Key Market Intelligence on December 3rd, How Much Did You Miss?

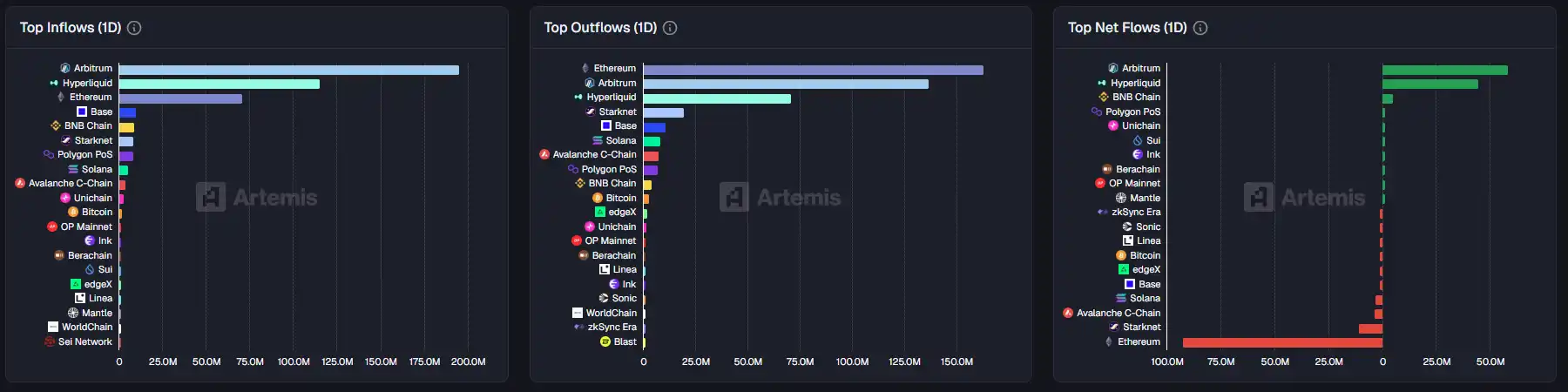

1. On-chain Funds: $58.5M USD inflow to Ethereum today; $92.5M USD outflow from Hyperliquid 2. Largest Price Swings: $BOB, $LUX 3. Top News: Farcaster Founder's Post Announces First-time Clanker Platform IDO Presale this Friday at 1:30

Featured News

2. SOL On-Chain Meme Surge, USELESS Up 30% in 24 Hours

4. Pre-market Crypto Concept Stocks in the U.S. Soar, BMNR Up 4.01%

5. Binance Co-Founder He Yi Appointed Co-CEO, Nearly 300 Million Registered Users on the Platform

Featured Articles

1. "New Fed Chair Could Bring on a Frenzied Bull Market"

On the prediction market Polymarket, the probability of Hassett being elected as the new Chair of the Federal Reserve has risen to 86%, far ahead of other potential candidates. It is highly likely that Kevin Hassett will be the next Chair of the Federal Reserve, Trump's favorite.

2. "The Rise and Fall of HUINENG in Phnom Penh: The 'Cambodian Alipay' Met Its Demise Last Night"

December 1, 2025, dawn, Sihanouk Boulevard. The once-'never-sleeping' financial totem, HUINENG headquarters building, lost its heartbeat overnight. The roar of the cash-carrying vehicles that used to come and go disappeared, replaced by a cold 'Withdrawal Suspension Notice' posted on the glass door, and in front of the main entrance, hundreds of East Asian faces gradually stiffened in fear.

On-chain Data

On-chain Fund Flow for the Week of December 3rd

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating How Vitalik Buterin's Advancements in ZK Technology Are Shaping Blockchain Investment Trends

- Vitalik Buterin's GKR protocol boosts Ethereum's scalability, enabling 43,000 TPS via ZK computation. - Institutional adoption accelerates with ZK-based compliance solutions, attracting BlackRock and Deutsche Bank partnerships. - ZK startups like zkSync and StarkNet secure $55M+ in funding, with market caps surging as infrastructure matures. - Investors target ZK-EVM compatible projects and hybrid models, aligning with Ethereum's 2026 roadmap.

ZK Technology's 2025 Price Increase: Sustained Value Driven by Blockchain Integration and Growing Institutional Engagement

- ZK technology's 2025 price surge stems from on-chain adoption and institutional investments, signaling a structural market shift. - ZK rollups now process 15,000 TPS with $3.3B TVL, driven by infrastructure upgrades and 230% developer engagement growth. - 35+ institutions including Goldman Sachs deploy ZKsync for confidential transactions, while Nike/Sony adopt it for supply-chain transparency. - Market fundamentals project 22.1% CAGR to $7.59B by 2033, validating ZK as blockchain's foundational infrastr

DASH Experiences 150% Price Jump and Growing Institutional Interest: Examining Blockchain’s Strength During Economic Uncertainty

- DASH surged 150% in June 2025 driven by tech upgrades, institutional interest, and favorable policies. - Platform 2.0 enhanced scalability and token support, positioning DASH as a competitive blockchain platform. - Institutional adoption grew in 2025 Q3-Q4 via merchant integrations in emerging markets and decentralized governance. - Macroeconomic factors like Fed policies and M2 growth boosted liquidity, while volatility persisted due to tightening markets. - Future growth depends on 2026 regulatory clar

The Increasing Importance of Stablecoins in Institutional Investment Strategies

- In 2025, U.S. GENIUS Act and EU MiCA regulations drove institutional adoption of USDC as a compliant, transparent stablecoin. - USDC's 98% U.S. Treasury-backed reserves and monthly audits made it preferred over USDT for regulated entities. - Institutions used USDC to reduce settlement delays by 35% and improve Sharpe ratios by 12% through yield-generating strategies. - With $73.7B circulation and $140B Q3 transaction volume, USDC became a 24/7 global liquidity tool for emerging markets.