Pi Network Mining Rate Surges in December: What Happened to the Miners?

Pi Network (PI) has closed six consecutive red months and still struggles to recover from last quarter’s decline. In December, however, the network’s mining rate increased again. The following report explains why Pi’s mining speed is rising under current conditions. Pi Miners Now Need Over 13 Days to Mine 1 Pi A long-time Pioneer who

Pi Network (PI) has closed six consecutive red months and still struggles to recover from last quarter’s decline. In December, however, the network’s mining rate increased again.

The following report explains why Pi’s mining speed is rising under current conditions.

Pi Miners Now Need Over 13 Days to Mine 1 Pi

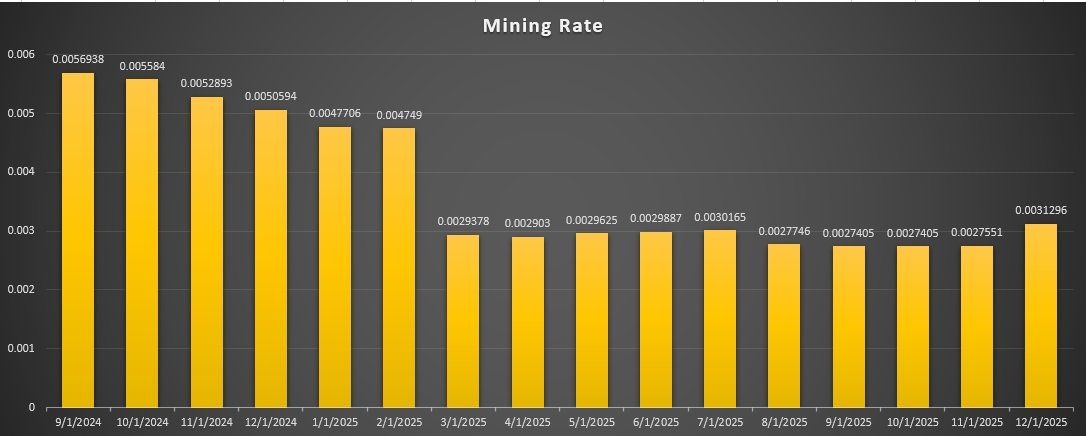

A long-time Pioneer who tracks Pi’s mining speed reported that December’s base mining rate reached 0.0031296 π/hour, up 13.59% from November’s 0.0027551 π/hour.

This increase marks the strongest jump since the dynamic mining formula launched in March 2022. It also breaks a two-year streak of continuous decline.

“It now takes about 13.3 days to mine 1 Pi, and 27.4 Pi can be mined in 1 year without bonuses,” the X account AKE1974 π stated.

A well-known Pioneer account in the Pi community, Dao World, confirmed AKE1974 π’s data.

Pi Network Mining Rate. Source:

Dao World

Pi Network Mining Rate. Source:

Dao World

The statistical chart shows more than just numbers. It reflects a significant shift in the Pi ecosystem.

Mining speed has declined for two consecutive years due to the growing user base diluting the rewards.

However, December shows a reversal. This trend suggests that some Pi miners may have paused their mining activity after many years of patience.

Why are miners giving up? The strongest reason lies in the fact that they can buy Pi cheaply instead of spending time and effort to mine it.

Pi Price Performance.

Pi Price Performance.

Data shows that Pi trades at $0.23, far below its nearly $3 price in March.

“Reason is people feel buying is easy and cheap rather than mining!” Pi Network Academy stated.

Earning $0.23 for 13 days of mining no longer appears appealing, especially as bullish price expectations fade. Many holders only hope for a recovery to break even, rather than make a profit.

