Fusaka Pushes Ethereum Above $3,200: It Will Reach $4,262 If This Happens

Ethereum has successfully activated the Fusaka upgrade on mainnet, marking its second major network enhancement in 2025. With PeerDAS now live, ETH has surged past the critical $3,200 resistance zone, and traders are watching whether the rally can sustain and even extend further. Fusaka Goes Live Ethereum confirmed the Fusaka mainnet activation on December 3

Ethereum has successfully activated the Fusaka upgrade on mainnet, marking its second major network enhancement in 2025.

With PeerDAS now live, ETH has surged past the critical $3,200 resistance zone, and traders are watching whether the rally can sustain and even extend further.

Fusaka Goes Live

Ethereum confirmed the Fusaka mainnet activation on December 3 at 22:04 UTC. The upgrade introduces PeerDAS technology, which unlocks up to 8x data throughput for rollups, raises the gas limit from 45 million to 60 million units, and adds R1 curve support for improved user experience. Currently, Ethereum processes between 1.3 and 1.8 million transactions daily and holds over $73 billion in value locked in DeFi.

For L2 and Layer 2 rollups, Fusaka is even more relevant. PeerDAS increases the available space for blobs and prepares gradual capacity increases in future forks focused solely on data. The goal is clear: to maintain very low fees on networks like Arbitrum, Base, or Optimism, even if demand continues to grow.

Community members will monitor the network for issues over the next 24 hours.

Fusaka is live on Ethereum mainnet!– PeerDAS now unlocks 8x data throughput for rollups– UX improvements via the R1 curve & pre-confirmatons– Prep for scaling the L1 with gas limit increase & moreCommunity members will continue to monitor for issues over the next 24 hrs.

— Ethereum (@ethereum) December 3, 2025

ETH Breaks $3,200 Resistance

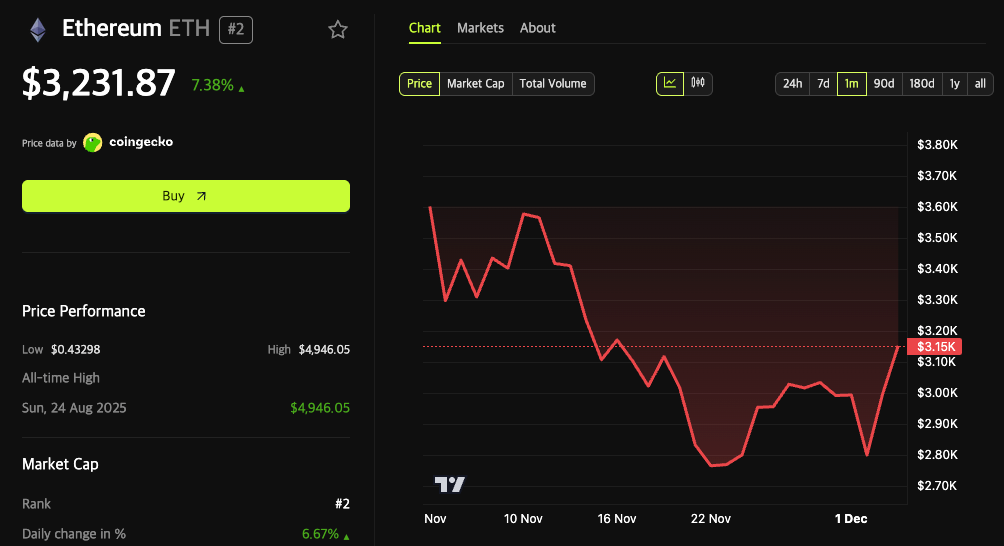

ETH is trading at $3,231, up 7.38% over the last 24 hours. The price has cleared the $3,154-$3,200 supply cluster that marked strong resistance, a move that traders see as a bullish signal.

The pattern echoes the pre-Pectra phase in May 2025, when Ethereum surged 56% in just seven days following that upgrade. Technical charts show a classic bullish divergence: while price marked a lower low between November 4 and December 1, RSI printed a higher low—a setup that often signals weakening selling pressure.

On-chain data supports the bullish case. Addresses holding at least $1 million in ETH have increased from 13,322 to 13,945, representing roughly $623 million in additional accumulation by large holders.

Key Levels to Watch

With the $3,200 zone now cleared, the next target sits at $3,653. If the rally extends 56% from Pectra, a move toward $4,262 comes into view.

The squeeze is on.$ETH surges above $3,200 and is now up +17% off Monday’s low.

— Noble Investing (@NobleInvesting) December 4, 2025

On the downside, $3,200 now serves as the first support to hold. A break below $2,996 would weaken the bullish structure, exposing $2,873 and potentially $2,618.

For now, sustaining above $3,200 will determine whether Fusaka marks the beginning of a new bullish phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE's Price Movement After Listing: Managing Retail REIT Fluctuations in the Context of AI-Influenced Industrial Property Developments

- KITE's Q3 2025 net loss of $16.2M and -$0.07 EPS highlight retail REIT sector challenges despite industrial real estate resilience. - Institutional investors show mixed positioning: Vanguard and JPMorgan sold shares while COHEN & STEERS increased stake by 190.4%. - KITE's indirect AI exposure through logistics partnerships contrasts with peers like Digital Realty , which directly develops AI infrastructure . - The stock's 10% YTD decline reflects market skepticism about its retail-centric model amid $350

The MMT Token TGE: Driving DeFi Advancement and Shaping Investment Approaches in 2025

- Momentum (MMT) launched its TGE on Sui , leveraging CLMM and ve(3,3) models to enhance DeFi efficiency and governance. - The TGE distributed 204.1M tokens, achieving $25B trading volume and $600M TVL within weeks, despite post-launch price volatility. - CLMM optimizes liquidity allocation while ve(3,3) aligns incentives through token locks, addressing DeFi's fragmentation and governance risks. - Investors face balancing long-term staking rewards against market risks, as MMT's success depends on Sui's ado

BTC Chart Shows 3 Major Rejections With a Clear Signal Toward 6% Support

Altcoins on the Edge of Phenomenal Gains — Top 5 High-Risk Plays Targeting 150%+ Upside as Small Caps Rally