Bitcoin Tests Key Ichimoku Cloud Resistance as $220M in Shorts Get Liquidated

Bitcoin is testing resistance on the daily Ichimoku Cloud while liquidation data shows heavy pressure on short sellers during its latest rebound.

Bitcoin is maintaining a strong upward bias following a fresh intraday advance, trading near the upper end of its 24-hour range. Over the past session, BTC has moved between $87,186 and $93,928, holding firm after a series of higher lows that reinforced the rebound structure.

The latest run places the market leader up roughly 6.5% over the last 24 hours, adding to a broader 7-day gain of about 6.8%. On the 14-day window, performance remains modest but positive with an increase of roughly 1.8%, reflecting slow but persistent accumulation after recent volatility.

With price now consolidating near the daily highs, traders are watching to see whether bullish pressure can extend into a clearer breakout. Will Bitcoin break out?

Bitcoin Price Analysis

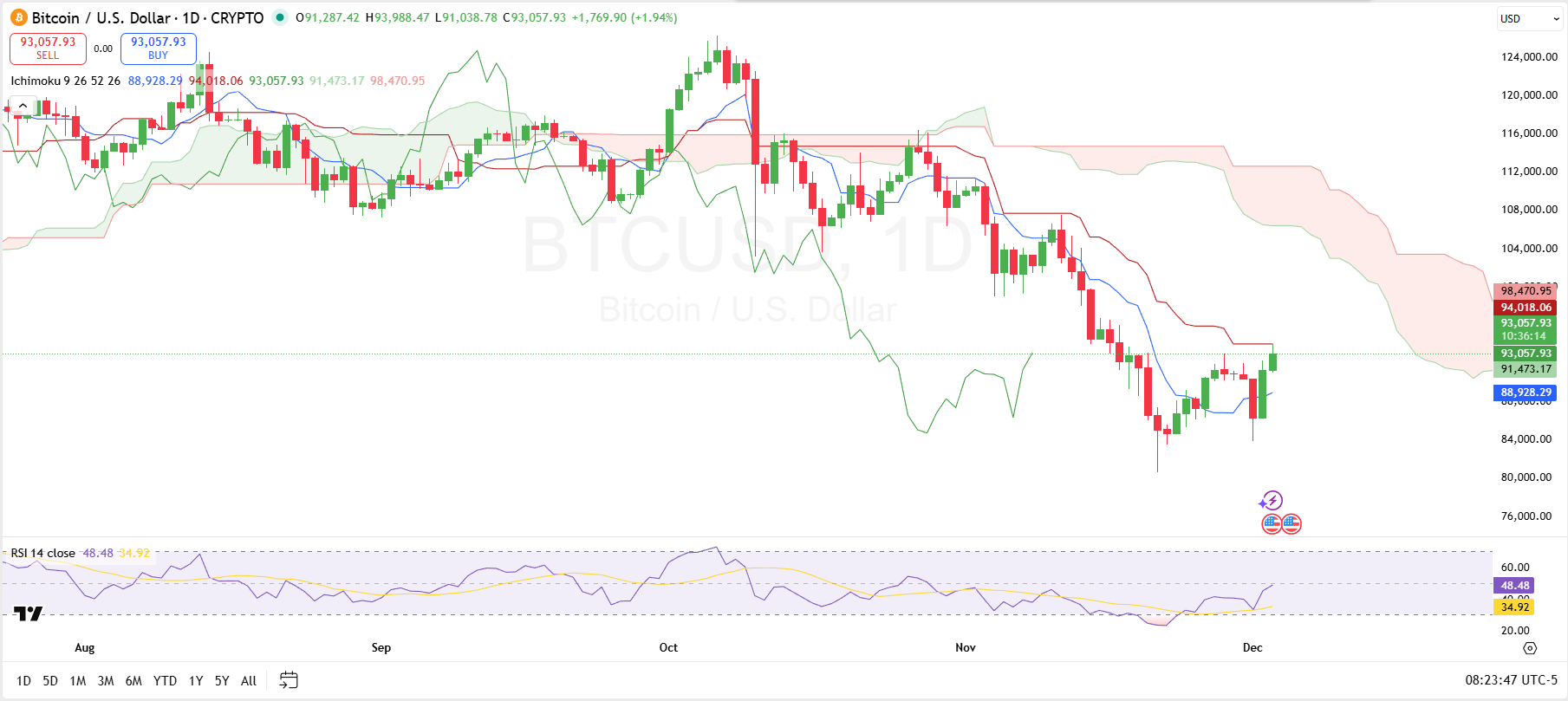

Bitcoin’s daily chart shows the price attempting to build a recovery structure after its November decline, with current action testing the Ichimoku cloud that had a lower boundary at $91,473. This cloud base had represented the first major resistance zone, acting as the point where bearish structure began to transition toward neutral conditions.

Until Bitcoin secures a full candle close above that lower cloud line, the overall trend bias remains cautious. Immediate resistance exists at the red base line at $94,018, while further resistance stands at the upper boundary of the cloud at $98,470.

