Date: Thu, Dec 04, 2025 | 10:20 AM GMT

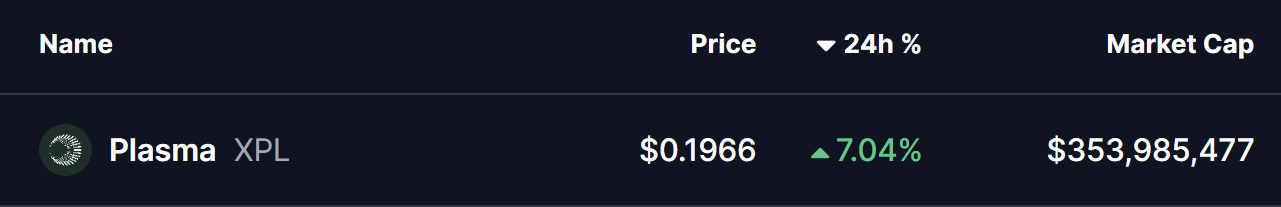

The broader cryptocurrency market is showing notable upside momentum as Ethereum (ETH) trades firmly in green, climbing over 4% in the last twenty-four hours. This recovery wave is helping several altcoins regain traction — including Plasma (XPL), which is up 7% today.

Beyond the daily gains, XPL is beginning to show an interesting bullish fractal that strongly resembles the earlier recovery structure seen in Hyperliquid (HYPE). If this mirrored pattern continues, XPL could be entering the early phase of a larger upside reversal.

Source: Coinmarketcap

Source: Coinmarketcap

XPL Mirrors HYPE’s Path

As highlighted in the comparative fractal chart, XPL’s current structure is tracking almost step-for-step with HYPE’s rounding bottom formation from April 2025.

HYPE had topped near $35.37 before sliding into a deep corrective phase, ultimately forming a clean rounded base near $9.30. It wasn’t until the token reclaimed the 200-MA that sentiment flipped bullish, leading to a neckline breakout and a stunning 230% follow-through rally.

HYPE and XPL Fractal Chart/Coinsprobe (Source: Tradingview)

HYPE and XPL Fractal Chart/Coinsprobe (Source: Tradingview)

XPL appears to be in the same developmental phase.

After peaking around $1.69, the token fell sharply and has now carved out a similar rounded structure at the $0.17 zone, where price has begun stabilizing. The resemblance becomes even more compelling when aligned with the 200-MA dynamic: just as HYPE struggled beneath its 200-MA before its explosive reversal, XPL is now capped by the same resistance barrier at $0.2405.

What’s Next for XPL?

HYPE marked its cycle bottom after a 73% decline. In comparison, XPL has corrected roughly 89%, suggesting that a structural low has already been formed around $0.17 before recovering back toward its current level.

If XPL continues to respect this fractal rhythm, a reclaim of the 200-MA would be a critical shift. That single technical flip could confirm the emerging bullish alignment and once again open the road toward a neckline breakout around the $0.33 region — the same trigger zone that propelled HYPE into a multi-week rally.

However, the fractal setup still requires confirmation. Sustaining above the $0.17 support base will be key to preserving the rounding bottom integrity and keeping the bullish trajectory intact.

XPL is not fully there yet, but structurally, it is building the same foundation HYPE did before its reversal phase initiated.