The Rapidly Growing Need for Dementia Support Services and Its Impact on Investments: A Strategic Perspective on Healthcare Facilities and the Caregiver Labor Force

- Global dementia care crisis accelerates as Alzheimer's deaths surge 142% since 2000, straining $384B U.S. care costs in 2025. - 11M U.S. caregivers provide $346.6B in unpaid care, facing 70% coordination challenges and 53% system navigation struggles. - Home healthcare and AI-assisted platforms emerge as key investment opportunities, with $770B+ market potential by 2032. - Long-term care services grow alongside dementia prevalence, projected to reach $40.64B by 2030 with AI integration. - Investors must

The Accelerating Global Dementia Care Challenge

Dementia care is facing a rapidly intensifying crisis worldwide, fueled by shifting demographics, increasing death rates, and a caregiving system stretched to its limits. This situation marks a pivotal moment for investors, highlighting urgent needs in healthcare infrastructure and the development of a skilled caregiving workforce.

Recent projections indicate that by 2025, dementia care costs in the United States alone will soar to $384 billion, not accounting for the immense value of unpaid caregiving. This staggering sum, which covers both medical and long-term care, reflects mounting pressure on the system as Alzheimer's-related deaths have surged by 142% from 2000 to 2022—far outpacing reductions in mortality from other major diseases such as heart disease. These trends signal a significant shift in healthcare priorities and a pressing demand for scalable, innovative approaches.

The Mounting Strain on Caregivers

The impact of dementia extends far beyond financial costs. In 2024, more than 11 million Americans provided unpaid care, dedicating 18.4 billion hours to supporting loved ones with Alzheimer's or related conditions—a contribution valued at $346.6 billion. Yet, caregivers face overwhelming challenges: 70% report difficulties in coordinating care, and 53% struggle with the complexities of the healthcare system. Financial burdens are also significant, with 42% naming costs as their primary source of stress and annual out-of-pocket expenses averaging $9,000. The emotional and physical toll is profound, with caregivers at higher risk for burnout, depression, and chronic health problems.

This crisis is not only a matter of compassion but also an economic concern. According to a 2024 CDC survey, 60% of healthcare professionals believe the U.S. is unprepared to effectively guide dementia care, revealing deep systemic shortcomings. The result is a care model that is increasingly unsustainable and costly.

Emerging Investment Opportunities in Dementia Care

The escalating dementia crisis is driving demand for home healthcare, long-term care services, and AI-powered care platforms. These sectors are set for rapid expansion, propelled by demographic changes and technological advancements.

1. Home Healthcare: An Affordable Solution

The global home healthcare industry is forecasted to grow at a compound annual growth rate of 8.5–9.9% between 2024 and 2032, potentially reaching $770–811 billion by 2032. This surge is driven by a rapidly aging population—those aged 80 and above are expected to triple by 2050—and the cost-effectiveness of in-home care. In the U.S., the market is projected to nearly double, from $154.73 billion in 2024 to $296.41 billion by 2033. Investors should look to companies specializing in skilled nursing, rehabilitation, and remote patient monitoring, all vital for managing chronic illnesses like dementia.

