LUNA Price Remains Steady as U.S. Lawmakers Advance Stock Trading Ban

- LUNA's price remained stable at $0.0727 in 24 hours but fell 82.47% annually amid U.S. legislative efforts to restrict congressional stock trading. - Rep. Anna Paulina Luna's bipartisan bill seeks to ban lawmakers, spouses, and children from individual stock trading to address ethical conflicts. - The bill, supported by 100+ co-sponsors, faces opposition over financial flexibility concerns for lower-income legislators amid unchanged congressional salaries since 2009. - A discharge petition aims to force

LUNA Price Holds Steady Amid U.S. Legislative Developments

As of December 4, 2025, LUNA’s price remained unchanged at $0.0727 over the previous 24 hours. Over the last week, the cryptocurrency saw a modest increase of 0.14%, and it has gained 0.69% in the past month. However, looking back over the year, LUNA has experienced a significant drop of 82.47%. These price movements are unfolding as U.S. lawmakers consider new restrictions on congressional stock trading.

Push for Congressional Stock Trading Restrictions

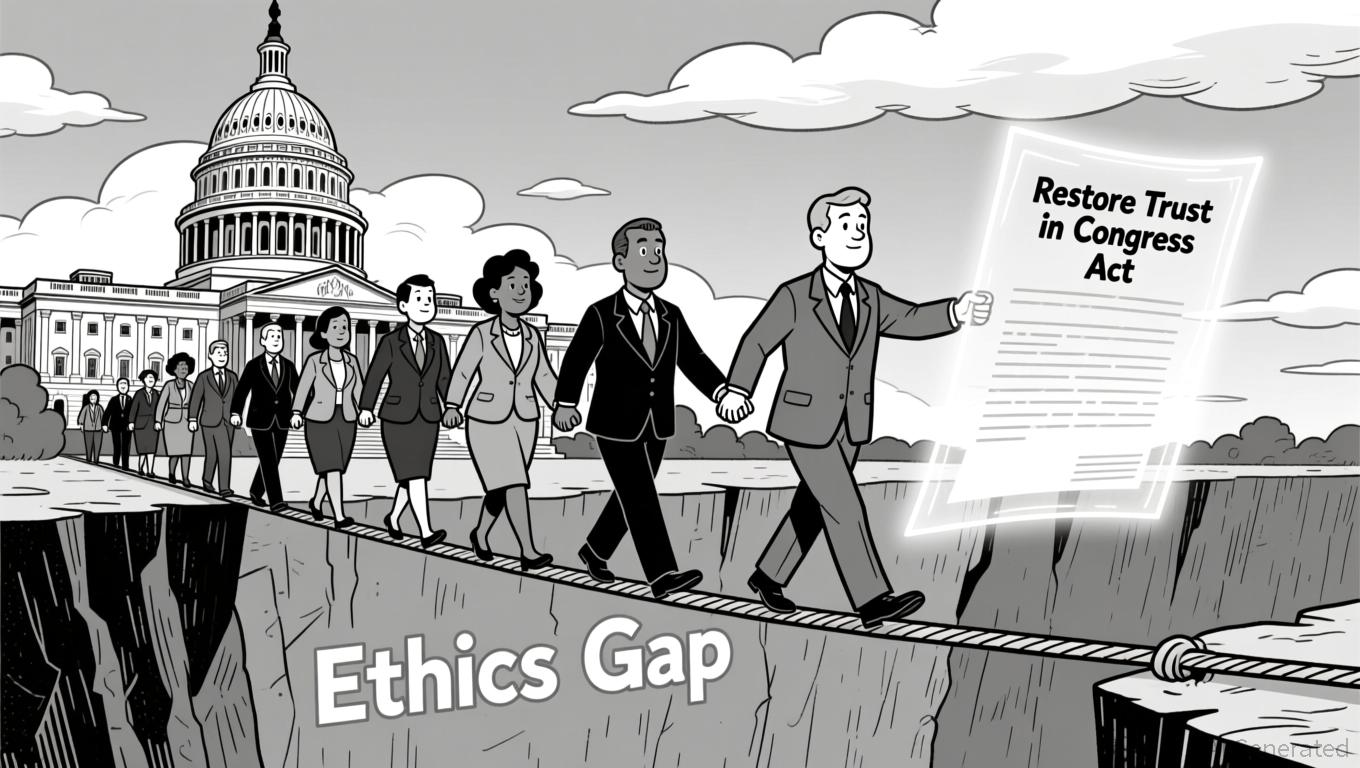

The bipartisan Restore Trust in Congress Act has become a central topic in the ongoing conversation about ethical standards for lawmakers. Introduced by Republican Representative Anna Paulina Luna, the bill would bar members of Congress, their spouses, and dependent children from trading individual stocks.

On December 3, 2025, Luna initiated a discharge petition—a procedural step that can force a House vote if at least 218 members sign on, bypassing traditional leadership channels.

Broad Support and Implementation Hurdles

The proposal has attracted over 100 co-sponsors from across the political spectrum, signaling widespread concern about conflicts of interest and the need to rebuild public trust. The legislation aims to address the advantages lawmakers may have due to access to confidential information and government briefings.

Notable supporters include Representatives Chip Roy and Seth Magaziner, who argue that the existing STOCK Act of 2012 falls short. While the STOCK Act requires lawmakers to disclose their stock trades, it does not prevent them from trading, leaving room for potential misuse of privileged information.

Despite bipartisan interest, the bill faces pushback. Some legislators worry that banning stock trading could limit their financial options, especially since congressional salaries have not increased since 2009. Opponents suggest that such a ban could disproportionately impact members with fewer financial resources who depend on investment income.

Public Attention and Legislative Tactics

Recent reports on lawmakers’ financial activities have shown that many in Congress and their families outperform the general market, fueling demands for stricter oversight. The discharge petition has brought additional visibility to the issue, positioning the bill as a possible turning point for congressional ethics reform. Earlier this year, a similar petition succeeded in forcing the release of documents related to the Jeffrey Epstein case, highlighting the effectiveness of this legislative tool.

If the current petition garners enough support, it could compel a vote on the proposed ban, thrusting the matter into the spotlight. The outcome is still uncertain, as House Speaker Mike Johnson has expressed reservations about using discharge petitions and has not endorsed the bill. Nevertheless, with mounting public interest and bipartisan support, the debate over ethical standards in Congress is expected to intensify in the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vanguard Group holds 27.2 million shares of MetaPlanet stock.

Bitcoin miners are shutting down their mining rigs due to declining hash revenue.

Tom Lee: Bitcoin may rise to $250,000 within months, and Ethereum is expected to rise to $12,000.