

The XRP daily chart shows that the token is trading within a descending channel structure that has governed price action through November and December. Price continues to compress between the two parallel lines.

Fibonacci retracement levels now create a tightly packed cluster around the $2 zone, a level XRP repeatedly attempts to reclaim.

For bullish traders, a decisive break above the descending channel resistance and a daily close above $2.1 is the first confirmation signal. If momentum builds, the next major barrier sits near $3.

On the other hand, failure to hold above the $1.9 support area increases the probability of a deeper move toward the $1.5 and $1.

Related: XRP Price Prediction: Price Compresses as Sellers Defend The Trendline

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The COAI Price Reduction: Impact on Technology and Green Energy Industries

- COAI's 88% price drop in Nov 2025 exposed governance failures and regulatory ambiguity, triggering investor reassessment of AI-linked assets. - U.S. clean energy investment fell 36% due to Trump-era policy shifts, while global clean energy attracted $3.3 trillion in 2025 despite AI sector turmoil. - Investors migrated to stable AI stocks (Microsoft/Nvidia) and non-AI renewables, prioritizing transparency over speculative crypto projects like COAI. - The crisis accelerated capital reallocation toward ethi

Timeless Strategies for Investing in Today's Market

- R.W. McNeel and Warren Buffett share timeless value investing principles emphasizing emotional discipline, long-term vision, and intrinsic value. - Both stress faith in the U.S. economy, with Buffett's Berkshire Hathaway exemplifying this through long-term investments in American icons like Apple and Coca-Cola . - Retained earnings and margin of safety strategies, demonstrated by Apple's reinvestment and Berkshire's share buybacks, highlight compounding's role in mitigating market volatility. - Modern be

Investing for Tomorrow: Preparing the Workforce and Advancing Tech Education in the Digital Age

- AI, cybersecurity, and data analytics are reshaping industries, driving 29% growth in cybersecurity roles and 56% wage premiums for AI skills. - Educational institutions like CCBC and Cengage Work are bridging skill gaps through AI-powered training and industry partnerships. - Government-industry collaborations aim to train 500 AI researchers by 2025, emphasizing workforce readiness as a shared responsibility. - ROI metrics for tech education now include operational efficiency gains and strategic alignme

FARTCOIN Trades at $0.347 as 9.6% Daily Gain Meets Strong $0.38–$0.40 Resistance