2. AI-Enabled Care Platforms: Transforming Dementia Support

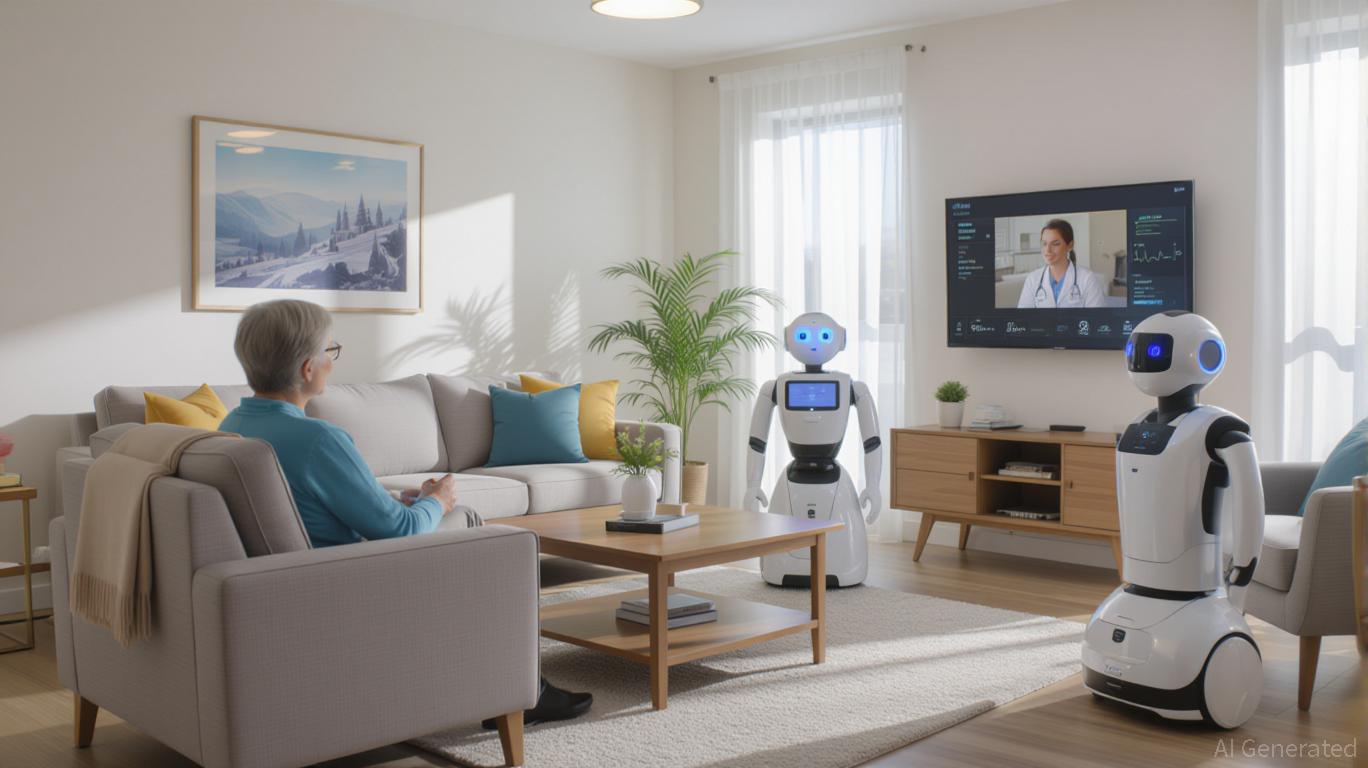

Artificial intelligence is revolutionizing dementia management. The global market for remote dementia care platforms is expected to grow at a 17.2% CAGR from 2024 to 2032, reaching $5.3 billion by the end of that period. These platforms utilize AI for monitoring cognitive health, early detection, and virtual caregiving, easing the burden on human caregivers. Innovations such as smart home technologies, assistive robots, and digital therapies are enhancing patient care. Additionally, AI-based cognitive training applications are anticipated to see robust growth through 2034, reflecting a strong appetite for non-drug interventions.

3. Long-Term Care Services: Meeting Growing Needs

With dementia cases on the rise, the necessity for long-term care (LTC) services is increasing sharply. The broader dementia treatment sector, including LTC, is projected to reach $40.64 billion by 2030, spurred by advancements in AI diagnostics and personalized medicine. Investors should consider businesses focused on assisted living, memory care facilities, and caregiver support platforms, which are essential for meeting the complex requirements of dementia patients.

Key Strategies for Investors

While the dementia care sector offers significant potential, it is not without challenges. Regulatory complexities, reimbursement issues, and the high costs associated with adopting AI technologies may impede growth. Nevertheless, the scale and urgency of the crisis make this a promising area for long-term investment. Recommended strategies include:

- Prioritizing AI-driven solutions that alleviate caregiver stress and enhance diagnostic precision.

- Backing home healthcare services that support the trend of aging in place.

- Investing in workforce development to ensure caregivers are trained in dementia-specific care.

Conclusion

Dementia care stands as one of the most pressing challenges of our time, with far-reaching effects on healthcare systems and caregiving networks. As Alzheimer's-related deaths climb and caregiver demands intensify, the need for innovative solutions is more urgent than ever. For investors, the greatest opportunities lie in sectors that address both the human and technological aspects of care. By focusing on home healthcare, AI-enabled platforms, and long-term care services, investors can not only benefit from a rapidly growing market but also help shape a more sustainable and compassionate future for dementia care.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Sharp Decline: What Sparks Anxiety During a Bullish Market?

- Bitcoin's 2025 bull market collapsed 30% to $83,824 amid Fed policy shifts and liquidity contractions, defying typical risk-on dynamics. - A 0.72 correlation to Nasdaq 100 and $19B leveraged liquidation event exposed Bitcoin's vulnerability to macro risks and institutional sentiment shifts. - AI-driven algorithms and algorithmic feedback loops amplified volatility, with Treasury yields and dollar strength triggering cascading sales. - Market psychology metrics (Fear & Greed Index, stablecoin outflows) an

Infrastructure Initiatives Fuel Real Estate Growth in Upstate New York: The Impact of Local Government Projects on Industrial Market Transformation

- Webster , NY leveraged a $9.8M FAST NY grant to transform a 300-acre Xerox brownfield into a high-tech industrial hub, slashing vacancy rates to 2%. - Infrastructure upgrades attracted food processing and semiconductor firms , with a $650M fairlife® dairy plant expected to create 250 jobs by 2025. - Strategic site readiness and pre-leased industrial space at the NEAT site reduced investor risk, driving 10.1% residential property value growth since 2023. - The model highlights underpenetrated markets' pot

ZEC Rises 4.81% After Major Investor Increases Long Position with 10x Leverage

- ZEC surged 4.81% in 24 hours to $330.5 amid a whale's 10x leveraged long position on HyperLiquid targeting $333.46. - The whale also holds 20x ETH and 5x DYDX longs but faces $2.7M total losses, highlighting risks of leveraged trading during crypto volatility. - Grayscale's ZEC ETF filing and Chainlink's ETF launch signal growing institutional interest in altcoins, potentially boosting ZEC liquidity and demand. - ZEC's 482.71% annual gain contrasts with 27.45% weekly drop, reflecting its cyclical nature

Amazon takes on rivals by introducing on-site Nvidia ‘AI Factories’