Number of Pi Nodes on Mainnet Surged Tenfold in 2025

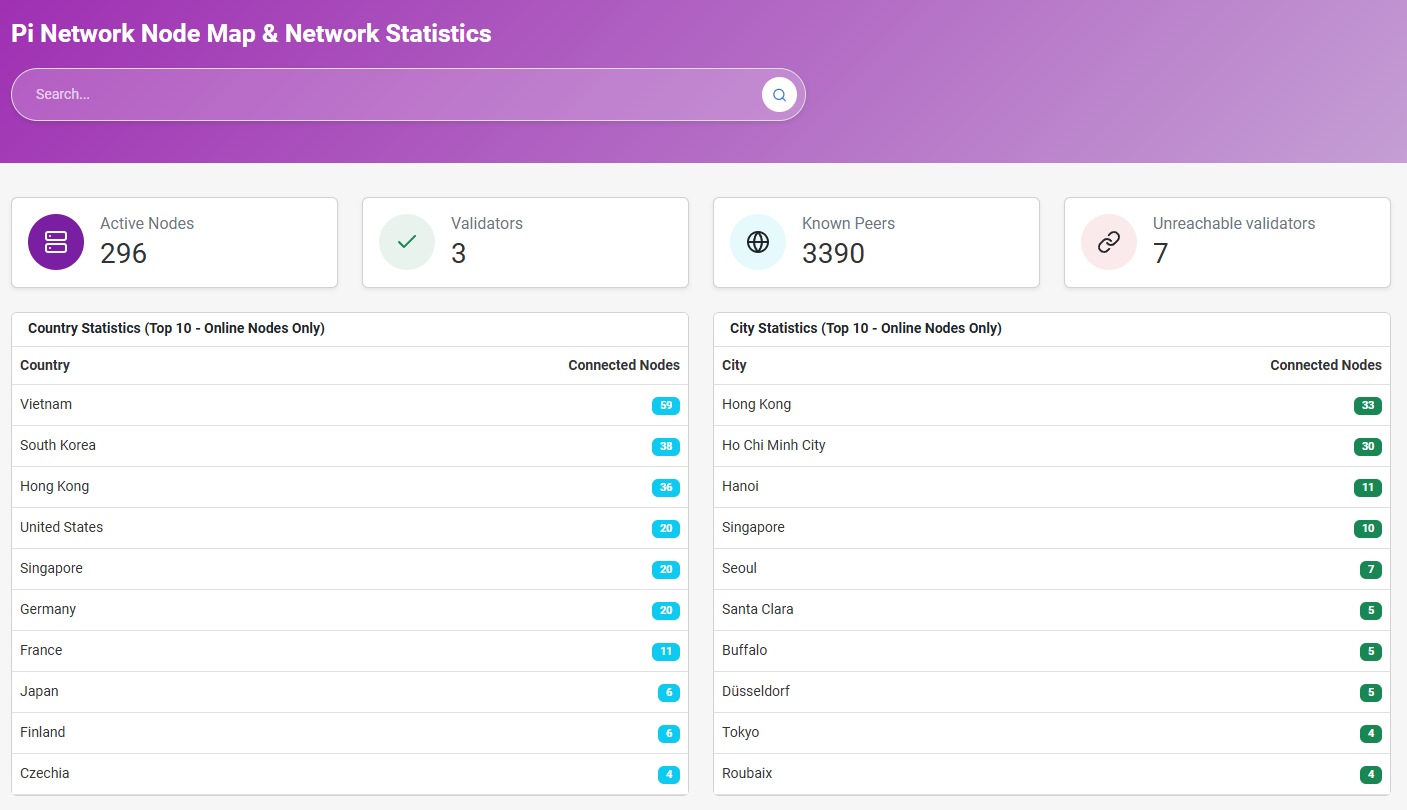

In reviewing 2025, the number of Pi nodes on the Pi Network’s mainnet has experienced significant growth.

In March, when Pi reached historical highs, Piscan reported 23 active nodes on the Pi Network mainnet. That number has since increased tenfold.

Pi Network Node Map.

Pi Network Node Map.

By December, the mainnet hosts 296 active nodes, with most located in Vietnam, South Korea, Hong Kong, and the United States.

This growth indicates that more investors are willing to take on a larger role in the network, reflecting long-term confidence in the network’s future. Recently, the Pi Core Team expanded node-related applications by investing in OpenMind.

When mining rewards rise, node operators benefit first. This increase may also encourage new users to join the ecosystem.

“This growth is another reminder that Pi Network is not stagnant but evolving every month with measurable progress fueled by millions of active Pioneers,” JB Exchange commented.

Pi’s journey back to previous highs—and to a new ATH—may still be difficult as the price has fallen more than 90%.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid (HYPE) Price Rally: The Role of DeFi Advancements and Investor Sentiment in Driving Recent Market Fluctuations

- Hyperliquid (HYPE) surged to $59.39 in 2025 before retreating, driven by DeFi innovations and volatile market sentiment. - Technical advancements like HyperBFT consensus and USDH stablecoin attracted 73% of decentralized trading volume, while institutional partnerships stabilized the ecosystem. - Despite short-term volatility near $36, bullish RSI patterns and $3 trillion trading volume suggest potential for a $59 rebound, though sustained momentum above $43 is critical. - Analysts project HYPE could rea

The Driving Forces Behind Economic Growth in Webster, NY

- Webster , NY, transformed a 300-acre Xerox brownfield into a high-tech industrial hub via a $9.8M FAST NY grant, boosting industrial and real estate growth. - Public-private partnerships enabled infrastructure upgrades, attracting $650M fairlife® dairy projects and 250 high-paying jobs by 2025. - Industrial vacancy rates dropped to 2%, while residential values rose 10.1% annually, highlighting synergies between infrastructure and economic development. - The model underscores secondary markets' potential

Unlocking Potential: The Impact of Targeted Grants and Public-Private Partnerships on Transforming Medium-Sized Real Estate Markets in the U.S.

- U.S. mid-sized cities leverage infrastructure investment and PPPs to drive commercial real estate growth, outpacing large cities in value creation. - Federal programs like IIJA enable upgrades in transportation and broadband, reducing business costs while boosting property values in Tampa and Grand Rapids. - PPPs in cities like Montgomery County combine affordable housing incentives with CRE development, balancing equity and economic resilience through data-driven strategies. - Market projections show $2

Modern Monetary Theory and the Transformation of International Markets: Inflation Trends, Asset Movements, and Currency Shifts in 2025

- Modern Monetary Theory (MMT) reshapes fiscal-monetary coordination, linking government spending to inflation and resource constraints in post-pandemic economies. - Central banks face challenges anchoring inflation expectations as CPI lags asset market pressures, risking self-fulfilling inflationary spirals amid eroding public trust. - Currency valuations shift with fiscal stimulus (e.g., euro's 2025 rebound) and U.S. dollar uncertainty, compounded by gold reserve diversification and rising bond yields. -