XRP Jumps 8% as Crypto Whales Scoop Up $1.3 Billion

XRP is attempting a strong recovery after last week’s decline, with the altcoin posting an 8% rise in the past 24 hours. The broader market’s positive shift is helping XRP regain momentum, but the real catalyst appears to be renewed confidence from large investors. This surge in whale activity could position XRP for a retest

XRP is attempting a strong recovery after last week’s decline, with the altcoin posting an 8% rise in the past 24 hours.

The broader market’s positive shift is helping XRP regain momentum, but the real catalyst appears to be renewed confidence from large investors. This surge in whale activity could position XRP for a retest of multi-week highs.

XRP Whales Rescue The Altcoin

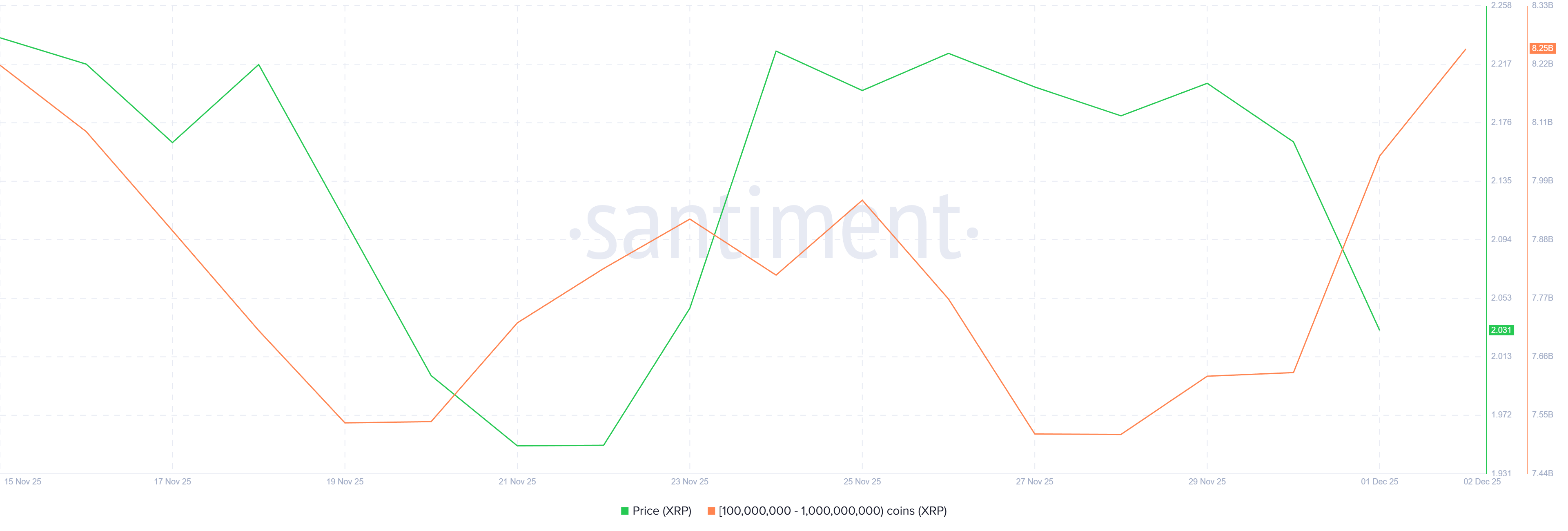

Whale buying has intensified as XRP approached the $2.00 psychological level earlier this week. On-chain data shows that wallets holding between 100 million and 1 billion XRP collectively accumulated 620 million XRP in just a few days. At current prices, this accumulation is worth more than $1.36 billion.

Such aggressive buying at discounted levels indicates that whales are positioning for a potential rebound and view the recent dip as a buying opportunity rather than a trend reversal. Their renewed confidence signals that the upside potential outweighs the short-term volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum Whale Holding. Source:

Ethereum Whale Holding. Source:

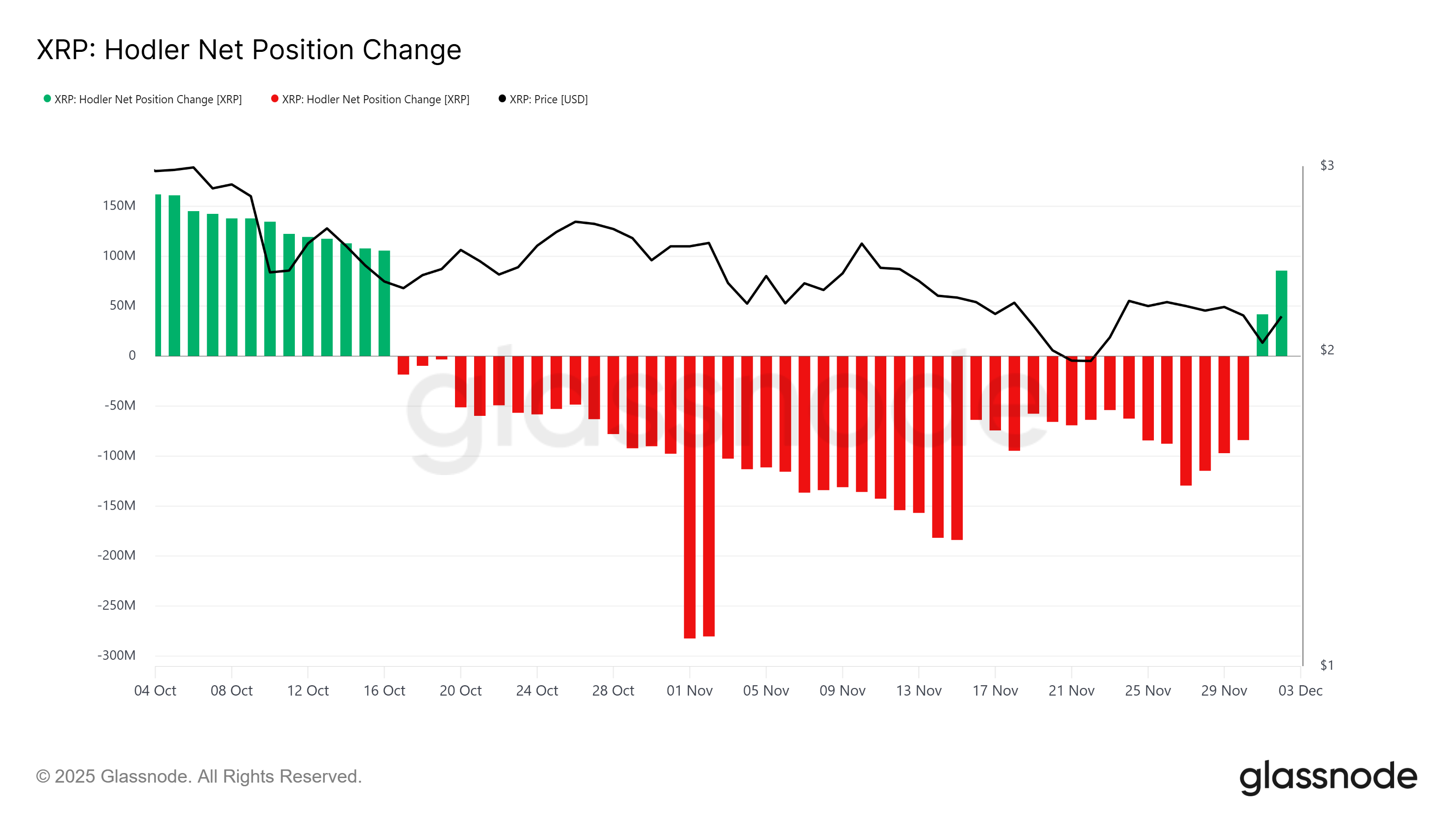

The macro backdrop for XRP is also showing marked improvement. The HODLer Net Position Change — an indicator tracking movements among long-term holders — is flashing bullish for the first time since mid-October. The metric has shifted back into positive territory, signaling that LTHs have stopped selling and are once again accumulating.

Support from long-term holders is critical for maintaining price floors during periods of market uncertainty. Their return provides XRP with a more stable base and reduces the likelihood of major downside moves, priming the asset for sustained recovery should broader market conditions remain favorable.

XRP HODLer Net Position Change. Source:

XRP HODLer Net Position Change. Source:

XRP Price Has A Shot At Recovery

XRP is trading at $2.20 at the time of writing, up 8% in 24 hours after bouncing cleanly from the $2.00 intra-day low. The rebound from this key psychological level reinforces bullish sentiment and aligns with heavy whale accumulation.

Holding $2.20 as support places XRP in a strong position to target $2.36 next. If XRP manages to break this resistance, the altcoin could climb toward $2.50 and log its highest price in three weeks. Whale buying and LTH support make this scenario increasingly realistic.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

However, failure to maintain investor confidence could still introduce downside risk. If selling pressure increases, XRP may slip back to the $2.02 support level. This would invalidate the bullish setup and erase recent gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZEC Falls by 2.16% as Traders Adjust Short Positions During Market Fluctuations

- ZEC fell 2.16% to $352.42 on Dec 6, 2025, despite a 526.09% annual gain, highlighting its extreme volatility. - Hyperliquid's $14.1M ZEC short position, averaging $412 entry, shows shrinking profits as prices rise toward breakeven. - Broader bearish activity includes ETH and MON shorts with $6.22M and $2.26M unrealized gains, reflecting active market positioning. - Traders adjust exposure amid ZEC's 17.68% monthly drop and 2.43% weekly rise, signaling cautious strategy shifts in volatile crypto markets.

The Growing Popularity of Momentum ETFs Amid Market Volatility: Tactical Portfolio Allocation and Optimizing Risk-Adjusted Performance in 2025

- Momentum ETFs surged 74.8% in 2023 and 72.7% in 2024 but faced a 4.3% average loss in 2025 amid volatility and macroeconomic uncertainty. - Quality/value ETFs like QUAL and AVUV showed greater resilience during downturns, contrasting momentum strategies' lack of defensive characteristics. - 2025 market shifts highlighted risks of overvaluation in momentum sectors, with tech indices diverging from economic fundamentals. - Strategic diversification through hedging (VIXY/UVXY), alternative assets (VTIP), an

The Unexpected Rise of the MMT Token: Reflecting Speculative Trends in an Evolving Cryptocurrency Market

- MMT token's 1,330% surge post-Binance listing and 77.82% correction highlight speculative volatility in a maturing crypto market driven by institutional adoption and macroeconomic factors. - Institutional participation and regulatory clarity, like ETF approvals, have shifted market dynamics, balancing speculative fervor with macroeconomic caution. - MMT's governance incentives and liquidity mechanisms contrast with Solana and Avalanche's ecosystem-driven growth, exposing risks of speculative altcoin stra

The Emergence of MMT Token TGE: Ushering in a New Era for Digital Finance?

- Momentum Token's TGE (MMT) surged 800% post-launch, reaching $5.18B market cap on Sui blockchain with ve(3,3) governance. - Volatile price swings (47% drop to $2.54) highlight risks, but buybacks and CLMM DEX innovations show technical resilience. - Sui's low-cost DeFi ecosystem (25B TVL) and MiCAR/GENIUS regulatory alignment position MMT as a bridge for institutional adoption. - Cross-border regulatory divergence between U.S. and EU frameworks complicates global scaling despite 47% institutional interes