On the support side, the blue conversion line provides short-term structural backing for the recovery. This conversion line sits just under current price action and will act as the first downside level to defend if momentum turns soft.

Further, RSI momentum offers modest reinforcement for bulls, with the indicator lifting away from bearish territory and trending toward mid-range alignment.

Taken together, price now sits at a sensitive juncture: a sustained break into or above the cloud base would solidify the upward shift, while failure to hold above the conversion line would risk eroding the confidence behind Bitcoin’s current recovery attempt.

Bitcoin Liquidation Data

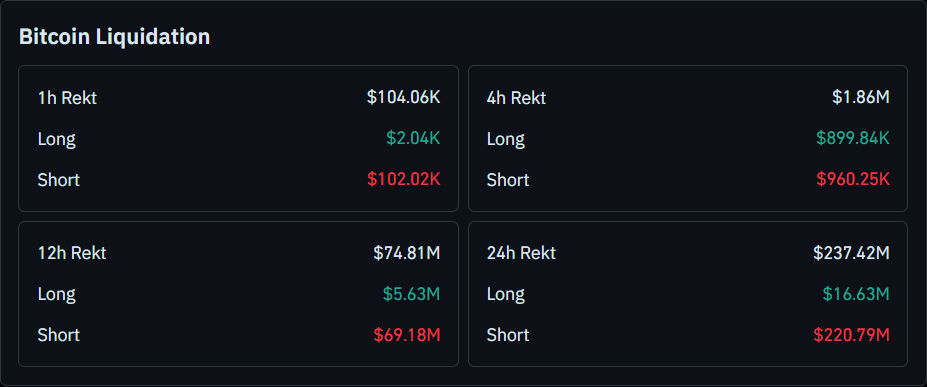

Bitcoin’s liquidation data confirms that the latest move higher has been due to pressure on short sellers. Over the past 24 hours, total liquidations reached about $237.4 million, with an overwhelming $220.8 million coming from short positions versus just $16.6 million from longs.

The pattern is similar on the 12-hour view, where roughly $74.8 million in positions faced liquidation, including $69.2 million in shorts and only $5.6 million in longs. This skew toward short liquidations suggests that traders betting against the rally have been forced to cover as price pushed higher.

Short-term readings echo the same dynamic, though at a smaller scale. In the last 4 hours, around $1.86 million in positions were liquidated, split between $899,800 in long and $960,000 in short exposure, while the 1-hour window shows approximately $104,000 in total liquidations, almost all of it ($102,000) from shorts.

Overall, the data indicates that Bitcoin’s upswing is being amplified by a series of short squeezes across multiple timeframes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast for 2026: Managing Fluctuations and Momentum from Key Catalysts After the 2025 Market Adjustment

- 2025 crypto market correction reshaped altcoin dynamics as Bitcoin/Ethereum declined amid macroeconomic uncertainty and regulatory pressures. - Pudgy Penguins (PENGU) saw sharp volatility post-correction, with technical indicators suggesting potential $0.069 rebound by 2026 if adoption metrics align. - Strategic partnerships with Bitso and cross-chain integrations, plus Kung Fu Panda NFT collaborations, aim to boost PENGU's liquidity and mainstream adoption. - Despite 12% early 2026 price drop, Pudgy Inv

ZEC Value Increases by 4.82% Following Recent Exchange Listing

- Zcash (ZEC) surged 4.82% in 24 hours after Bitget listed it for spot trading on Dec 3, 2025, boosting short-term liquidity and visibility. - Zcash’s zero-knowledge proof technology enables encrypted transactions while maintaining blockchain integrity, distinguishing it as a privacy-focused asset. - Bitget’s UEX model supports multi-chain access, aligning with Zcash’s goal to balance transparency and privacy, though recent 7-day and 1-month declines highlight market volatility risks.

Tether (USDT) Price Fluctuations and Market Response to PENGU Sell Indicators: Assessing Potential Risks and Opportunities within a Divided Stablecoin Landscape

- Tether (USDT) faced 2025 depegging to $0.90, exposing reserve management flaws and triggering S&P's "weak" stability rating. - Algorithmic PENGU USDT's 28.5% price drop and $66.6M team outflows highlighted systemic risks in opaque collateral structures. - Regulatory shifts (GENIUS Act, MiCA) accelerated migration to compliant stablecoins like USDC , now dominating 30% of on-chain transaction volume. - Market fragmentation reveals dual dynamics: algorithmic risks vs. institutional adoption opportunities i

DASH Increases by 2.44% as Significant Insider Selling and Purchase Indicators Emerge

- DASH rose 2.44% in 24 hours to $50.1, showing a 31.63% annual gain despite a 11.79% seven-day drop. - High-ranking insiders sold millions via 10b5-1 plans, including $9. 3M by Stanley Tang and $6.19M by Andy Fang. - Alfred Lin’s $100.2M purchase signaled confidence, contrasting with other sales and suggesting undervaluation. - Market reacted positively short-term, but analysts expect macroeconomic and business fundamentals to support DASH ahead.